Region:Europe

Author(s):Rebecca

Product Code:KRAB5861

Pages:100

Published On:October 2025

By Type:The market is segmented into personal loans, business loans, student loans, auto loans, home equity loans, payday loans, peer-to-peer loans, crowdfunding loans, and others. Personal loans are the most prominent segment, reflecting strong consumer demand for flexible financing, especially for home improvement, travel, and debt consolidation. Business loans are also significant, with small and medium enterprises increasingly utilizing digital platforms for working capital, equipment financing, and expansion. Peer-to-peer and crowdfunding loans are gaining traction as alternative financing channels, particularly among younger and digitally native borrowers .

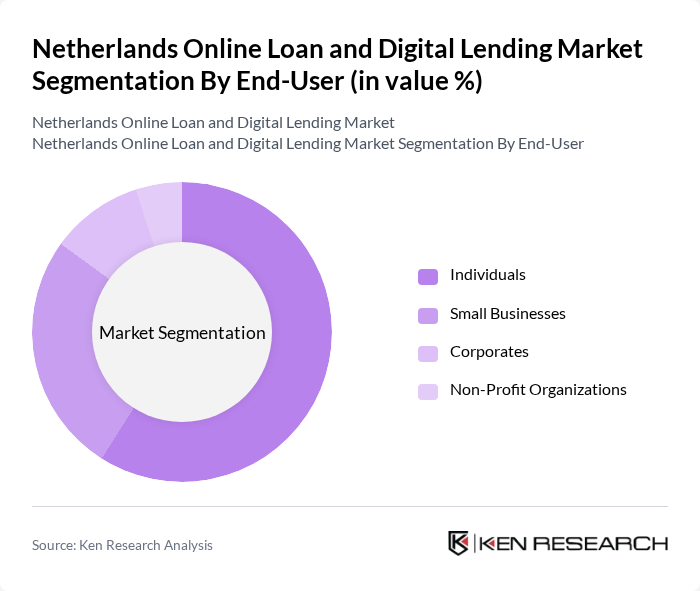

By End-User:The end-user segmentation includes individuals, small businesses, corporates, and non-profit organizations. Individuals are the largest segment, as digital lending platforms cater to a wide range of personal financial needs, including debt consolidation, home renovation, and consumer purchases. Small businesses are a major end-user group, leveraging online lending for operational liquidity, inventory management, and business growth. Corporates and non-profit organizations represent smaller but growing segments, particularly as digital lending solutions become more sophisticated and tailored .

The Netherlands Online Loan and Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABN AMRO Bank N.V., ING Groep N.V., Rabobank, NIBC Bank N.V., Bunq B.V., Knab N.V., Florius, Moneyou, Kredietbank Nederland, Ferratum Group, Lendico, Funding Circle Netherlands, Younited Credit, Spotcap Netherlands, Revolut Ltd., Tink AB, N26 GmbH, Yolt Technology Services B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands online loan and digital lending market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As digital payment solutions continue to expand, lenders are likely to enhance their offerings, focusing on personalized products that cater to diverse customer needs. Additionally, collaboration between fintech firms and traditional banks is expected to foster innovation, creating a more integrated financial ecosystem that benefits consumers and lenders alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Equity Loans Payday Loans Peer-to-Peer Loans Crowdfunding Loans Others |

| By End-User | Individuals Small Businesses Corporates Non-Profit Organizations |

| By Loan Purpose | Debt Consolidation Home Improvement Medical Expenses Travel Expenses Business Expansion Education Financing |

| By Loan Amount | Micro Loans (up to €10,000) Small Loans (€10,001–€50,000) Medium Loans (€50,001–€250,000) Large Loans (above €250,000) |

| By Interest Rate Type | Fixed Rate Loans Variable Rate Loans |

| By Application Channel | Online Platforms Mobile Applications Direct Lenders Third-Party Aggregators |

| By Customer Segment | New Customers Returning Customers High-Value Customers Millennials Gen Z Retirees |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 100 | Consumers aged 25-45, recent borrowers |

| Small Business Loan Applicants | 60 | Small business owners, entrepreneurs |

| Peer-to-Peer Lending Participants | 40 | Investors and borrowers in P2P platforms |

| Fintech Industry Experts | 40 | Financial analysts, fintech consultants |

| Regulatory Stakeholders | 20 | Policy makers, regulatory body representatives |

The Netherlands Online Loan and Digital Lending Market is valued at approximately EUR 9 billion, reflecting significant growth driven by the adoption of digital financial services and increasing consumer demand for accessible credit.