Region:Middle East

Author(s):Dev

Product Code:KRAA8376

Pages:85

Published On:November 2025

By Type:The segmentation by type includes various subsegments such as Dietary Supplements, Weight Loss Programs, Fitness Equipment, Meal Replacement Products, Weight Management Apps, Coaching Services, Surgical Devices, Wearable Devices & Smart Trackers, and Others. Among these, Dietary Supplements and Weight Loss Programs are particularly prominent due to their widespread acceptance and effectiveness in aiding weight management. The market is also witnessing rapid growth in the adoption of wearable devices and smart trackers, driven by increasing consumer interest in digital health monitoring and personalized fitness solutions .

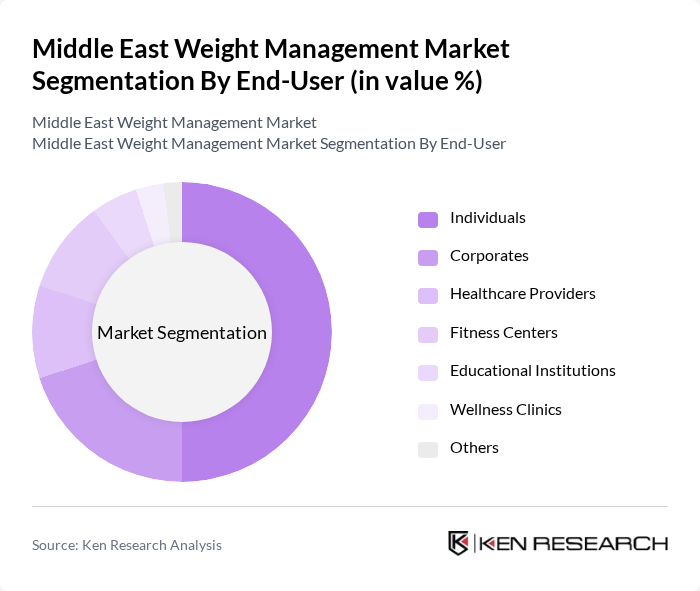

By End-User:The end-user segmentation includes Individuals, Corporates, Healthcare Providers, Fitness Centers, Educational Institutions, Wellness Clinics, and Others. Individuals represent the largest segment, driven by the increasing awareness of health and fitness among the general population, while Corporates are also significant due to employee wellness programs. Healthcare providers and wellness clinics are expanding their offerings to include integrated weight management services, reflecting a broader shift toward preventive healthcare .

The Middle East Weight Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., WW International, Inc. (formerly Weight Watchers), Atkins Nutritionals, Inc., Nestlé Health Science (Optifast Middle East), VLCC Health Care Ltd., Dr. Nutrition (UAE), Fitness First Middle East, Gold's Gym Middle East, Bodyline Clinics (UAE, KSA), NutriCentre (Saudi Arabia), Lifesum, MyFitnessPal, Noom, Inc., Fitbit, Inc., Under Armour, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East weight management market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital health platforms gain traction, more individuals will have access to personalized weight management solutions. Additionally, the integration of artificial intelligence in health applications is expected to enhance user experience and effectiveness. These trends indicate a shift towards more tailored and accessible weight management options, fostering a healthier population and a more dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Dietary Supplements Weight Loss Programs Fitness Equipment Meal Replacement Products Weight Management Apps Coaching Services Surgical Devices Wearable Devices & Smart Trackers Others |

| By End-User | Individuals Corporates Healthcare Providers Fitness Centers Educational Institutions Wellness Clinics Others |

| By Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Urban vs. Rural Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia) Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Health Stores Direct Sales Fitness Centers & Clinics Others |

| By Product Formulation | Natural Products Synthetic Products Organic Products Herbal Products Others |

| By Service Type | In-Person Services Virtual Services Hybrid Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dietary Program Providers | 100 | Nutritionists, Program Coordinators |

| Fitness Centers and Gyms | 60 | Gym Owners, Personal Trainers |

| Healthcare Professionals | 50 | Doctors, Dietitians |

| Weight Management Product Retailers | 40 | Retail Managers, Product Developers |

| Consumers Engaged in Weight Management | 90 | Individuals on weight loss programs, Fitness Enthusiasts |

The Middle East Weight Management Market is valued at approximately USD 7.1 billion, driven by rising obesity rates, health awareness, and demand for weight management solutions. This growth reflects significant lifestyle changes and urbanization in the region.