Region:Middle East

Author(s):Dev

Product Code:KRAC3431

Pages:88

Published On:October 2025

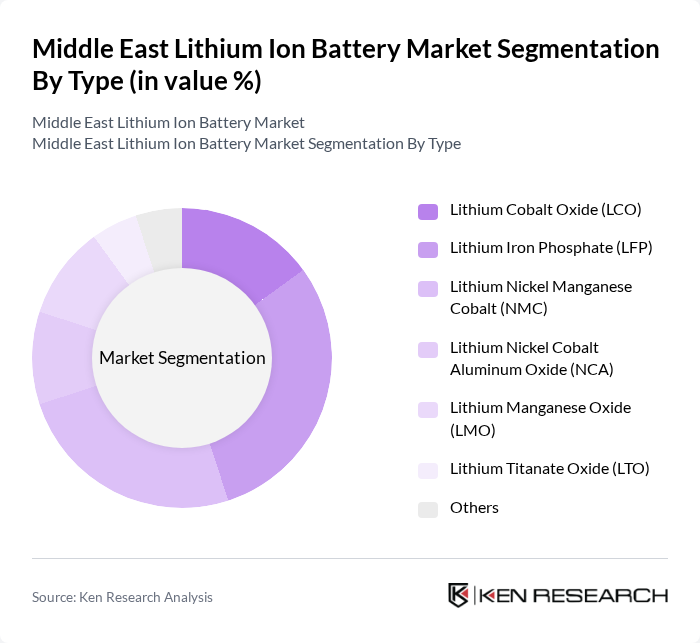

By Type:The lithium-ion battery market can be segmented into various types, including Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate Oxide (LTO), and Others. Among these, Lithium Iron Phosphate (LFP) is gaining traction due to its safety, thermal stability, and cost-effectiveness, making it a preferred choice for electric vehicles and energy storage systems .

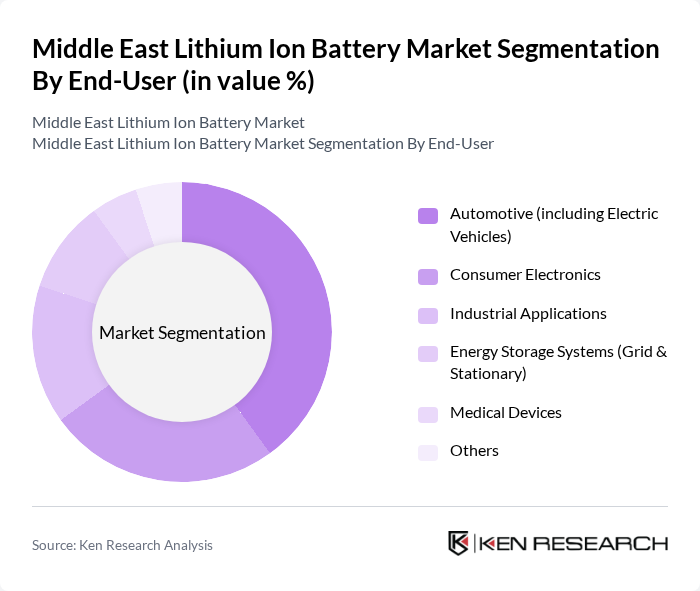

By End-User:The end-user segmentation includes Automotive (including Electric Vehicles), Consumer Electronics, Industrial Applications, Energy Storage Systems (Grid & Stationary), Medical Devices, and Others. The automotive sector, particularly electric vehicles, is the leading end-user due to the rising demand for sustainable transportation solutions and government initiatives promoting electric mobility .

The Middle East Lithium Ion Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Energy Solution, Samsung SDI, Panasonic Corporation, CATL (Contemporary Amperex Technology Co., Limited), BYD Company Limited, Amara Raja Batteries Ltd., EVE Energy Co., Ltd., Envision AESC, Saft Groupe S.A., Northvolt AB, SK On (SK Innovation Co., Ltd.), Farasis Energy, Inc., Hitachi Energy, BTR New Material Group (Morocco), DUBATT Battery Recycling LLC (UAE), Tesla, Inc., Exide Industries Ltd., and Toshiba Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lithium-ion battery market in the Middle East appears promising, driven by increasing investments in renewable energy and electric vehicle infrastructure. As governments continue to implement supportive policies, the market is expected to see significant advancements in battery technology and efficiency. Furthermore, the growing emphasis on sustainability will likely lead to innovations in battery recycling and material sourcing, enhancing the overall market landscape and attracting new players to the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium Cobalt Oxide (LCO) Lithium Iron Phosphate (LFP) Lithium Nickel Manganese Cobalt (NMC) Lithium Nickel Cobalt Aluminum Oxide (NCA) Lithium Manganese Oxide (LMO) Lithium Titanate Oxide (LTO) Others |

| By End-User | Automotive (including Electric Vehicles) Consumer Electronics Industrial Applications Energy Storage Systems (Grid & Stationary) Medical Devices Others |

| By Application | Electric Vehicles Grid Storage Portable Devices Power Tools Renewable Energy Integration Telecom Infrastructure Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Outlets |

| By Component | Cells Battery Management Systems Packaging Cathode Anode Electrolyte Separator Others |

| By Capacity | to 3,000 mAh ,000 mAh to 10,000 mAh ,000 mAh to 60,000 mAh ,000 mAh & above |

| By Voltage | Low (Below 12V) Medium (12V–36V) High (Above 36V) |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Battery Manufacturers | 60 | Production Managers, R&D Directors |

| Consumer Electronics Battery Suppliers | 50 | Product Managers, Supply Chain Analysts |

| Renewable Energy Storage Providers | 40 | Business Development Managers, Technical Engineers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Research Institutions and Universities | 45 | Academic Researchers, Industry Consultants |

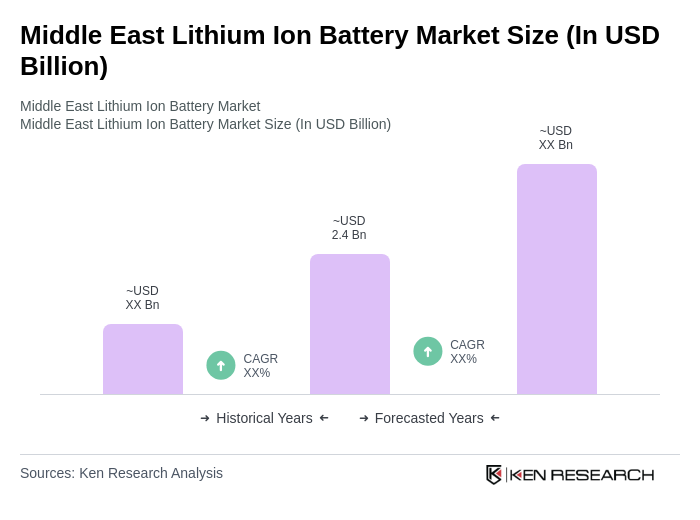

The Middle East Lithium Ion Battery Market is valued at approximately USD 2.4 billion, driven by the rising demand for electric vehicles, consumer electronics, and renewable energy storage solutions, alongside advancements in battery technology.