Region:Asia

Author(s):Rebecca

Product Code:KRAA9403

Pages:85

Published On:November 2025

By Type:The snacks market is segmented into fruit-based snacks, nut and seed snacks, dairy snacks, whole grain snacks, protein bars, vegetable chips, seaweed snacks, confectionery, savory snacks, sweet snacks, and others. Fruit-based snacks and savory snacks are particularly popular, driven by health consciousness and flavor innovation. The increasing demand for healthier options has boosted fruit-based snacks, especially freeze-dried fruits, while savory snacks such as potato chips and nuts remain staples due to their taste and convenience.

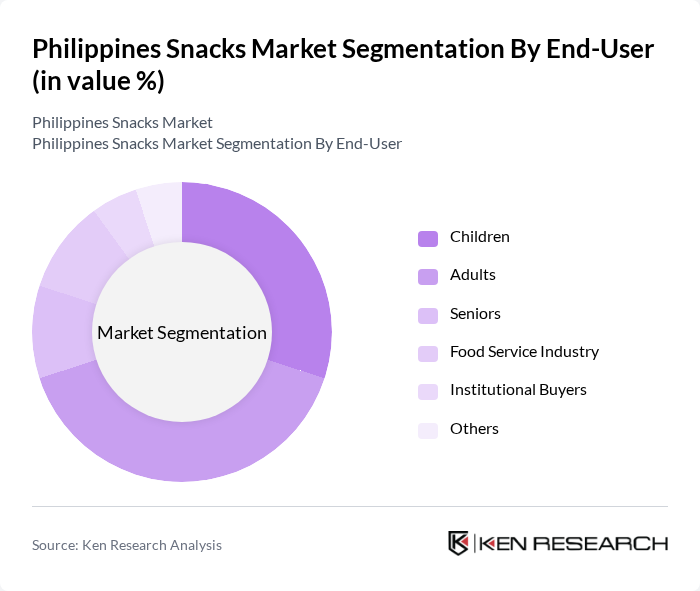

By End-User:The end-user segmentation includes children, adults, seniors, the food service industry, institutional buyers, and others. Children and adults are the primary consumers, with children preferring sweeter and visually appealing snacks, while adults increasingly opt for healthier and more sophisticated flavors. The food service industry, including restaurants and cafes, continues to expand its snack offerings to meet evolving consumer preferences and multi-occasion snacking needs.

The Philippines Snacks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Monde Nissin Corporation, Universal Robina Corporation, Jack 'n Jill, Del Monte Philippines, Inc., Nestlé Philippines, Inc., CDO Foodsphere, Inc., San Miguel Foods, Inc., Liwayway Marketing Corporation (Oishi), Gardenia Bakeries (Philippines) Inc., Purefoods Hormel Company, Inc., M.Y. San Corporation, RFM Corporation, Hizon's Catering, Snack Factory Philippines, Tasty Treats Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines snacks market is poised for continued growth, driven by evolving consumer preferences and lifestyle changes. As urbanization accelerates and disposable incomes rise, the demand for innovative and convenient snack options will likely increase. Additionally, the trend towards healthier eating will push manufacturers to develop products that cater to health-conscious consumers. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruit-Based Snacks Nut and Seed Snacks Dairy Snacks Whole Grain Snacks Protein Bars Vegetable Chips Seaweed Snacks Confectionery Savory Snacks Sweet Snacks Others |

| By End-User | Children Adults Seniors Food Service Industry Institutional Buyers Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Health Food Stores Food Specialty Stores Small Grocery Stores Others |

| By Packaging Type | Pouches Jars Cartons Single-Serve Packs Family Packs Bulk Packaging Others |

| By Flavor Profile | Sweet Savory Spicy Local Flavors (e.g., Adobo, Sinigang, Calamansi, Tamarind) Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Health Attribute | Organic Gluten-Free Low-Calorie Plant-Based Clean Label Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Snack Preferences | 100 | General Consumers, Snack Enthusiasts |

| Retail Distribution Insights | 60 | Retail Managers, Store Owners |

| Health-Conscious Snack Trends | 50 | Health and Wellness Advocates, Nutritionists |

| Market Entry Strategies for New Brands | 40 | Entrepreneurs, Product Launch Managers |

| Consumer Feedback on Packaging and Branding | 60 | Designers, Marketing Professionals |

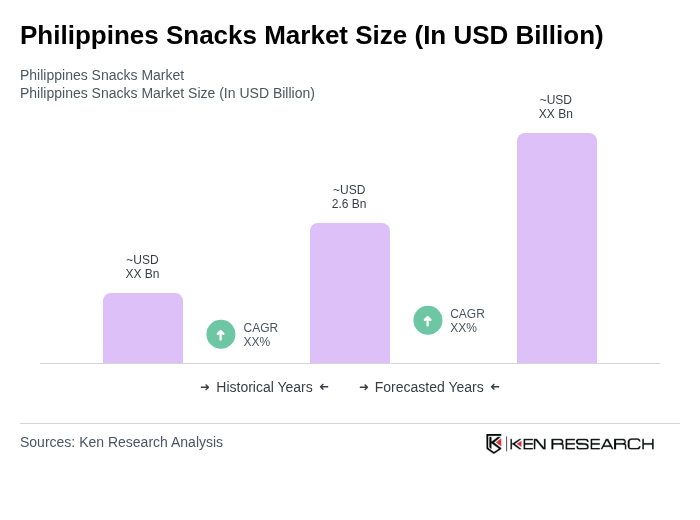

The Philippines Snacks Market is valued at approximately USD 2.6 billion, reflecting significant growth driven by urbanization, changing consumer lifestyles, and a preference for convenient food options.