Region:Europe

Author(s):Shubham

Product Code:KRAB4975

Pages:89

Published On:October 2025

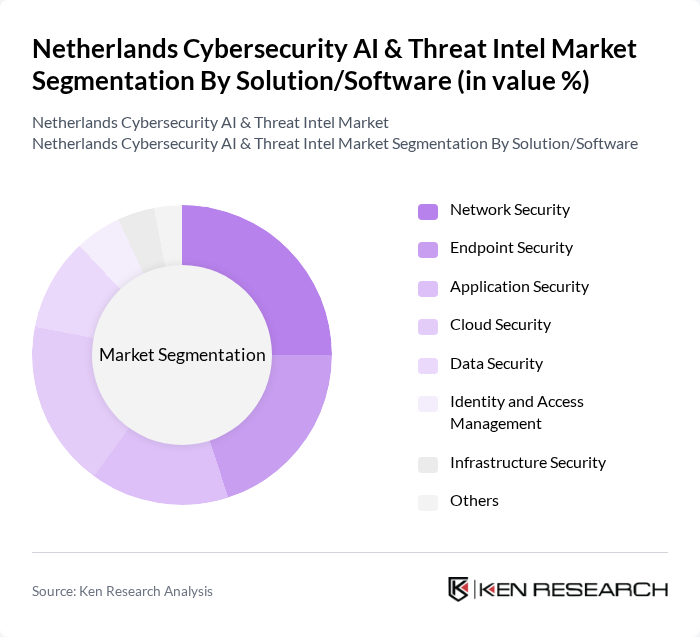

By Solution/Software:The market is segmented into various solutions that address distinct cybersecurity needs. The primary subsegments includeNetwork Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Security,andOthers. Each subsegment plays a critical role in mitigating specific security risks, with cloud security and endpoint security seeing particularly strong demand due to increased cloud adoption and remote work trends.

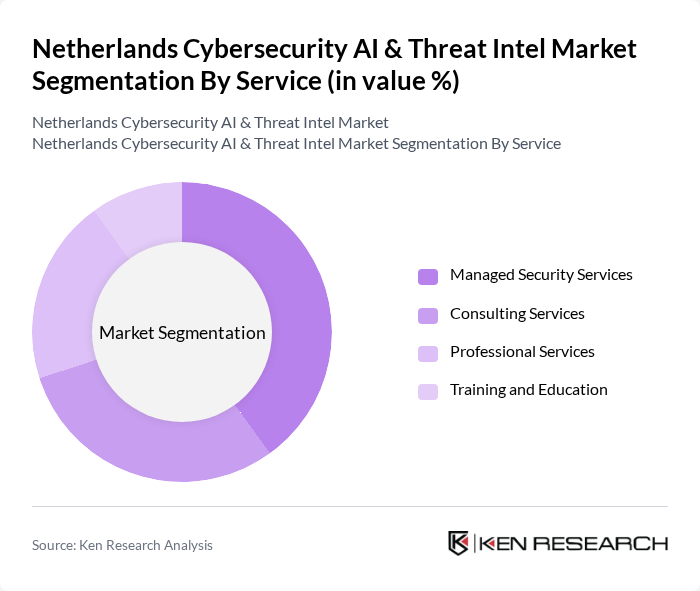

By Service:The service segment encompasses offerings that support organizational cybersecurity initiatives. This includesManaged Security Services, Consulting Services, Professional Services,andTraining and Education. Managed security services are in high demand as organizations seek to outsource ongoing security management and monitoring, while consulting and professional services address strategic and technical requirements. Training and education remain essential for workforce development and compliance.

The Netherlands Cybersecurity AI & Threat Intel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, IBM Security, Cisco Systems, Fortinet, Check Point Software Technologies, Palo Alto Networks, Trend Micro, Tesorion, Fox-IT (part of NCC Group), Northwave Cyber Security, Microsoft, KPN Security, EclecticIQ, Darktrace, and CrowdStrike contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands cybersecurity market is poised for significant transformation, driven by technological advancements and evolving threat landscapes. As organizations increasingly adopt AI and machine learning technologies, the demand for sophisticated threat intelligence platforms will rise. Furthermore, the shift towards zero trust security models will reshape how businesses approach cybersecurity, emphasizing continuous verification and risk assessment. These trends indicate a dynamic market environment where innovation and adaptability will be crucial for success in combating cyber threats.

| Segment | Sub-Segments |

|---|---|

| By Solution/Software | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Infrastructure Security Others |

| By Service | Managed Security Services Consulting Services Professional Services Training and Education |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Organization Size | Small and Medium-Sized Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | Public Sector Energy and Utilities Healthcare Retail Automotive Manufacturing BFSI (Banking, Financial Services, and Insurance) Telecom IT Others |

| By Security Type | Threat Intelligence Incident Response Vulnerability Management Denial-of-Service (DoS) Protection Zero-Day Exploit Protection Man-in-the-Middle (MITM) Attack Protection Malware Protection Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee |

| By Application | Unified Vulnerability Management Governance, Risk & Compliance Data Security & Privacy Identity & Access Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 60 | Chief Information Security Officers, IT Security Managers |

| Healthcare Cybersecurity Solutions | 50 | Healthcare IT Directors, Compliance Officers |

| Government Cybersecurity Initiatives | 40 | Policy Makers, Cybersecurity Analysts |

| Retail Sector Threat Intelligence | 45 | IT Managers, Risk Management Officers |

| Manufacturing Cybersecurity Practices | 55 | Operations Managers, Security Compliance Managers |

The Netherlands Cybersecurity AI & Threat Intel Market is valued at approximately USD 3.2 billion, reflecting significant growth driven by increasing cyber threats and the adoption of advanced security solutions, particularly in critical sectors like finance and government.