Region:Asia

Author(s):Geetanshi

Product Code:KRAB0099

Pages:91

Published On:August 2025

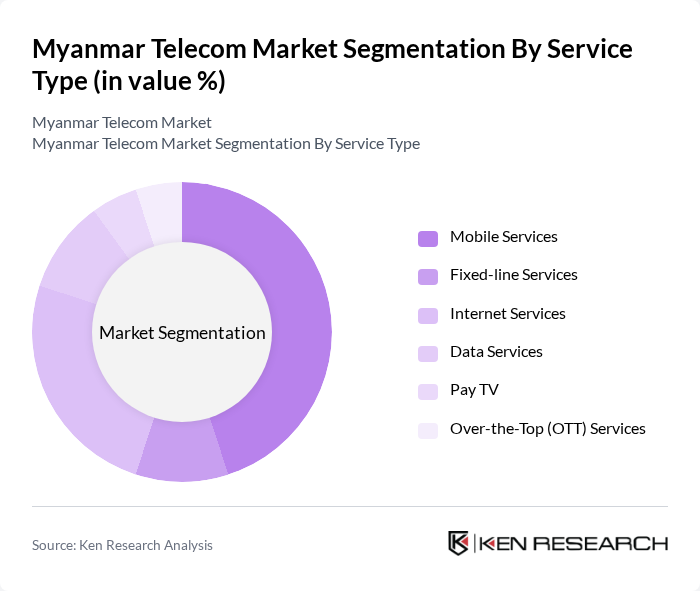

By Service Type:The service type segmentation includes mobile services, fixed-line services, internet services, data services, pay TV, and over-the-top (OTT) services. Mobile services continue to dominate the market, driven by widespread smartphone adoption and increasing reliance on mobile internet for communication and entertainment. Internet services are gaining traction as more consumers seek reliable connectivity for work, education, and leisure .

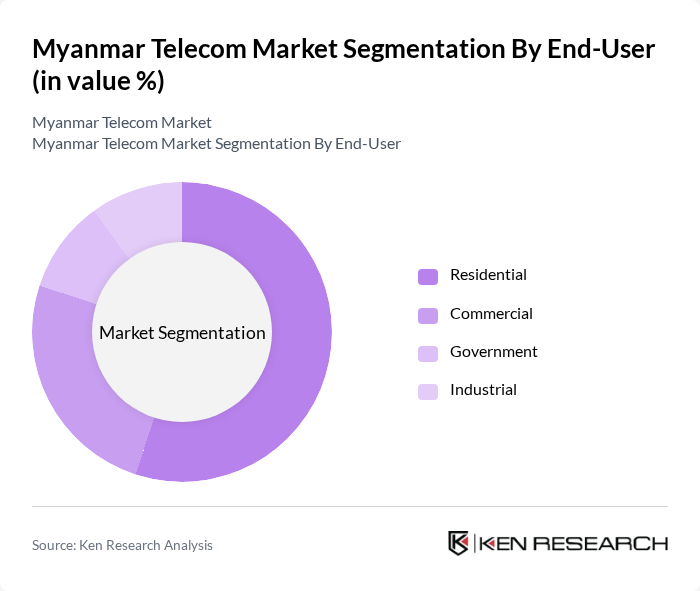

By End-User:The end-user segmentation covers residential, commercial, government, and industrial users. Residential users represent the largest segment, driven by the growing number of households adopting internet and mobile services. Commercial users are also significant, as businesses increasingly seek reliable telecom solutions to enhance operations and customer engagement. Government and industrial users are growing segments, with a focus on digital transformation and improved connectivity .

The Myanmar Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Myanma Posts and Telecommunications (MPT), Ooredoo Myanmar, Mytel, Atom (formerly Telenor Myanmar), Yatanarpon Teleport (YTP), Myanmar Net, Red Dot Network, Wave Money, KBZPay (KBZ Bank), AYA Bank, TrueMoney Myanmar, MPT Money, Ooredoo Money, MytelPay, and Myanmar Payment Union (MPU) contribute to innovation, geographic expansion, and service delivery in this space .

The Myanmar telecom market is poised for significant transformation, driven by increasing mobile penetration and government initiatives aimed at digitalization. In future, the focus will shift towards enhancing customer experience through innovative digital services and mobile applications. The adoption of IoT solutions is expected to rise, facilitating smart city projects and improving urban infrastructure. As competition intensifies, telecom operators will need to prioritize service quality and customer engagement to maintain market share and drive sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Mobile Services Fixed-line Services Internet Services Data Services Pay TV Over-the-Top (OTT) Services |

| By End-User | Residential Commercial Government Industrial |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms |

| By Pricing Model | Prepaid Postpaid Bundled Packages |

| By Service Tier | Basic Services Premium Services Enterprise Solutions |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations |

| By Geographic Coverage | Urban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 100 | Individual Consumers, Mobile Subscribers |

| Broadband Internet Subscribers | 80 | Residential Users, Small Business Owners |

| Telecom Industry Experts | 40 | Regulatory Officials, Industry Analysts |

| Corporate Telecom Clients | 60 | IT Managers, Procurement Officers |

| Rural Telecom Access Users | 50 | Community Leaders, Local Business Owners |

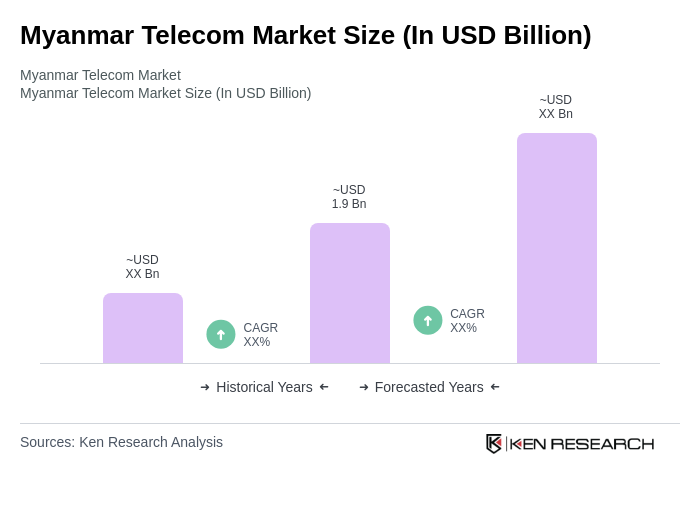

The Myanmar Telecom Market is valued at approximately USD 1.9 billion, reflecting a growing demand for mobile connectivity, internet services, and digital transformation initiatives across various sectors, driven by the expansion of 4G and the anticipated rollout of 5G networks.