Region:Europe

Author(s):Geetanshi

Product Code:KRAB5209

Pages:91

Published On:October 2025

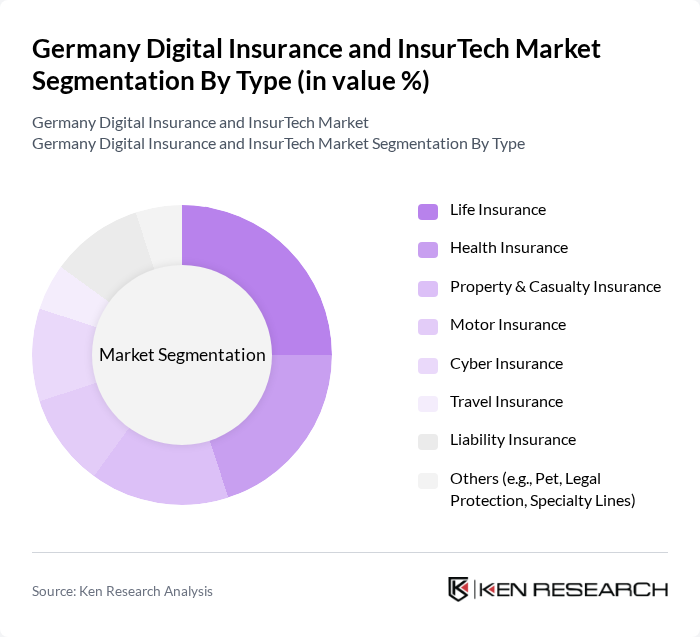

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Property & Casualty Insurance, Motor Insurance, Cyber Insurance, Travel Insurance, Liability Insurance, and Others (e.g., Pet, Legal Protection, Specialty Lines). Each sub-segment caters to different consumer needs and preferences, with specific trends influencing their growth. Life and health insurance remain dominant due to demographic shifts and rising health awareness, while cyber insurance is gaining traction amid increased digitalization and cyber risk exposure .

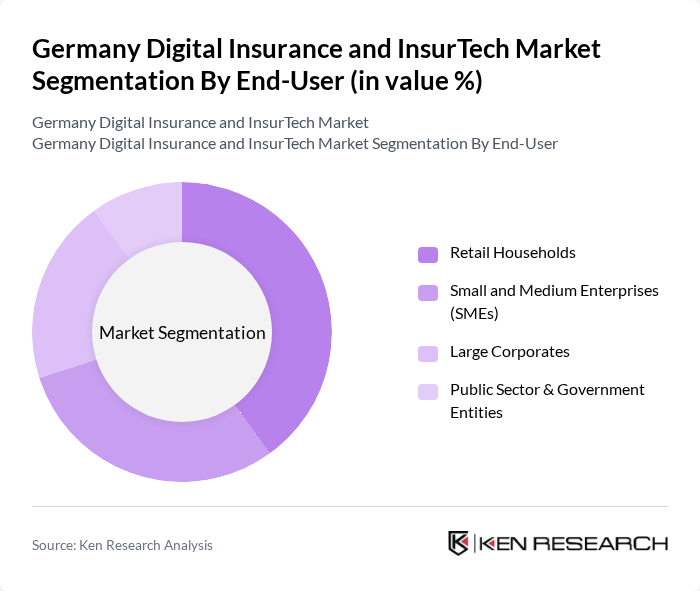

By End-User:The market is segmented by end-users, including Retail Households, Small and Medium Enterprises (SMEs), Large Corporates, and Public Sector & Government Entities. Each segment has unique insurance needs, with retail households increasingly seeking personalized products and digital self-service, SMEs focusing on cost-effective and flexible solutions, and corporates demanding comprehensive risk management. Public sector entities are adopting digital insurance for efficiency and compliance .

The Germany Digital Insurance and InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz SE, Munich Re (Münchener Rückversicherungs-Gesellschaft AG), AXA Konzern AG, ERGO Group AG, Talanx AG, Gothaer Versicherungsbank VVaG, Wüstenrot & Württembergische AG, DEVK Versicherungen, HUK-COBURG, SIGNAL IDUNA Gruppe, Baloise Group (Basler Versicherungen Deutschland), Versicherungskammer Bayern, R+V Versicherung AG, Wefox Insurance AG, Getsafe Digital GmbH, ELEMENT Insurance AG, Neodigital Versicherung AG, Deutsche Familienversicherung AG (DFV) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the digital insurance and InsurTech market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As the demand for on-demand insurance products grows, companies are likely to invest in flexible offerings that cater to individual needs. Additionally, the integration of artificial intelligence and machine learning will enhance risk assessment and customer service, further transforming the industry landscape. These trends indicate a shift towards more agile and responsive insurance solutions, positioning the market for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property & Casualty Insurance Motor Insurance Cyber Insurance Travel Insurance Liability Insurance Others (e.g., Pet, Legal Protection, Specialty Lines) |

| By End-User | Retail Households Small and Medium Enterprises (SMEs) Large Corporates Public Sector & Government Entities |

| By Distribution Channel | Independent Agents & Brokers Digital Aggregators & Online Platforms Bancassurance Direct Sales (Insurer-Owned) Embedded Insurance (via Third-Party Platforms) |

| By Product Offering | Standard Insurance Products Unit-Linked & Hybrid Products Customized & Usage-Based Insurance Bundled Insurance Packages |

| By Customer Segment | Individuals (Young Adults, Families, Seniors) Businesses (SMEs, Large Enterprises) Institutional & Public Sector Clients |

| By Claims Processing Method | Automated/Digital Claims Processing Manual Claims Processing Hybrid Claims Processing |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance Product Offerings | 120 | Product Managers, Marketing Directors |

| Consumer Adoption of InsurTech Solutions | 150 | End Consumers, Policyholders |

| Regulatory Impact on Digital Insurance | 85 | Compliance Officers, Legal Advisors |

| Technological Innovations in Insurance | 80 | CTOs, IT Managers |

| Market Trends and Consumer Insights | 95 | Market Analysts, Research Directors |

The Germany Digital Insurance and InsurTech Market is valued at approximately USD 13 billion, driven by the adoption of digital technologies and consumer demand for personalized insurance products.