Region:Europe

Author(s):Rebecca

Product Code:KRAB5321

Pages:83

Published On:October 2025

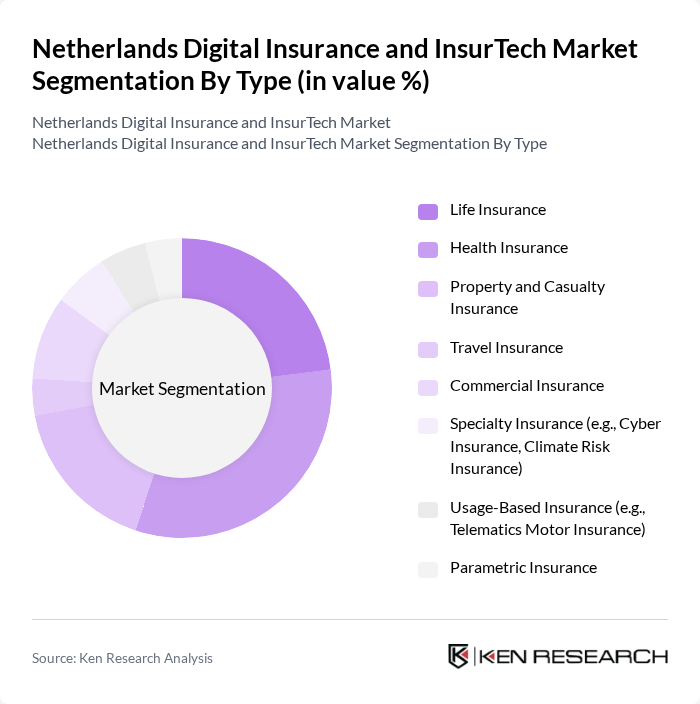

By Type:The market is segmented into various insurance products tailored to evolving consumer needs. Health Insurance remains the dominant sub-segment, driven by increasing healthcare costs, regulatory mandates for universal coverage, and heightened consumer awareness of health risks. Life Insurance holds a significant share as individuals seek financial protection for their families. Property and Casualty Insurance is expanding, supported by rising demand for home, auto, and liability coverage. Specialty Insurance, including cyber and climate risk insurance, is gaining traction due to the increasing frequency of cyberattacks and climate-related events. Usage-Based Insurance and Parametric Insurance are emerging as innovative solutions, leveraging telematics and real-time data to offer personalized and event-triggered coverage .

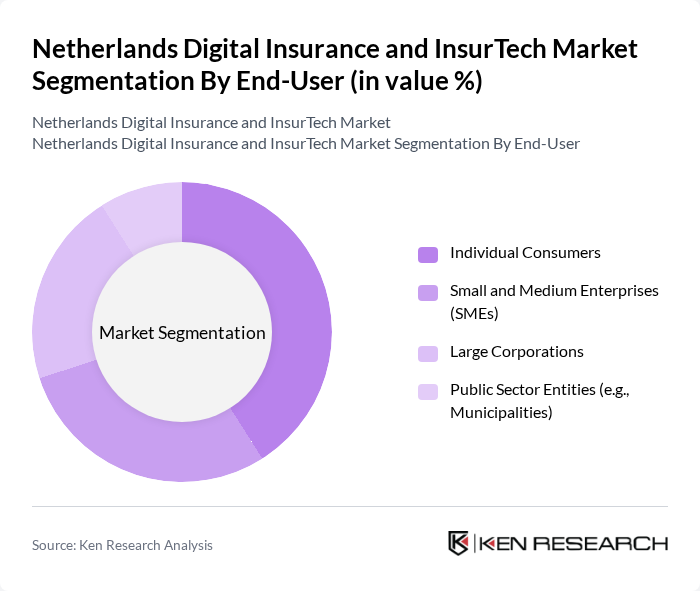

By End-User:The market is segmented by end-users, including individual consumers, small and medium enterprises (SMEs), large corporations, and public sector entities. Individual Consumers represent the largest segment, driven by the need for personal insurance products and digital self-service platforms. SMEs are increasingly adopting digital insurance solutions for cost-effective risk management and regulatory compliance. Large Corporations require complex, multi-line coverage, including cyber and climate risk insurance, to address evolving business risks. Public Sector Entities, such as municipalities, are adopting parametric and specialty insurance to manage infrastructure and climate-related risks .

The Netherlands Digital Insurance and InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Achmea, ASR Nederland N.V., Nationale-Nederlanden (NN Group), Aegon N.V., Univé, Zilveren Kruis, Allianz Nederland, Interpolis, Klaverblad Verzekeringen, Verzekeruzelf.nl, InShared, InsurTech Nederland, Lemonade, Wefox, Baloise Insurance, ABN AMRO Verzekeringen, Rabobank Group (Bancassurance), One Underwriting B.V., Digital Insurance Group (DIG), Yolt Technology Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands Digital Insurance and InsurTech market appears promising, driven by technological advancements and evolving consumer preferences. As the demand for personalized insurance products grows, companies are likely to leverage AI and data analytics to enhance customer experiences. Additionally, the expansion of mobile platforms will facilitate greater accessibility, allowing insurers to reach underserved demographics. The regulatory landscape will continue to evolve, fostering innovation while ensuring consumer protection, ultimately shaping a more resilient insurance ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property and Casualty Insurance Travel Insurance Commercial Insurance Specialty Insurance (e.g., Cyber Insurance, Climate Risk Insurance) Usage-Based Insurance (e.g., Telematics Motor Insurance) Parametric Insurance |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Public Sector Entities (e.g., Municipalities) |

| By Distribution Channel | Direct Sales (Digital Portals) Brokers and Agents Online Platforms (Embedded Insurance, API-driven Distribution) Bancassurance (Bank Partnerships) MGAs and Wholesalers |

| By Customer Segment | Millennials Gen X Baby Boomers High Net-Worth Individuals Tech-Savvy Drivers |

| By Product Features | Customizable Policies Usage-Based Insurance Bundled Insurance Products Automated Claims Processing Digital-First Customer Experience |

| By Claims Processing Method | Automated Claims Processing Manual Claims Processing Hybrid Claims Processing |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Digital Adoption | 100 | Product Managers, Digital Transformation Leads |

| Health Insurance Consumer Insights | 90 | Customer Experience Managers, Policyholders |

| Property Insurance Trends | 80 | Underwriters, Risk Assessment Analysts |

| InsurTech Startup Innovations | 60 | Founders, CTOs, and Product Development Heads |

| Regulatory Impact on Digital Insurance | 50 | Compliance Officers, Legal Advisors |

The Netherlands Digital Insurance and InsurTech Market is valued at approximately USD 6.1 billion, driven by the adoption of digital technologies and consumer demand for personalized insurance products.