Region:Europe

Author(s):Shubham

Product Code:KRAB4488

Pages:94

Published On:October 2025

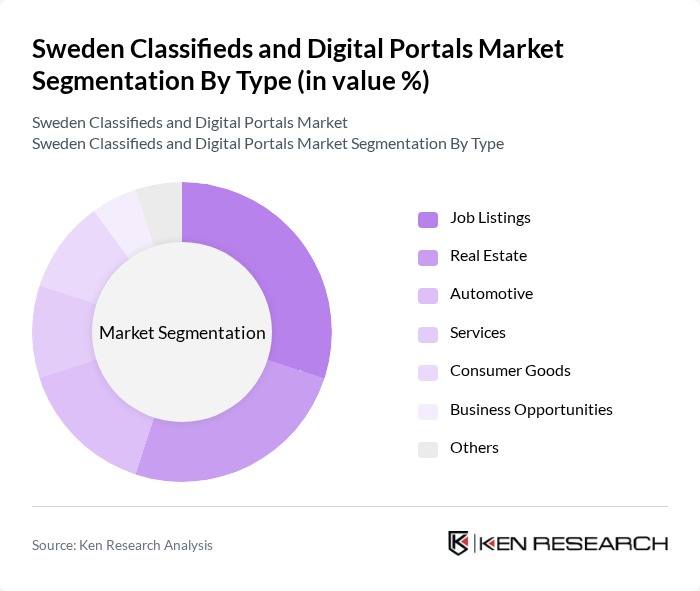

By Type:The market is segmented into various types, including Job Listings, Real Estate, Automotive, Services, Consumer Goods, Business Opportunities, and Others. Among these, Job Listings and Real Estate are particularly prominent due to the high demand for employment opportunities and housing in urban areas. The increasing reliance on digital platforms for job searches and property listings has made these segments crucial for market growth.

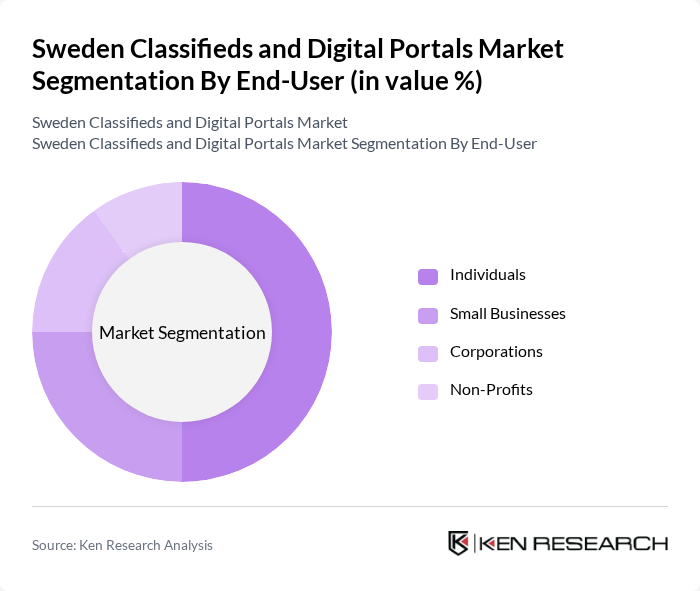

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporations, and Non-Profits. Individuals dominate the market as they frequently utilize classifieds for personal transactions, such as job searches and buying/selling goods. Small businesses also leverage these platforms for advertising services and products, contributing significantly to the overall market dynamics.

The Sweden Classifieds and Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blocket AB, Tradera AB, Hemnet AB, Bostadsdeal AB, Bytbil AB, Jobbsafari AB, Marketplace Sweden AB, Oikotie AB, Lokus.se, Blocket Jobb AB, KVD Bil AB, Bostadsportal AB, Jobbmatchen AB, B2B Marketplace AB, Dagens Nyheter AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the classifieds and digital portals market in Sweden appears promising, driven by technological advancements and evolving consumer behaviors. As mobile usage continues to rise, platforms that prioritize user experience and personalization are likely to thrive. Additionally, the integration of AI technologies will enhance search functionalities and targeted advertising, making listings more relevant. Companies that adapt to these trends while addressing regulatory challenges will be well-positioned to capture market share and foster sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Job Listings Real Estate Automotive Services Consumer Goods Business Opportunities Others |

| By End-User | Individuals Small Businesses Corporations Non-Profits |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms Offline Listings |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Nationwide |

| By Pricing Model | Free Listings Paid Listings Subscription-Based Commission-Based |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Service Type | B2C Services C2C Services B2B Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 150 | Real Estate Agents, Property Managers |

| Automotive Classifieds | 100 | Car Dealership Owners, Automotive Sales Managers |

| Job Portals | 120 | HR Managers, Recruitment Consultants |

| Consumer Goods Marketplace | 80 | E-commerce Managers, Small Business Owners |

| Local Services Advertising | 90 | Service Providers, Marketing Directors |

The Sweden Classifieds and Digital Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital platforms for buying and selling goods and services, as well as the rise of e-commerce.