Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4406

Pages:85

Published On:October 2025

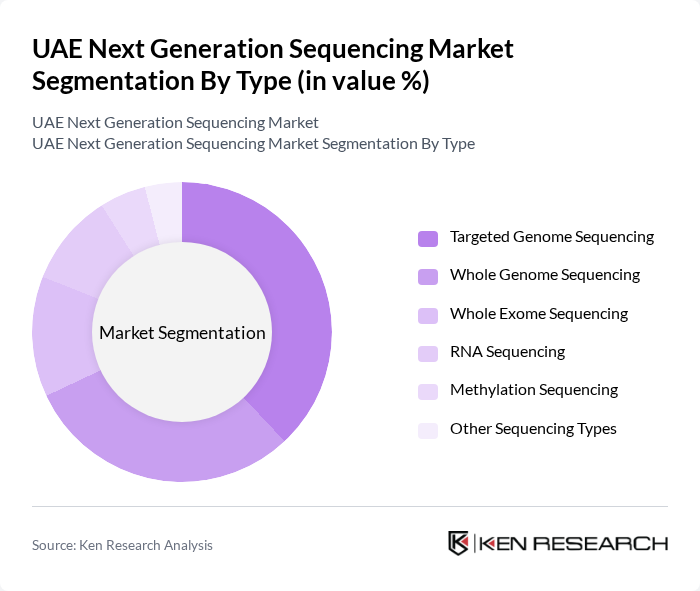

By Type:The segmentation by type includes various methods of sequencing that cater to different research and clinical needs. Whole Genome Sequencing, Targeted Genome Sequencing, Whole Exome Sequencing, RNA Sequencing, Methylation Sequencing, and Other Sequencing Types are the primary categories. Targeted Genome Sequencing is currently leading the market due to its cost-effectiveness, high sensitivity for variant detection, and suitability for clinical diagnostics and oncology applications. Whole Genome Sequencing remains important for comprehensive genomic analysis, particularly in research and personalized medicine .

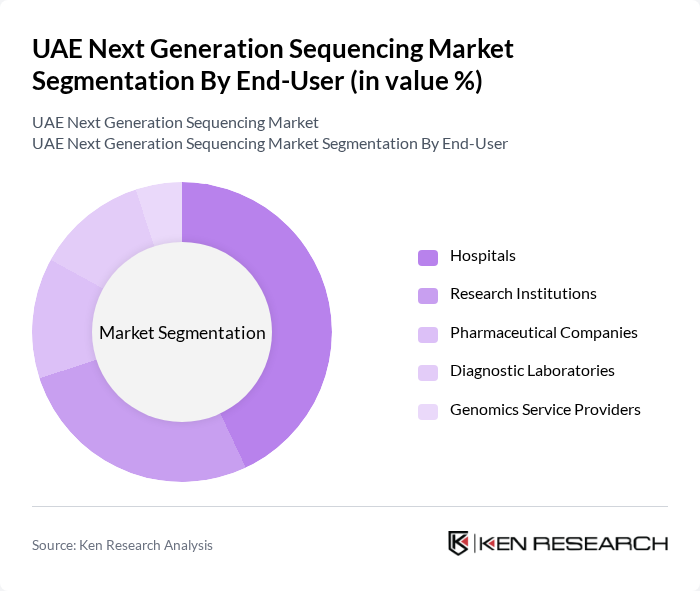

By End-User:The end-user segmentation includes Hospitals, Research Institutions, Pharmaceutical Companies, Diagnostic Laboratories, and Genomics Service Providers. Hospitals are the leading end-users, driven by the increasing adoption of NGS for clinical diagnostics, oncology, and personalized treatment plans. Research institutions and diagnostic laboratories are also significant contributors, reflecting the UAE’s focus on translational research and precision medicine .

The UAE Next Generation Sequencing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., BGI Genomics Co., Ltd., Roche Sequencing Solutions (F. Hoffmann-La Roche Ltd.), Agilent Technologies, Inc., QIAGEN N.V., Pacific Biosciences of California, Inc., Oxford Nanopore Technologies plc, Bio-Rad Laboratories, Inc., Revvity, Inc. (formerly PerkinElmer, Inc.), Genomatix Software GmbH, 10x Genomics, Inc., Myriad Genetics, Inc., Guardant Health, Inc., Fulgent Genetics, Inc., New England Biolabs, Inc., Becton, Dickinson and Company contribute to innovation, geographic expansion, and service delivery in this space .

The UAE's next-generation sequencing market is poised for significant growth, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in genomic analysis is expected to enhance data interpretation, leading to more accurate diagnostics. Additionally, the rise of direct-to-consumer genetic testing will empower individuals to take charge of their health, further propelling market expansion. As the government continues to support biotechnology initiatives, the NGS landscape will evolve, fostering innovation and collaboration within the healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Genome Sequencing Targeted Genome Sequencing Whole Exome Sequencing RNA Sequencing Methylation Sequencing Other Sequencing Types |

| By End-User | Hospitals Research Institutions Pharmaceutical Companies Diagnostic Laboratories Genomics Service Providers |

| By Application | Oncology Infectious Diseases Genetic Disorders Reproductive Health Agriculture and Animal Research Drug Discovery |

| By Technology | Sequencing by Synthesis Ion Semiconductor Sequencing Single-Molecule Real-Time Sequencing Nanopore Sequencing Other Technologies |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Premium Mid-range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Genomics Laboratories | 45 | Laboratory Managers, Genetic Counselors |

| Biotechnology Firms | 40 | R&D Directors, Product Managers |

| Healthcare Providers | 50 | Oncologists, Pathologists |

| Regulatory Bodies | 15 | Policy Makers, Compliance Officers |

| Academic Institutions | 40 | Research Scientists, Professors |

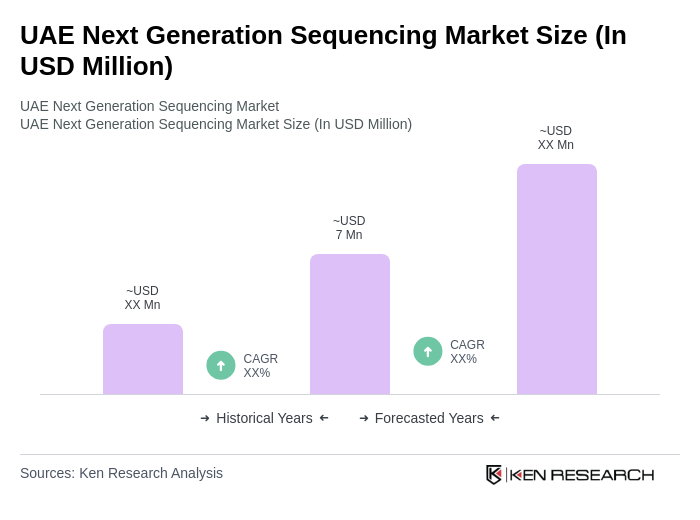

The UAE Next Generation Sequencing market is valued at approximately USD 7 million, reflecting a five-year historical analysis and broader regional data triangulation. This growth is driven by advancements in genomic research and increasing demand for personalized medicine.