Middle East Pet Care E-Commerce Market Overview

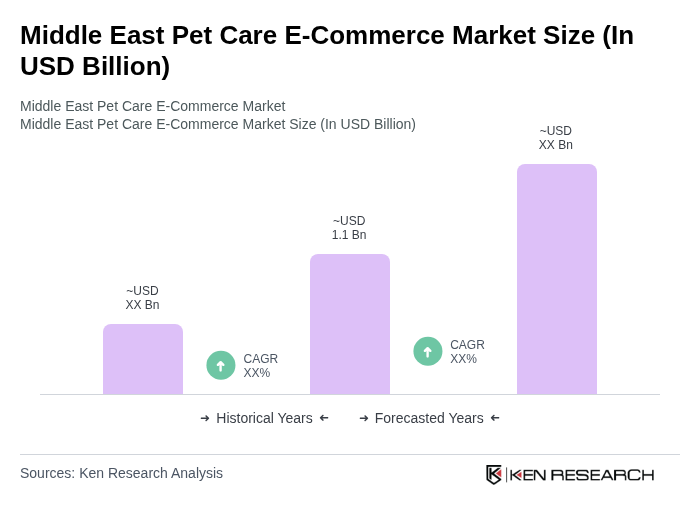

- The Middle East Pet Care E-Commerce Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing pet ownership, rising disposable incomes, and a shift towards online shopping. The convenience of e-commerce platforms has made it easier for consumers to access a wide range of pet products, contributing to the market's expansion. The market is further supported by the rising trend of premiumization, with consumers seeking high-quality, organic, and specialized pet care products, as well as the expansion of digital payment solutions and logistics infrastructure in the region .

- Key players in this market include the GCC countries, particularly Saudi Arabia and the UAE, which dominate due to their high pet ownership rates and a growing trend of pet humanization. Urbanization and a young population in these regions further fuel demand for premium pet products, making them significant contributors to the market. The UAE, in particular, has seen a surge in luxury pet products and services, reflecting changing consumer preferences .

- In 2023, the UAE government implemented regulations to enhance the safety and quality of pet products sold online. This includes mandatory compliance with health and safety standards for pet food and accessories, ensuring that e-commerce platforms adhere to strict guidelines to protect consumer interests and promote responsible pet ownership. The relevant regulatory framework is the "UAE Veterinary Products Regulation, 2023" issued by the Ministry of Climate Change and Environment, which mandates product registration, quality assurance, and periodic inspections for all pet food and accessories retailed online .

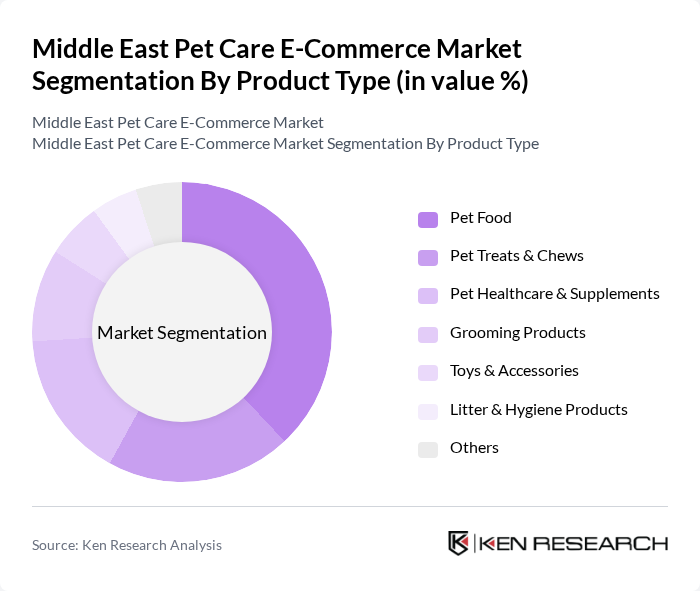

Middle East Pet Care E-Commerce Market Segmentation

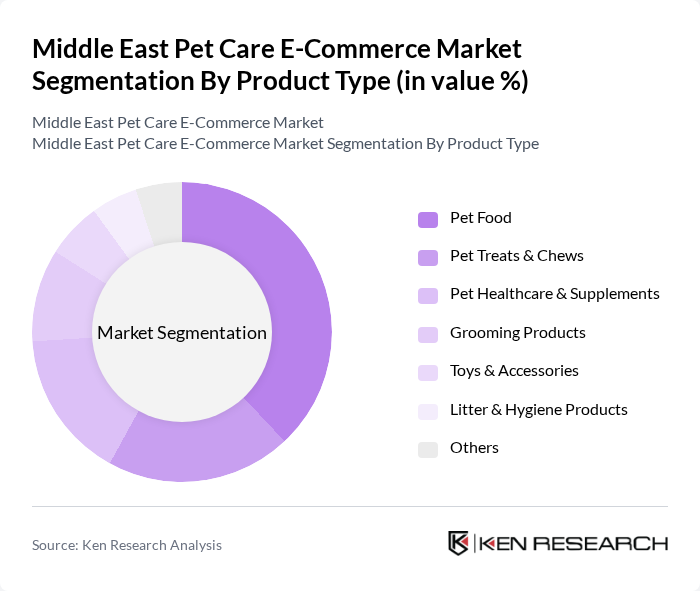

By Product Type:The product type segmentation includes categories such as Pet Food, Pet Treats & Chews, Pet Healthcare & Supplements, Grooming Products, Toys & Accessories, Litter & Hygiene Products, and Others. Among these, Pet Food is the leading sub-segment, driven by the increasing demand for high-quality and specialized diets for pets. Consumers are increasingly opting for premium and organic pet food options, reflecting a growing trend towards health-conscious choices for their pets. Supplements and healthcare products are also gaining traction as pet owners focus on preventive wellness and longevity for their animals .

