Region:Global

Author(s):Shubham

Product Code:KRAA2478

Pages:90

Published On:August 2025

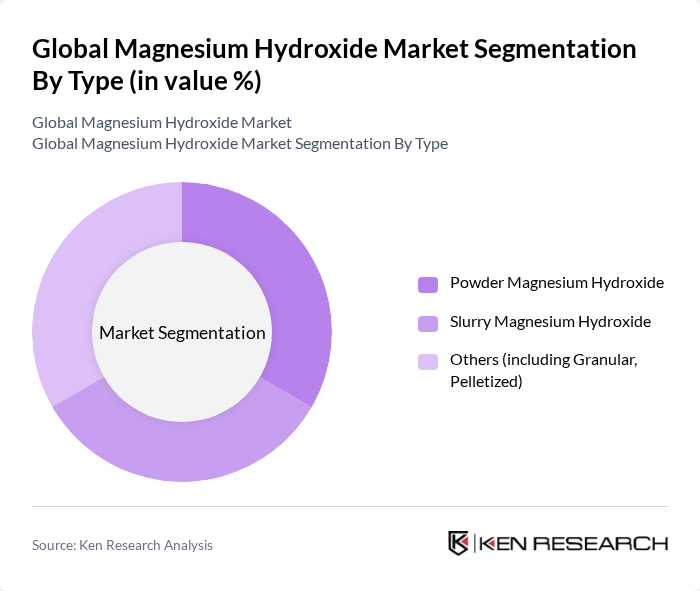

By Type:

The market is segmented into three types: Powder Magnesium Hydroxide, Slurry Magnesium Hydroxide, and Others (including Granular, Pelletized). Powder Magnesium Hydroxide is the leading subsegment, favored for its versatility and widespread adoption in pharmaceuticals, water treatment, and flame retardant applications. Its high purity, ease of handling, and superior reactivity make it the preferred choice for industries requiring stringent quality standards. Slurry Magnesium Hydroxide is primarily used in wastewater treatment and flue gas desulfurization, while the 'Others' category includes specialized forms for niche industrial uses.

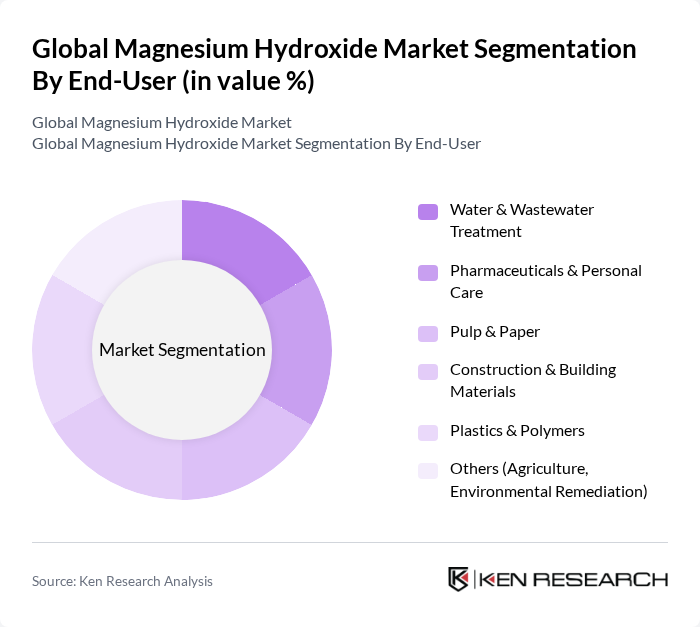

By End-User:

The end-user segmentation includes Water & Wastewater Treatment, Pharmaceuticals & Personal Care, Pulp & Paper, Construction & Building Materials, Plastics & Polymers, and Others (Agriculture, Environmental Remediation). Water & Wastewater Treatment is the dominant segment, driven by the global focus on water sanitation, regulatory compliance, and the need for cost-effective, non-toxic treatment solutions. Pharmaceuticals & Personal Care is also significant, with magnesium hydroxide widely used in antacids and laxatives. The construction, plastics, and pulp & paper industries leverage magnesium hydroxide for its flame retardant and neutralizing properties.

The Global Magnesium Hydroxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, Martin Marietta Materials, Inc., Ube Industries, Ltd., Huber Engineered Materials, Kyowa Chemical Industry Co., Ltd., Nedmag B.V., Konoshima Chemical Co., Ltd., Russian Mining Chemical Company, ICL Group Ltd., NikoMag, Sibelco, Omya AG, Solvay S.A., Magnesia Specialties (a division of Martin Marietta), Tateho Chemical Industries Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the magnesium hydroxide market appears promising, driven by increasing environmental awareness and the shift towards sustainable materials. Innovations in product formulations are expected to enhance the versatility of magnesium hydroxide across various applications, particularly in wastewater treatment and construction. Additionally, the growing focus on health and safety in pharmaceuticals will likely spur demand. As emerging economies continue to develop, the market is poised for significant growth, with strategic partnerships playing a crucial role in expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Powder Magnesium Hydroxide Slurry Magnesium Hydroxide Others (including Granular, Pelletized) |

| By End-User | Water & Wastewater Treatment Pharmaceuticals & Personal Care Pulp & Paper Construction & Building Materials Plastics & Polymers Others (Agriculture, Environmental Remediation) |

| By Application | Flame Retardants Antacids & Laxatives Neutralizing Agent Filler in Plastics & Rubber Desulfurization Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 60 | R&D Managers, Quality Control Analysts |

| Water Treatment Solutions | 50 | Environmental Engineers, Water Quality Specialists |

| Agricultural Uses | 40 | Agronomists, Crop Protection Specialists |

| Industrial Applications | 55 | Production Managers, Chemical Engineers |

| Consumer Products | 45 | Product Development Managers, Marketing Executives |

The Global Magnesium Hydroxide Market is valued at approximately USD 1.4 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand for eco-friendly materials in various applications, including water treatment and pharmaceuticals.