Region:Asia

Author(s):Shubham

Product Code:KRAC0594

Pages:96

Published On:August 2025

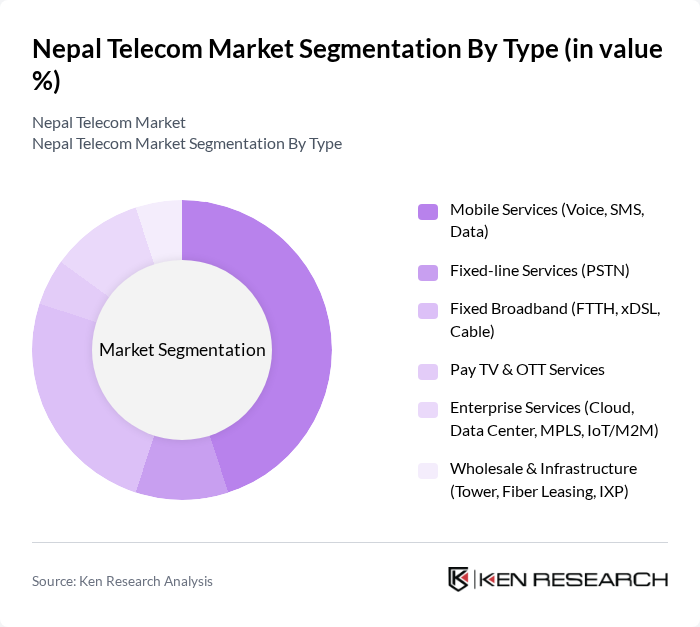

By Type:This segmentation includes various services offered in the telecom market, such as mobile services, fixed-line services, broadband, and more. Each sub-segment caters to different consumer needs and preferences, reflecting the diverse landscape of telecommunications in Nepal. According to industry coverage, market sizing commonly spans voice (wired and wireless), data and messaging, and OTT/pay TV, with fiber-optic broadband growing in share alongside sustained 4G data usage growth .

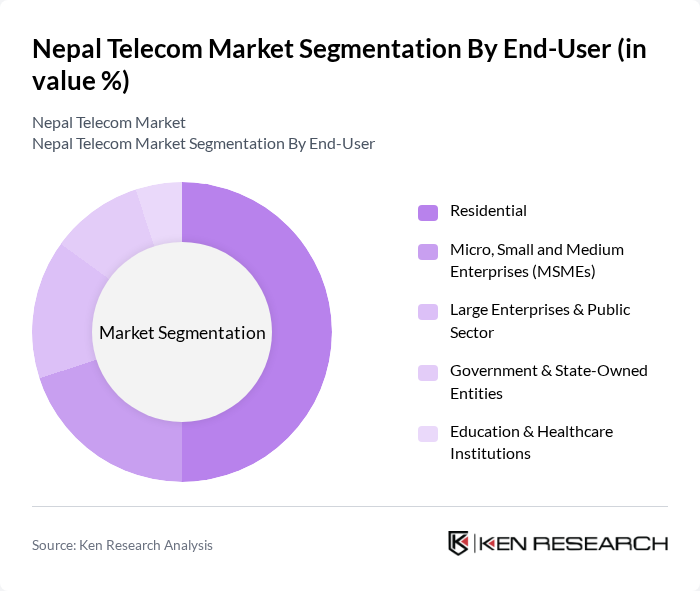

By End-User:This segmentation focuses on the different categories of users who utilize telecom services, including residential customers, businesses, and government entities. Understanding the end-user demographics helps in tailoring services to meet specific needs. In Nepal, consumer mobile broadband and residential FTTH dominate usage, while MSMEs and larger enterprises increasingly adopt managed connectivity and data services, consistent with market analyses of service uptake patterns .

The Nepal Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nepal Doorsanchar Company Limited (Nepal Telecom, NTC), Ncell Axiata Limited, Smart Telecom Private Limited, Subisu Cablenet Pvt. Ltd., WorldLink Communications Ltd., Vianet Communications Pvt. Ltd., Classic Tech Pvt. Ltd., CG Communications Ltd. (CG Net), Nepal Satellite Telecom Pvt. Ltd. (Hello Nepal), Websurfer Nepal Communication System Pvt. Ltd., Nepal Telecom Authority-licensed ISPs: Subisu, WorldLink, Vianet, Classic Tech, CG Net (aggregated), DishHome Fibernet (Dish Media Network Ltd.), Mercantile Communication Pvt. Ltd., Techminds Network Pvt. Ltd., Nepal Telecommunications Authority (Regulator) – for ecosystem mapping contribute to innovation, geographic expansion, and service delivery in this space. Market commentary consistently identifies NTC and Ncell as dominant mobile operators, with strong momentum in fiber broadband from major ISPs including WorldLink, Vianet, Subisu, Classic Tech, and DishHome Fibernet .

The future of the Nepal telecom market appears promising, driven by technological advancements and increasing digital adoption. With the anticipated growth in mobile financial services and the expansion of broadband connectivity, telecom operators are likely to explore innovative solutions to enhance customer experience. Additionally, the integration of AI and machine learning technologies will enable operators to optimize their services, improve operational efficiency, and cater to the evolving needs of consumers, positioning them for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services (Voice, SMS, Data) Fixed-line Services (PSTN) Fixed Broadband (FTTH, xDSL, Cable) Pay TV & OTT Services Enterprise Services (Cloud, Data Center, MPLS, IoT/M2M) Wholesale & Infrastructure (Tower, Fiber Leasing, IXP) |

| By End-User | Residential Micro, Small and Medium Enterprises (MSMEs) Large Enterprises & Public Sector Government & State-Owned Entities Education & Healthcare Institutions |

| By Service Plan | Prepaid Mobile Postpaid Mobile Fixed Broadband Plans (Speed Tiers & FUP) Bundled Converged Plans (Mobile + Broadband + TV) Corporate Contracts & SLAs |

| By Distribution Channel | Operator-Owned Stores & Direct Sales Authorized Retailers & Recharge Outlets Online/Digital Channels (Web, App, eKYC) Third-party Distributors & Dealers |

| By Pricing Strategy | Economy/Entry Plans Mid-tier Value Plans Unlimited/High-ARPU Plans Promotional/Introductory Offers |

| By Customer Segment | Individual Consumers SOHO & Startups SMEs Large Enterprises & Institutions |

| By Geographic Coverage | Urban Municipalities Semi-Urban Municipalities Rural & Remote (Hills/Mountain Districts) National Backhaul & International Gateways |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-45, diverse income levels |

| Broadband Subscribers | 100 | Households with internet access, urban and rural |

| Telecom Industry Experts | 40 | Regulatory officials, telecom analysts, and consultants |

| Small Business Owners | 80 | Owners of SMEs utilizing telecom services for operations |

| Corporate Telecom Managers | 70 | IT managers and procurement officers in large enterprises |

The Nepal Telecom Market is valued at approximately USD 1.3 billion, reflecting revenues from mobile, fixed broadband, and related services. This valuation is based on a five-year historical analysis and aligns with recent trends in operator revenues.