Region:Asia

Author(s):Rebecca

Product Code:KRAB5891

Pages:88

Published On:October 2025

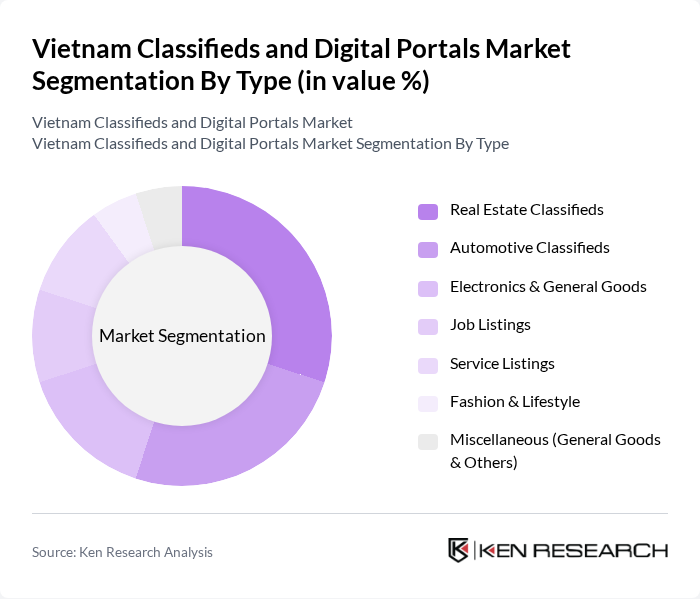

By Type:The market is segmented into various types, including Real Estate Classifieds, Automotive Classifieds, Electronics & General Goods, Job Listings, Service Listings, Fashion & Lifestyle, and Miscellaneous (General Goods & Others). Each of these segments addresses distinct consumer needs and preferences, with Real Estate and Automotive segments remaining dominant due to high-value transactions and strong demand in urban centers. Electronics and Job Listings segments benefit from rapid digital adoption and workforce mobility, while Service Listings and Fashion & Lifestyle cater to evolving lifestyle needs .

The Real Estate Classifieds segment is currently dominating the market, supported by a booming real estate sector and ongoing urbanization in Vietnam. The growing middle class and increased demand for housing have led to a surge in online property listings. Consumers increasingly turn to digital platforms for convenience, a broader selection, and transparent information, making this segment a key driver in the classifieds market .

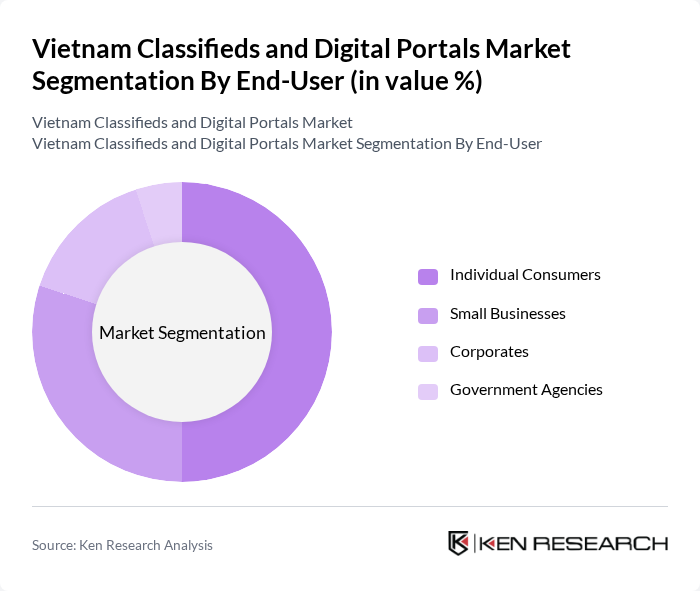

By End-User:The market is segmented by end-users, including Individual Consumers, Small Businesses, Corporates, and Government Agencies. Each segment exhibits distinct needs and usage patterns, with individual consumers driving the majority of transactions due to the convenience and accessibility of online classifieds. Small businesses and corporates leverage these platforms for broader reach and cost-effective marketing, while government agencies utilize digital portals for public service announcements and procurement .

Individual Consumers represent the largest segment in the classifieds market, driven by the increasing trend of online shopping and the need for various services. The ease of accessing listings from home and the ability to compare options have made this segment highly attractive. Small businesses also play a significant role, utilizing digital platforms to reach a wider audience and promote their products and services efficiently .

The Vietnam Classifieds and Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chotot.com, Muaban.net, Sendo.vn, Tiki.vn, Lazada.vn, Shopee.vn, Vatgia.com, 5giay.vn, Rongbay.com, Dothi.net, Timnhanh.com, Muabannhadat.vn, Nhadat24h.net, MuaBanNhanh.com, Batdongsan.com.vn contribute to innovation, geographic expansion, and service delivery in this space .

The Vietnam classifieds and digital portals market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As internet penetration continues to rise, platforms will increasingly leverage data analytics to enhance user experiences. Additionally, the integration of AI and machine learning will streamline operations and improve personalization. The focus on sustainability and ethical practices will also shape market dynamics, as consumers become more conscious of their purchasing decisions, leading to the emergence of eco-friendly marketplaces.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Classifieds Automotive Classifieds Electronics & General Goods Job Listings Service Listings Fashion & Lifestyle Miscellaneous (General Goods & Others) |

| By End-User | Individual Consumers Small Businesses Corporates Government Agencies |

| By Sales Channel | Online Platforms Mobile Applications Social Commerce (e.g., Facebook, TikTok Shop) Offline Listings |

| By Product Category | Real Estate Automotive Electronics Jobs Services Fashion General Goods & Miscellaneous |

| By Geographic Coverage | Urban Areas Rural Areas Regional Markets |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Product Condition | New Used Refurbished |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 120 | Real Estate Agents, Property Managers |

| Job Portals | 90 | HR Managers, Job Seekers |

| Service Providers | 60 | Small Business Owners, Freelancers |

| Automotive Classifieds | 50 | Car Dealers, Private Sellers |

| Consumer Goods Listings | 70 | Retail Managers, E-commerce Entrepreneurs |

The Vietnam Classifieds and Digital Portals Market is valued at approximately USD 1.3 billion, driven by increased internet penetration, mobile device usage, and a growing e-commerce sector, reflecting a significant shift towards online shopping and services among consumers.