Region:Middle East

Author(s):Dev

Product Code:KRAB3018

Pages:84

Published On:October 2025

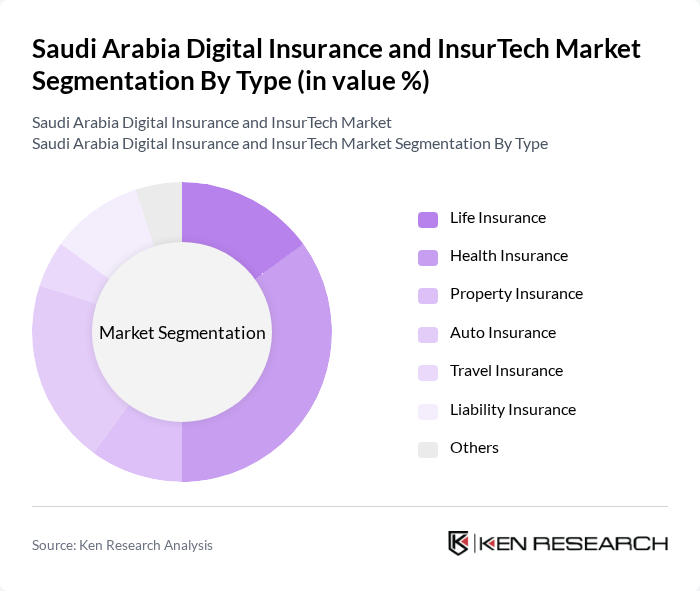

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Property Insurance, Auto Insurance, Travel Insurance, Liability Insurance, and Others. Among these, Health Insurance is currently the leading segment due to the increasing healthcare costs and the rising demand for comprehensive health coverage among individuals and families. The growing awareness of health-related issues and the government's initiatives to promote health insurance further bolster this segment's dominance.

By End-User:The market is segmented by end-users, including Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. The Individuals segment is the most significant contributor to the market, driven by the increasing awareness of personal insurance products and the growing need for financial security among the population. The rise in disposable income and changing consumer behavior towards insurance products further enhance the growth of this segment.

The Saudi Arabia Digital Insurance and InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Al Rajhi Takaful, Gulf Insurance Group, Allianz Saudi Fransi, Medgulf, Alinma Tokio Marine, Al-Ahlia Insurance, United Cooperative Assurance, Al Sagr Cooperative Insurance, Al-Etihad Cooperative Insurance, Walaa Cooperative Insurance, Al-Jazira Takaful Taawuni, Al-Mawared Insurance, Al-Bilad Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital insurance and InsurTech market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As the market matures, we can expect increased collaboration between traditional insurers and InsurTech startups, fostering innovation. Additionally, the integration of advanced technologies such as AI and blockchain will enhance operational efficiency and customer experience, paving the way for more personalized and secure insurance solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Auto Insurance Travel Insurance Liability Insurance Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Product Offering | Standard Insurance Products Customized Insurance Solutions Bundled Insurance Packages |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Technology Utilization | Mobile Applications Web Platforms AI-Driven Solutions |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance Adoption Trends | 150 | Insurance Executives, Digital Transformation Officers |

| Consumer Preferences in InsurTech | 200 | End Consumers, Tech-Savvy Users |

| Regulatory Impact on Digital Insurance | 100 | Regulatory Officials, Compliance Managers |

| Market Challenges and Opportunities | 120 | Industry Analysts, Market Researchers |

| Investment Trends in InsurTech | 80 | Venture Capitalists, Financial Analysts |

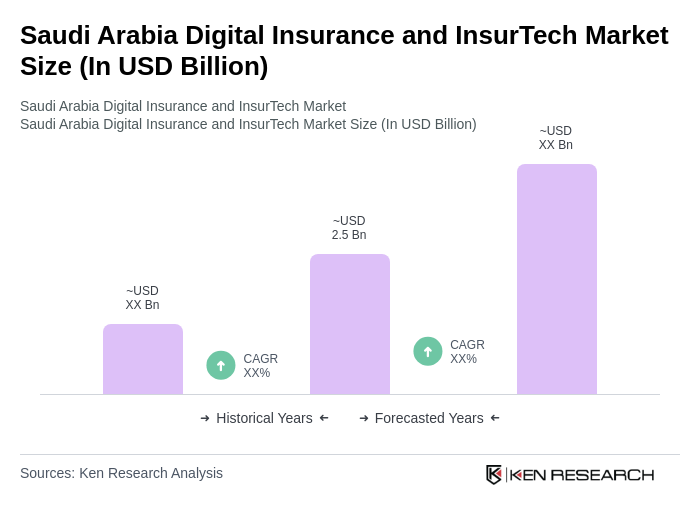

The Saudi Arabia Digital Insurance and InsurTech Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by digital technology adoption and increased consumer awareness of insurance products.