Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2434

Pages:97

Published On:October 2025

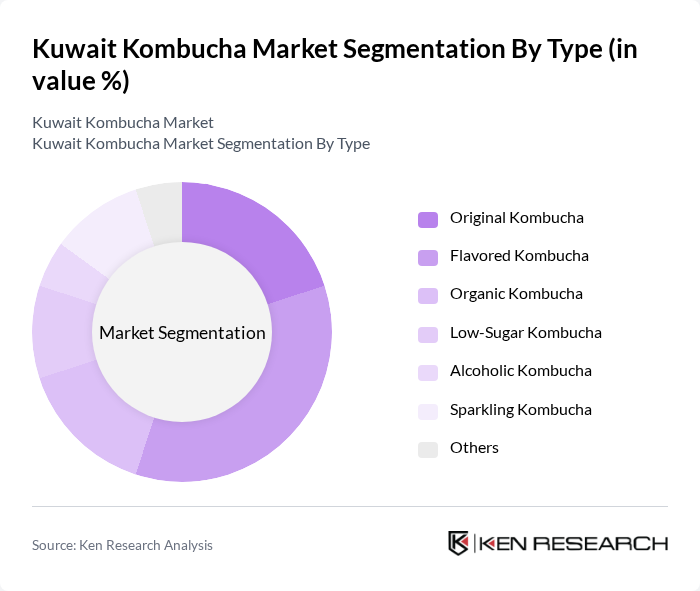

By Type:The market is segmented into various types of kombucha, including Original Kombucha, Flavored Kombucha, Organic Kombucha, Low-Sugar Kombucha, Alcoholic Kombucha, Sparkling Kombucha, and Others. Among these, Flavored Kombucha is gaining significant traction due to its diverse taste profiles that appeal to a broader audience. Consumers are increasingly drawn to unique flavors, which enhances their overall drinking experience and encourages repeat purchases. The segmentation reflects global and regional trends toward flavor innovation and health-focused product differentiation.

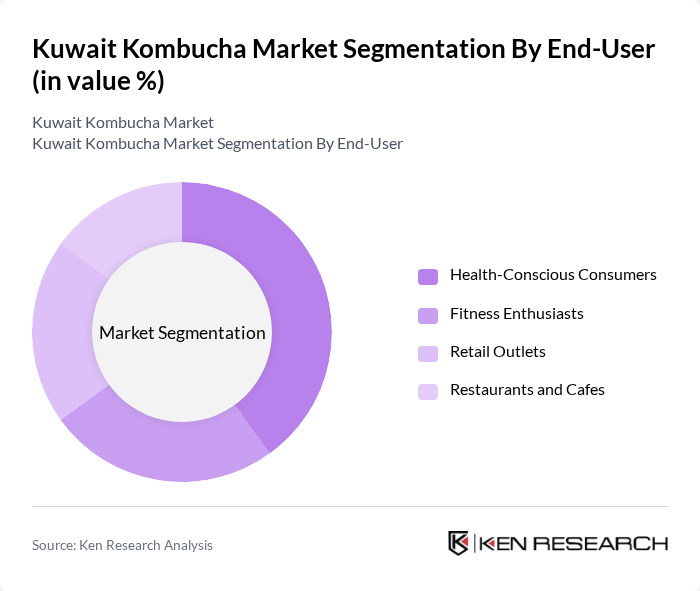

By End-User:The end-user segmentation includes Health-Conscious Consumers, Fitness Enthusiasts, Retail Outlets, and Restaurants and Cafes. Health-Conscious Consumers are the leading segment, driven by a growing awareness of the health benefits associated with kombucha, such as improved digestion and enhanced immunity. This demographic is increasingly prioritizing functional beverages, leading to a surge in demand for kombucha products. The segmentation aligns with broader Middle East consumer trends toward wellness and preventive health.

The Kuwait Kombucha Market is characterized by a dynamic mix of regional and international players. Leading participants such as Remedy Drinks (Australia, imported), GT’s Living Foods (USA, imported), Health-Ade (USA, imported), The Coca-Cola Company (USA, via local distributors), PepsiCo Inc. (USA, via local distributors), Humm Kombucha (USA, imported), Brew Dr. Kombucha (USA, imported), Pure Kombucha (Local, Kuwait), Kombucha Kuwait Co. (Local, Kuwait), Fermented Bliss (Local, Kuwait), Vitality Kombucha (Local, Kuwait), Green Leaf Kombucha (Local, Kuwait), Organic Brew Co. (Local, Kuwait), Refreshing Ferments (Local, Kuwait), The Tea Fermenter (Local, Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the kombucha market in Kuwait appears promising, driven by increasing health awareness and a shift towards functional beverages. As consumer preferences evolve, brands are likely to innovate with new flavors and health benefits. Additionally, the rise of e-commerce platforms is expected to enhance distribution channels, making kombucha more accessible. With the government focusing on health initiatives, the market is poised for growth, creating opportunities for both local and international brands to thrive.

| Segment | Sub-Segments |

|---|---|

| By Type | Original Kombucha Flavored Kombucha Organic Kombucha Low-Sugar Kombucha Alcoholic Kombucha Sparkling Kombucha Others |

| By End-User | Health-Conscious Consumers Fitness Enthusiasts Retail Outlets Restaurants and Cafes |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Health Food Stores Specialty Stores |

| By Packaging Type | Glass Bottles Cans PET Bottles |

| By Flavor Profile | Fruity Herbal Spicy Floral |

| By Price Range | Premium Mid-Range Budget |

| By Consumer Demographics | Age Group Gender Income Level |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kombucha Retailers | 50 | Store Managers, Beverage Buyers |

| Health and Wellness Consumers | 100 | Health Enthusiasts, Fitness Trainers |

| Local Kombucha Producers | 40 | Founders, Production Managers |

| Distributors and Wholesalers | 60 | Logistics Managers, Sales Directors |

| Nutritionists and Health Experts | 40 | Dietitians, Health Coaches |

The Kuwait Kombucha Market is valued at approximately USD 12 million, reflecting a growing interest in health-conscious beverages among consumers. This market is part of the broader Middle East kombucha market, which was valued at USD 200 million in 2024.