Region:Middle East

Author(s):Shubham

Product Code:KRAB4415

Pages:91

Published On:October 2025

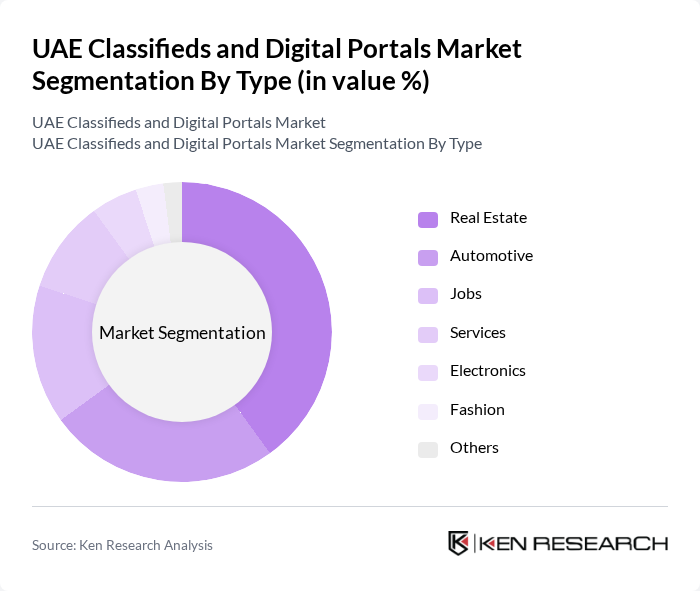

By Type:The market is segmented into various types, including Real Estate, Automotive, Jobs, Services, Electronics, Fashion, and Others. Among these, the Real Estate segment is particularly dominant due to the continuous growth in the property market, driven by both local and foreign investments. The demand for housing and commercial properties has led to a surge in online listings, making it a key area for digital portals.

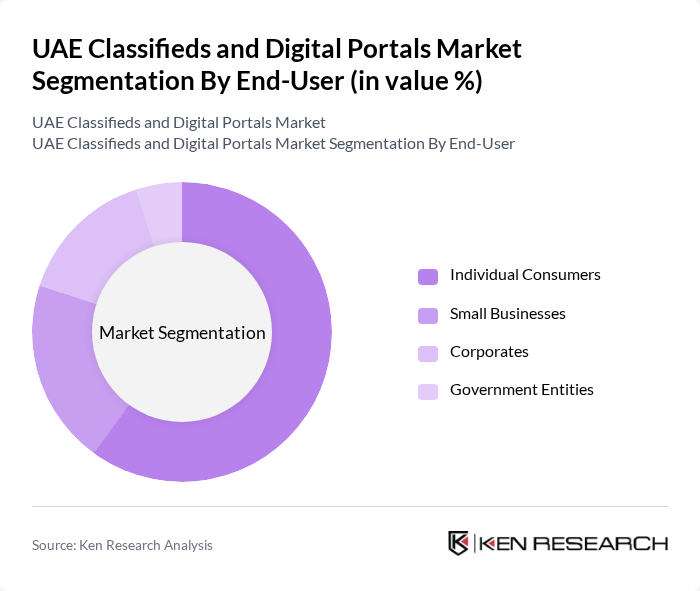

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporates, and Government Entities. Individual Consumers dominate the market as they increasingly turn to online platforms for buying and selling goods and services. The convenience and accessibility of digital classifieds cater to the needs of everyday users, making this segment the largest contributor to market growth.

The UAE Classifieds and Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubizzle, OLX UAE, Bayut, Property Finder, YallaMotor, ExpatWoman, Gulf News Classifieds, JustProperty, UAE Classifieds, SellAnyCar.com, CarSwitch, Zawya, Souq.com, Facebook Marketplace, Instagram Shopping contribute to innovation, geographic expansion, and service delivery in this space.

The UAE classifieds and digital portals market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As mobile-first strategies gain traction, platforms that prioritize user experience and security will likely thrive. Additionally, the integration of AI and machine learning will enhance personalization, making services more relevant to users. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture emerging opportunities in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Jobs Services Electronics Fashion Others |

| By End-User | Individual Consumers Small Businesses Corporates Government Entities |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms |

| By Geographic Coverage | UAE-Wide Emirate-Specific |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By User Demographics | Age Groups Income Levels Urban vs Rural |

| By Advertising Model | Pay-Per-Click Pay-Per-Lead Flat Rate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 150 | Real Estate Agents, Property Managers |

| Automotive Classifieds | 100 | Car Dealership Owners, Automotive Advertisers |

| Job Portals | 120 | HR Managers, Recruitment Consultants |

| Consumer Goods Advertisements | 80 | Small Business Owners, Marketing Managers |

| Service Listings (e.g., Home Services) | 90 | Service Providers, Business Development Managers |

The UAE Classifieds and Digital Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online shopping and services among consumers.