Region:Asia

Author(s):Geetanshi

Product Code:KRAB5243

Pages:80

Published On:October 2025

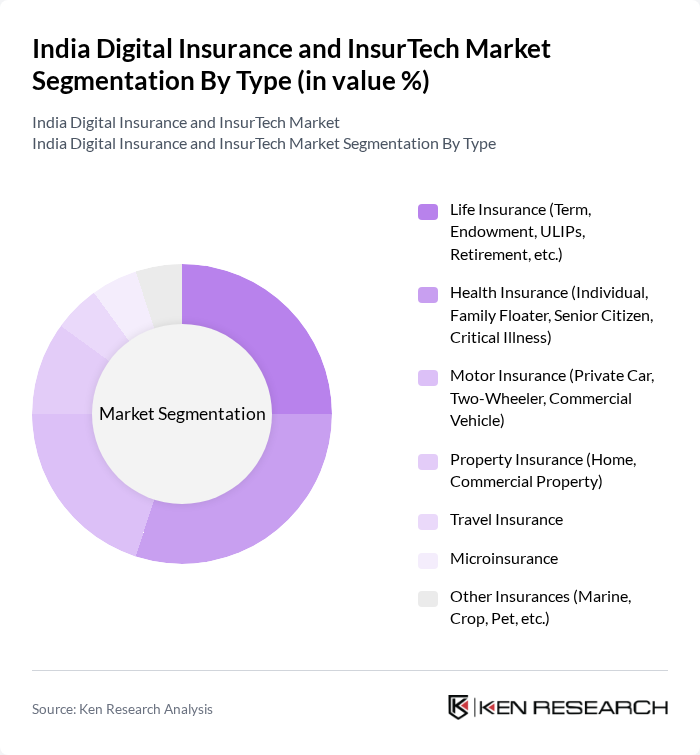

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Motor Insurance, Property Insurance, Travel Insurance, Microinsurance, and Other Insurances. Among these, Health Insurance has seen significant growth due to rising healthcare costs and increased consumer awareness about health-related risks. Life Insurance products, particularly ULIPs and term plans, are also gaining traction as consumers seek long-term financial security. The demand for Motor Insurance is driven by the increasing number of vehicles on the road, while Property Insurance is bolstered by urbanization and real estate development. Microinsurance and travel insurance are emerging segments, reflecting broader financial inclusion and the growth of India’s middle class.

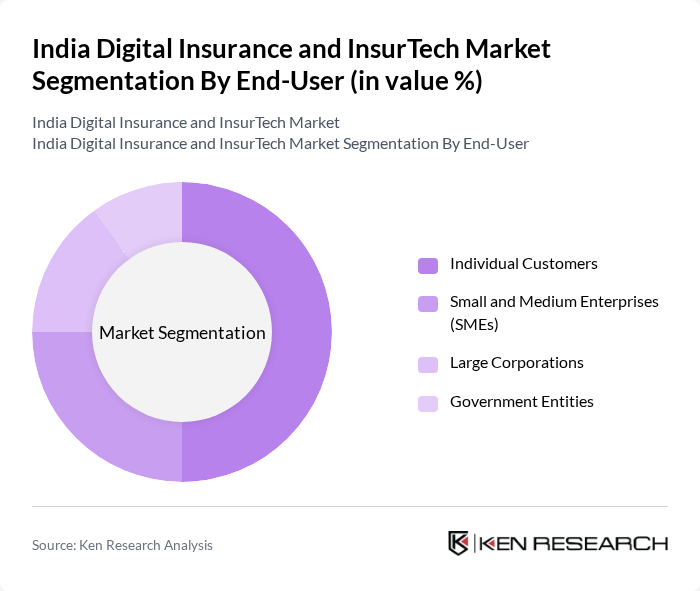

By End-User:The market is segmented by end-users, including Individual Customers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Customers dominate the market, driven by the increasing need for personal financial security and health coverage. SMEs are also becoming significant contributors as they seek to protect their assets and employees. Large Corporations typically invest in comprehensive insurance packages to mitigate risks, while Government Entities are increasingly involved in promoting insurance awareness and accessibility, including through public-private partnerships and targeted schemes for underserved populations.

The India Digital Insurance and InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as HDFC ERGO General Insurance Company Limited, ICICI Lombard General Insurance Company Limited, Bajaj Allianz General Insurance Company Limited, SBI Life Insurance Company Limited, Max Life Insurance Company Limited, Policybazaar.com, Go Digit General Insurance Limited, Acko General Insurance Limited, Reliance General Insurance Company Limited, Aditya Birla Health Insurance Company Limited, Future Generali India Insurance Company Limited, ManipalCigna Health Insurance Company Limited, Bharti AXA General Insurance Company Limited, TATA AIG General Insurance Company Limited, Kotak Mahindra General Insurance Company Limited, United India Insurance Company Limited, Life Insurance Corporation of India (LIC), The New India Assurance Company Limited, Edelweiss General Insurance Company Limited, Star Health and Allied Insurance Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India digital insurance and InsurTech market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy increases, more consumers are expected to embrace online insurance solutions. Additionally, the integration of innovative technologies like blockchain and AI will enhance operational efficiencies and customer experiences. Insurers that prioritize customer-centric approaches and adapt to regulatory changes will likely thrive in this dynamic landscape, fostering sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance (Term, Endowment, ULIPs, Retirement, etc.) Health Insurance (Individual, Family Floater, Senior Citizen, Critical Illness) Motor Insurance (Private Car, Two-Wheeler, Commercial Vehicle) Property Insurance (Home, Commercial Property) Travel Insurance Microinsurance Other Insurances (Marine, Crop, Pet, etc.) |

| By End-User | Individual Customers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms (Web Aggregators, Mobile Apps) Insurance Brokers Agents |

| By Product Offering | Standard Insurance Products Customized Insurance Solutions Bundled Insurance Packages |

| By Customer Segment | Urban Customers Rural Customers High Net-Worth Individuals (HNWIs) |

| By Payment Mode | Online Payments (UPI, Net Banking, Cards) Offline Payments Subscription Models |

| By Policy Duration | Short-Term Policies Long-Term Policies Renewable Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Digital Adoption | 90 | Insurance Product Managers, Digital Marketing Heads |

| Life Insurance Consumer Insights | 70 | Policyholders, Financial Advisors |

| Property Insurance Trends | 60 | Underwriters, Risk Assessment Analysts |

| InsurTech Startup Ecosystem | 50 | Founders, CTOs, and Product Development Leads |

| Regulatory Impact on Digital Insurance | 40 | Compliance Officers, Legal Advisors |

The India Digital Insurance and InsurTech Market is valued at approximately USD 10 billion, driven by increased digital technology adoption, internet penetration, and consumer awareness of insurance products. This growth has been significantly accelerated by the COVID-19 pandemic.