Region:Middle East

Author(s):Dev

Product Code:KRAC2097

Pages:86

Published On:October 2025

By Type:The market is segmented into Powder, Slurry, Granular, and Others. The Powder segment is the most dominant, attributed to its versatility and widespread application in pharmaceuticals, construction, and flame retardant manufacturing. Powdered magnesium hydroxide is preferred for its high reactivity and ease of dispersion in water treatment and fire safety applications. The Slurry and Granular segments serve specific industrial requirements, such as continuous dosing in wastewater treatment and specialized polymer compounding .

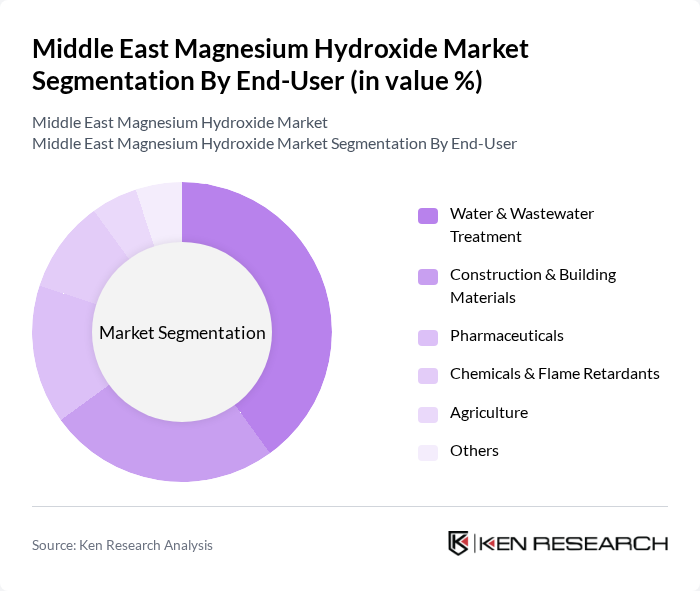

By End-User:The end-user segments include Water & Wastewater Treatment, Construction & Building Materials, Pharmaceuticals, Chemicals & Flame Retardants, Agriculture, and Others. Water & Wastewater Treatment leads the market, driven by regulatory mandates and the need for effective, sustainable neutralization solutions. Construction & Building Materials follows, as magnesium hydroxide is increasingly used as a non-toxic flame retardant and smoke suppressant in building products. The Pharmaceuticals segment benefits from magnesium hydroxide’s role as an antacid and laxative, while Chemicals & Flame Retardants and Agriculture represent growing but smaller shares .

The Middle East Magnesium Hydroxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kyowa Chemical Industry Co., Ltd., Huber Engineered Materials, Martin Marietta Magnesia Specialties LLC, Nedmag B.V., Premier Magnesia LLC, Tateho Chemical Industries Co., Ltd., Konoshima Chemical Co., Ltd., Elementis PLC, ICL Group Ltd., Xinyang Minerals Group, UBE Corporation, NikoMag, SLB (Schlumberger Limited), Geopolymer Solutions, LLC, Magnesia Specialties (Martin Marietta) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East magnesium hydroxide market appears promising, driven by increasing investments in sustainable technologies and infrastructure. As governments prioritize environmental compliance and water treatment solutions, the demand for magnesium hydroxide is expected to rise. Additionally, innovations in product formulations and applications will likely enhance its appeal across various industries, including construction and pharmaceuticals, positioning the market for robust growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Powder Slurry Granular Others |

| By End-User | Water & Wastewater Treatment Construction & Building Materials Pharmaceuticals Chemicals & Flame Retardants Agriculture Others |

| By Application | Flame Retardants Antacids & Pharmaceuticals Water Treatment Chemicals Filler in Plastics & Rubber Desulfurization Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain) Levant (Jordan, Lebanon, Israel, Palestine, Syria) North Africa (Egypt, Algeria, Morocco, Tunisia, Libya) Others (Turkey, Iran, Iraq, Yemen, etc.) |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Control Specialists |

| Agricultural Uses | 60 | Agronomists, Product Development Managers |

| Environmental Management | 50 | Environmental Engineers, Compliance Officers |

| Industrial Applications | 80 | Production Managers, Supply Chain Analysts |

| Research Institutions | 40 | Academic Researchers, Laboratory Technicians |

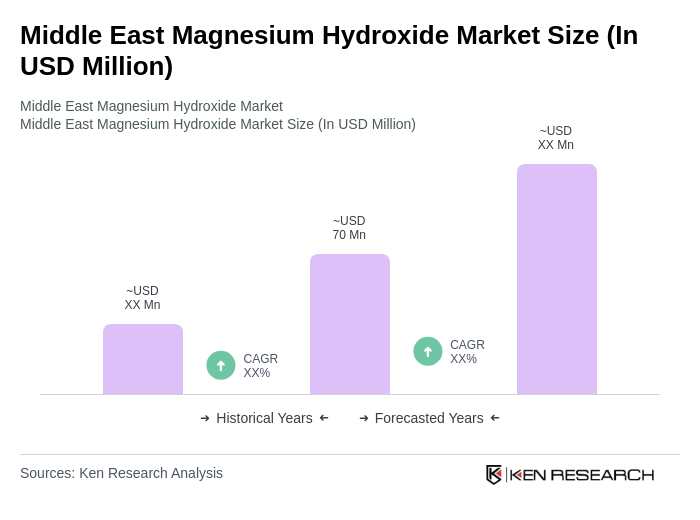

The Middle East Magnesium Hydroxide Market is valued at approximately USD 70 million, driven by increasing demand in sectors such as water treatment, pharmaceuticals, and flame retardants, reflecting a growing trend towards sustainable and environmentally friendly solutions.