Region:Africa

Author(s):Geetanshi

Product Code:KRAB6326

Pages:100

Published On:October 2025

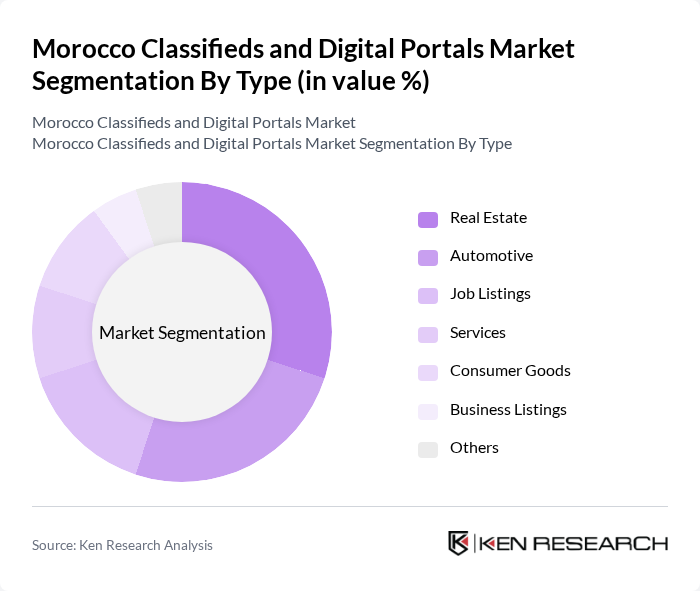

By Type:The market can be segmented into various types, including Real Estate, Automotive, Job Listings, Services, Consumer Goods, Business Listings, and Others. Each of these segments caters to different consumer needs and preferences, with some experiencing higher demand than others.

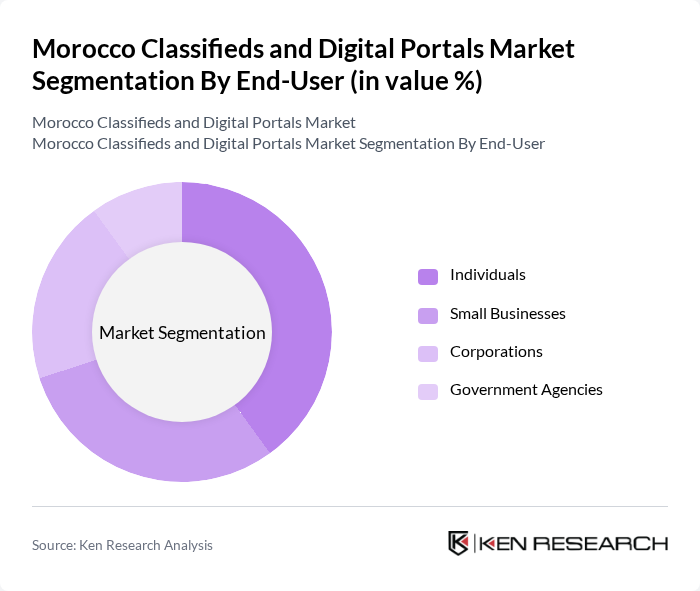

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporations, and Government Agencies. Each of these user groups has distinct requirements and usage patterns, influencing the overall market dynamics.

The Morocco Classifieds and Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avito.ma, Bikhir.ma, MarocAnnonces.com, Jumia.ma, Souq.com, Ouedkniss.com, Moteur.ma, Annonces.ma, Kifache.com, Lkhedma.com, Tanjawiya.com, Mouloudia.com, B2B.ma, Moubarmij.com, Makhzan.com contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Moroccan classifieds and digital portals market appears promising, driven by technological advancements and evolving consumer preferences. As mobile commerce continues to rise, platforms that prioritize user experience and security will likely thrive. Additionally, the integration of AI and data analytics will enhance personalization, making services more relevant to users. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Job Listings Services Consumer Goods Business Listings Others |

| By End-User | Individuals Small Businesses Corporations Government Agencies |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms Direct Listings |

| By Geographic Focus | Urban Areas Rural Areas Regional Markets |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Service Type | Classified Ads Auctions Direct Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales Platforms | 80 | Car Dealership Owners, Automotive Sales Managers |

| Job Portals | 120 | HR Managers, Recruitment Consultants |

| General Merchandise Classifieds | 90 | Small Business Owners, E-commerce Entrepreneurs |

| Consumer Electronics Listings | 70 | Electronics Retailers, Product Managers |

The Morocco Classifieds and Digital Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online transactions among consumers.