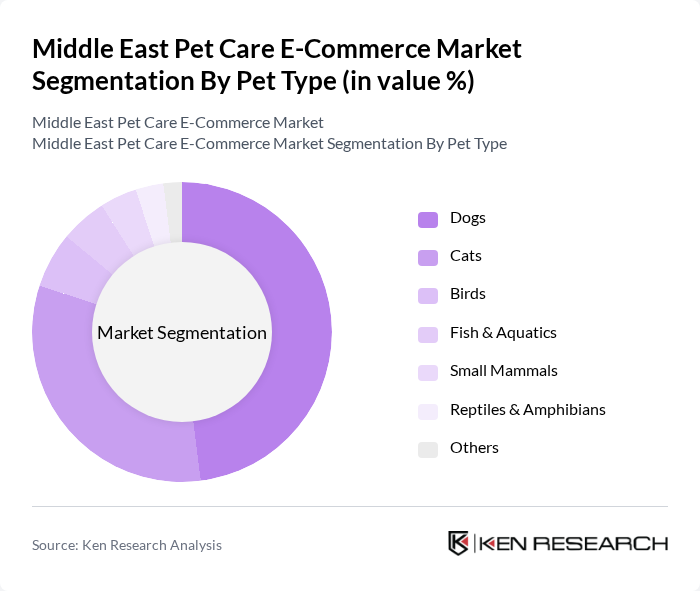

By Pet Type:The pet type segmentation includes Dogs, Cats, Birds, Fish & Aquatics, Small Mammals, Reptiles & Amphibians, and Others. Dogs and Cats dominate this segment, with dogs being the most popular pet in the region. The increasing trend of pet humanization has led to higher spending on pet care products, particularly for dogs, as owners seek to provide the best for their furry companions. Cat ownership is also rising, with demand for premium wet food and specialized products .

Middle East Pet Care E-Commerce Market Competitive Landscape

The Middle East Pet Care E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petzone, MyPets, Amazon.sa, Carrefour Middle East, Noon, Pet Arabia, Dubai Pet Food, The Pet Shop Dubai, PetMart Kuwait, Petworld UAE, Pet Boutique Qatar, Zooplus (serving GCC via cross-border), Pet Corner UAE, Petzania, PetMania Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Pet Care E-Commerce Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The Middle East has seen a significant rise in pet ownership, with estimates indicating that over 30% of households now own pets, translating to approximately 20 million pets in the region. This surge is driven by changing lifestyles and increased urbanization, particularly in countries like the UAE and Saudi Arabia. The growing affection for pets has led to a higher demand for pet care products and services, fueling the e-commerce market's expansion.

- Rise in Disposable Income:The World Bank reports that the Middle East's GDP per capita is approximately $15,000, reflecting a steady increase in disposable income. This economic growth enables pet owners to spend more on premium pet care products, including food, grooming, and health services. As consumers prioritize quality and convenience, the shift towards online shopping for pet products is becoming increasingly prevalent, further driving e-commerce growth.

- Shift Towards Online Shopping:E-commerce in the Middle East is estimated at over $37 billion in value, with pet care being a significant contributor. The convenience of online shopping, coupled with the rise of digital payment solutions, has encouraged pet owners to purchase products online. This trend is particularly strong among younger demographics, who prefer the ease of accessing a wide range of pet products from the comfort of their homes, thus boosting the e-commerce sector.

Market Challenges

- Intense Competition:The Middle East pet care e-commerce market is characterized by intense competition, with numerous local and international players vying for market share. This competitive landscape can lead to price wars, which may erode profit margins. According to industry reports, over 150 e-commerce platforms are currently operating in the pet care sector, making it challenging for new entrants to establish a foothold and for existing players to maintain profitability.

- Regulatory Compliance Issues:Navigating the regulatory landscape in the Middle East can pose significant challenges for e-commerce businesses. Import regulations on pet products vary by country, and compliance with animal welfare laws is mandatory. For instance, the UAE has stringent regulations regarding the importation of pet food, requiring businesses to adhere to specific labeling and safety standards. Non-compliance can result in hefty fines and operational disruptions, hindering market growth.

Middle East Pet Care E-Commerce Market Future Outlook

The future of the Middle East pet care e-commerce market appears promising, driven by technological advancements and evolving consumer preferences. As more pet owners seek convenience, the integration of mobile applications for shopping and pet care services is expected to gain traction. Additionally, the increasing focus on sustainability will likely influence product offerings, with a growing demand for eco-friendly and organic pet products. These trends will shape the market landscape, fostering innovation and enhancing customer engagement.

Market Opportunities

- Expansion of Product Range:There is a significant opportunity for e-commerce platforms to expand their product offerings, particularly in niche categories such as organic and specialty pet foods. With the organic pet food market projected to grow by 10% annually, businesses can capitalize on this trend by diversifying their inventory to meet consumer demand for healthier options.

- Development of Mobile Applications:The increasing smartphone penetration in the Middle East, expected to reach 80% in future, presents a lucrative opportunity for developing mobile applications tailored for pet care. These apps can enhance customer experience through personalized recommendations, subscription services, and easy access to pet-related content, driving customer loyalty and repeat purchases.