Indonesia Digital Insurance and InsurTech Market Overview

- The Indonesia Digital Insurance and InsurTech Market is valued at USD 8.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital technologies, rising internet penetration, and a growing awareness of insurance products among the population. The market has seen a significant shift towards online platforms, enabling easier access to insurance services and products for consumers. Key growth drivers include the integration of artificial intelligence and machine learning to streamline underwriting and claims, the expansion of e-commerce platforms offering embedded insurance, and the demand for instant, personalized digital insurance solutions. Life and health insurance segments currently dominate, with property, travel, and embedded insurance showing high growth potential as consumer expectations evolve toward seamless digital experiences .

- Key players in this market are concentrated in major urban centers such as Jakarta, Surabaya, and Bandung. These cities dominate due to their high population density, economic activity, and technological infrastructure, which facilitate the growth of digital insurance solutions. The urban population's increasing demand for convenient and accessible insurance options further propels market expansion in these regions .

- Regulation of digital insurance in Indonesia is governed byOtoritas Jasa Keuangan (OJK) Regulation No. 38/POJK.05/2020 on the Implementation of Insurance Products and Marketing Channels by Insurance Companies, issued by the Financial Services Authority (OJK) in 2020. This regulation mandates that insurance companies may distribute and manage insurance products through electronic systems, including online platforms, and sets operational, compliance, and reporting requirements for digital insurance offerings. It aims to increase financial inclusion, ensure consumer protection, and foster innovation in the InsurTech sector .

