Region:Middle East

Author(s):Rebecca

Product Code:KRAA0362

Pages:100

Published On:August 2025

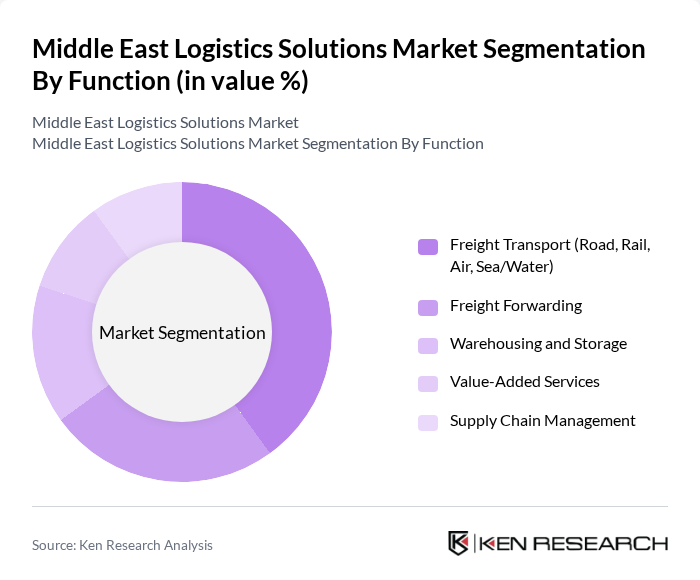

By Function:The logistics solutions market can be segmented into various functions, including Freight Transport, Freight Forwarding, Warehousing and Storage, Value-Added Services, and Supply Chain Management. Each of these functions plays a crucial role in the overall logistics ecosystem, catering to different needs and requirements of businesses across various industries .

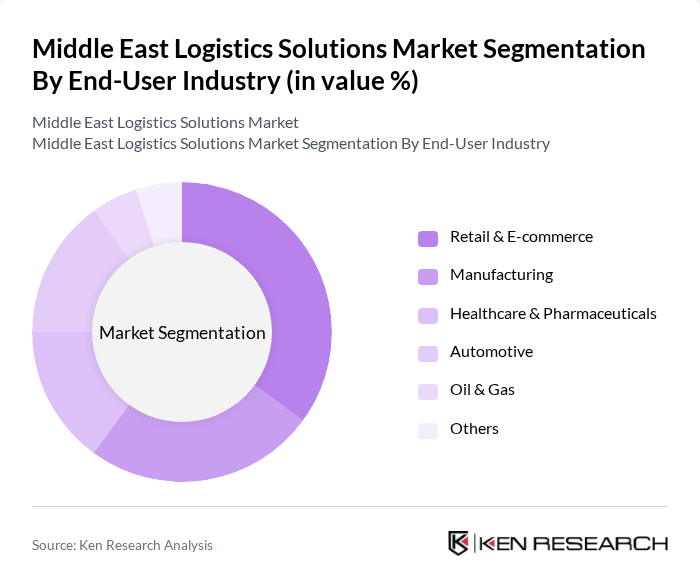

By End-User Industry:The logistics solutions market serves various end-user industries, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Oil & Gas, and Others. Each industry has unique logistics requirements, driving demand for tailored solutions that enhance operational efficiency and customer satisfaction .

The Middle East Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DP World, Aramex, Agility Logistics, Gulf Agency Company (GAC), Kuehne + Nagel, DHL Supply Chain, FedEx, Maersk, CEVA Logistics, UPS, DB Schenker, Bolloré Logistics, DSV, Yusen Logistics, Hellmann Worldwide Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The Middle East logistics market is poised for significant transformation, driven by technological innovations and evolving consumer demands. As e-commerce continues to expand, logistics providers will increasingly adopt automation and AI to enhance efficiency. Furthermore, the focus on sustainability will drive the adoption of green logistics practices. With ongoing infrastructure investments and a shift towards digital platforms, the region is likely to see improved logistics capabilities, positioning it as a key player in global supply chains.

| Segment | Sub-Segments |

|---|---|

| By Function | Freight Transport (Road, Rail, Air, Sea/Water) Freight Forwarding Warehousing and Storage Value-Added Services Supply Chain Management |

| By End-User Industry | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Oil & Gas Others |

| By Service Model | First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Others |

| By Mode of Transport | Road Rail Air Sea/Water Multimodal |

| By Technology Adoption | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Supply Chain Visibility Solutions Automation & Robotics Others |

| By Geographic Region | GCC Countries Levant North Africa Others |

| By Customer Segment | B2B B2C E-commerce Government & Public Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 100 | Logistics Directors, Operations Managers |

| Warehousing Solutions | 80 | Warehouse Managers, Supply Chain Analysts |

| Last-Mile Delivery Innovations | 60 | eCommerce Logistics Managers, Delivery Operations Heads |

| Cold Chain Logistics | 50 | Quality Assurance Managers, Cold Chain Specialists |

| Logistics Technology Adoption | 40 | IT Managers, Digital Transformation Leads |

The Middle East Logistics Solutions Market is valued at approximately USD 250 billion, driven by the growth of e-commerce, demand for efficient supply chain management, and significant infrastructure investments across the region.