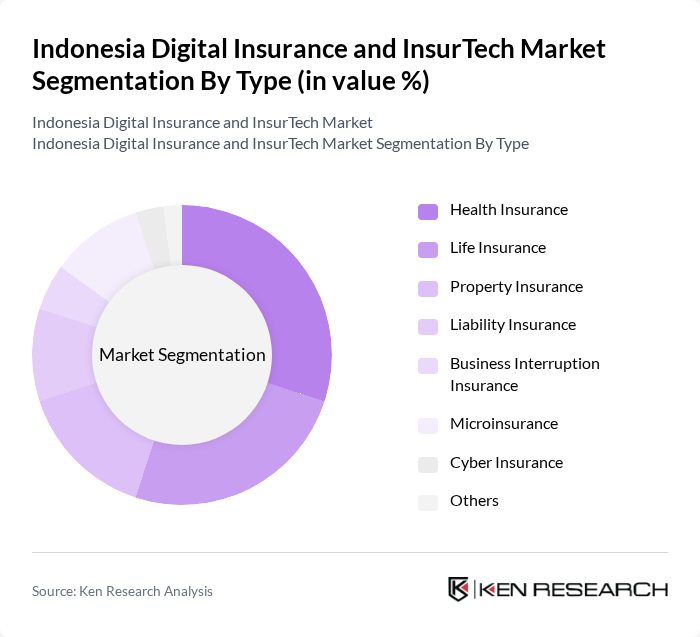

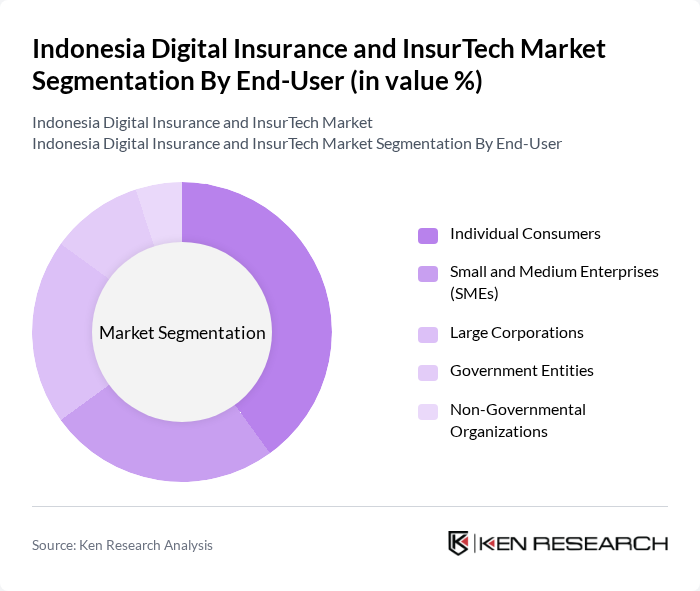

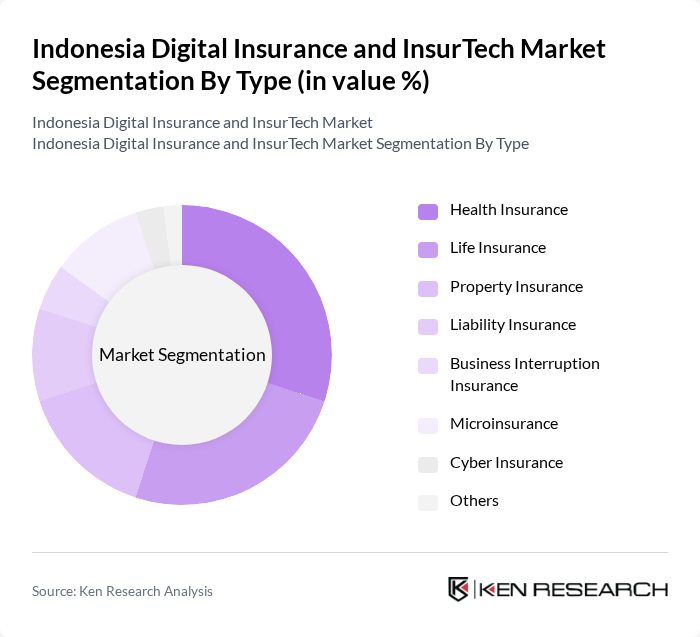

Indonesia Digital Insurance and InsurTech Market Segmentation

By Type:The market is segmented into various types of insurance products, including Health Insurance, Life Insurance, Property Insurance, Liability Insurance, Business Interruption Insurance, Microinsurance, Cyber Insurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of insurance offerings in Indonesia.Life and health insurance segments are currently the largest, driven by rising health awareness, digital distribution, and the expansion of private health coverage. Property and cyber insurance are emerging segments, supported by the growth of digital assets and increased risk awareness among businesses and individuals.

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Non-Governmental Organizations. Each segment has unique requirements and purchasing behaviors, influencing the types of insurance products that are most popular.Individual consumers account for the largest share, reflecting the rapid digitalization of personal insurance purchases, while SMEs and large corporations are increasingly adopting digital insurance for risk management and employee benefits.

Indonesia Digital Insurance and InsurTech Market Competitive Landscape

The Indonesia Digital Insurance and InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Indonesia, Prudential Indonesia, AXA Mandiri Financial Services, BCA Insurance, Sinarmas MSIG Life, Tokio Marine Life Insurance Indonesia, Cigna Indonesia, FWD Insurance Indonesia, Adira Insurance (Asuransi Adira Dinamika), Sequis Life, Manulife Indonesia, Great Eastern Life Indonesia, Asuransi Sinar Mas, Zurich Indonesia, Tugu Insurance, BRI Insurance, AIA Financial, BNI Life Insurance, Asuransi Jiwa Bersama (AJB) Bumiputera 1912, PasarPolis, Qoala, Fuse Insurtech, Igloo Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

Indonesia Digital Insurance and InsurTech Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:Indonesia's internet penetration rate reached 77% in 2023, with approximately 210 million users accessing online services. This growth is driven by affordable mobile data plans and expanding infrastructure, particularly in urban areas. The World Bank projects that by 2024, internet users will exceed 220 million, facilitating greater access to digital insurance platforms. Enhanced connectivity allows insurers to reach previously underserved populations, driving demand for innovative insurance products tailored to digital consumers.

- Rising Awareness of Insurance Products:The awareness of insurance products in Indonesia has significantly increased, with a reported 60% of the population recognizing the importance of insurance in financial planning. Government campaigns and educational initiatives have contributed to this shift, leading to a 15% increase in insurance policy purchases in 2023. As more individuals understand the benefits of insurance, the demand for digital solutions is expected to rise, creating a favorable environment for InsurTech growth in the coming years.

- Government Initiatives for Digital Transformation:The Indonesian government has launched several initiatives to promote digital transformation, including the 2024 Digital Economy Roadmap, which aims to increase the digital economy's contribution to GDP by 25%. This includes support for InsurTech through regulatory frameworks and funding opportunities. The Financial Services Authority (OJK) has also introduced guidelines to facilitate the entry of digital insurance providers, fostering innovation and competition in the market, which is crucial for industry growth.

Market Challenges

- Regulatory Compliance Issues:Navigating the regulatory landscape poses significant challenges for InsurTech firms in Indonesia. The OJK has stringent regulations that require compliance with licensing, reporting, and operational standards. In 2023, over 30% of InsurTech startups reported difficulties in meeting these regulatory requirements, which can hinder their ability to innovate and scale. This regulatory burden can deter new entrants and slow down the overall growth of the digital insurance market.

- Limited Consumer Trust in Digital Insurance:Despite the growth of digital insurance, consumer trust remains a significant barrier. A survey indicated that 45% of potential customers expressed concerns about the reliability and security of digital insurance platforms. Issues such as data privacy and the perceived complexity of digital products contribute to this skepticism. Building consumer trust through transparent practices and robust customer support is essential for InsurTech firms to thrive in this competitive landscape.

Indonesia Digital Insurance and InsurTech Market Future Outlook

The future of Indonesia's digital insurance and InsurTech market appears promising, driven by technological advancements and evolving consumer preferences. As mobile-first solutions gain traction, insurers are expected to leverage AI and big data analytics to enhance customer experiences and streamline operations. Additionally, the rise of on-demand insurance models will cater to the growing demand for flexibility among consumers. These trends indicate a dynamic market landscape, with significant potential for innovation and growth in the coming years.

Market Opportunities

- Expansion of Microinsurance Products:The demand for microinsurance is on the rise, with an estimated 70% of the population lacking adequate coverage. By 2024, the microinsurance market is projected to grow significantly, providing affordable options for low-income individuals. This presents a unique opportunity for InsurTech firms to develop tailored products that address the specific needs of underserved communities, enhancing financial inclusion across Indonesia.

- Partnerships with FinTech Companies:Collaborations between InsurTech and FinTech companies are becoming increasingly common, with over 50 partnerships established in 2023. These alliances enable insurers to leverage advanced technologies and customer bases, enhancing product offerings and distribution channels. By 2024, such partnerships are expected to drive innovation, improve customer engagement, and expand market reach, positioning InsurTech firms for sustained growth in Indonesia's evolving digital landscape.