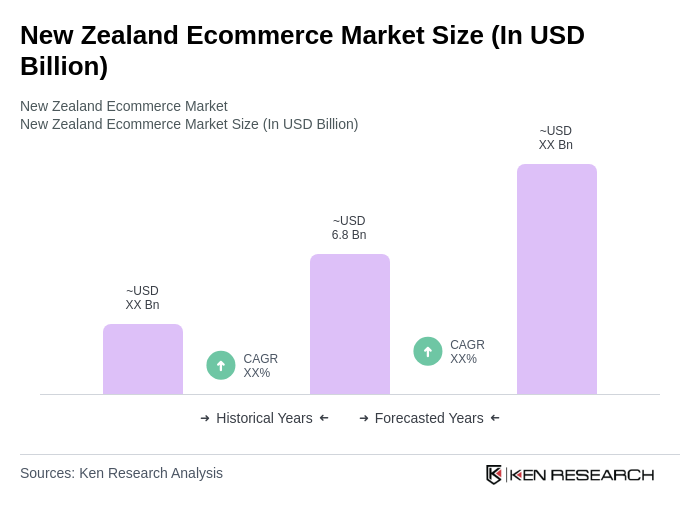

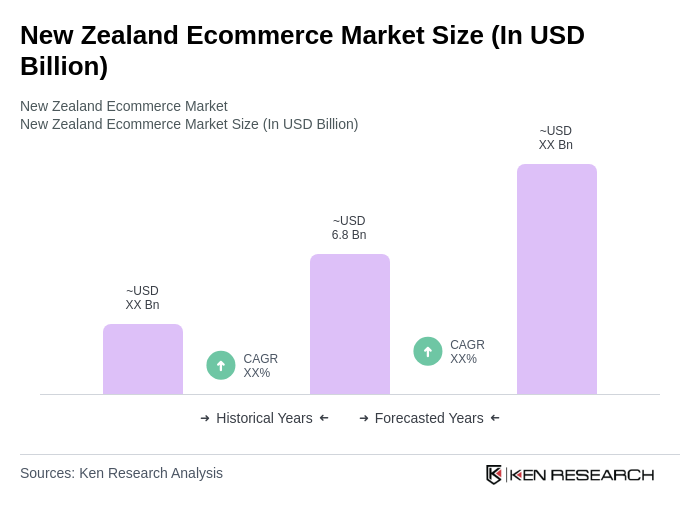

New Zealand Ecommerce Market Overview

- The New Zealand Ecommerce Market is valued at USD 6.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet, the rise of mobile commerce, and changing consumer preferences towards online shopping. The convenience of ecommerce platforms, the dominance of mobile commerce, and the availability of diverse product offerings have significantly contributed to the market's expansion.

- Auckland, Wellington, and Christchurch are the dominant cities in the New Zealand Ecommerce Market. Auckland, being the largest city, serves as a commercial hub with a high concentration of online retailers and consumers. Wellington, the capital, benefits from a strong government presence and tech-savvy population, while Christchurch has seen a resurgence in ecommerce activity post-earthquake, making these cities pivotal in driving market growth.

- In 2023, the New Zealand government implemented the Digital Economy Strategy, which aims to enhance the digital infrastructure and support the growth of the ecommerce sector. This initiative includes investments in broadband expansion and digital skills training, ensuring that businesses and consumers can effectively engage in online commerce, thereby fostering a more robust ecommerce ecosystem.

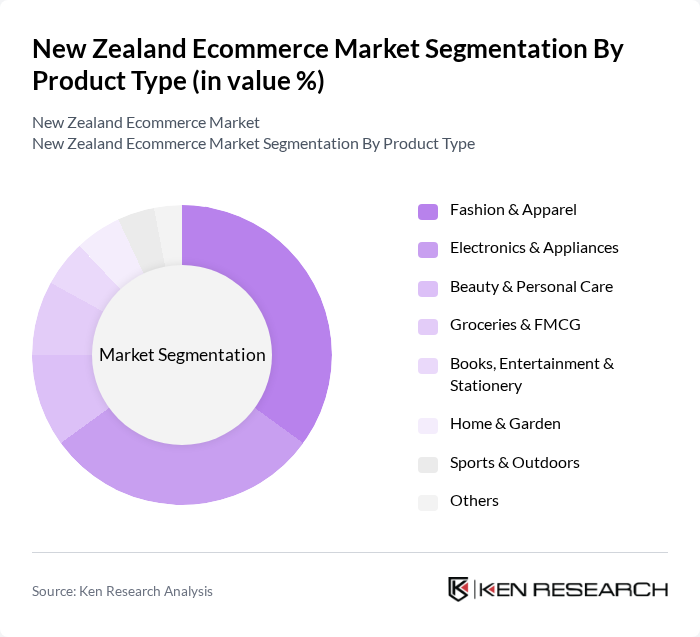

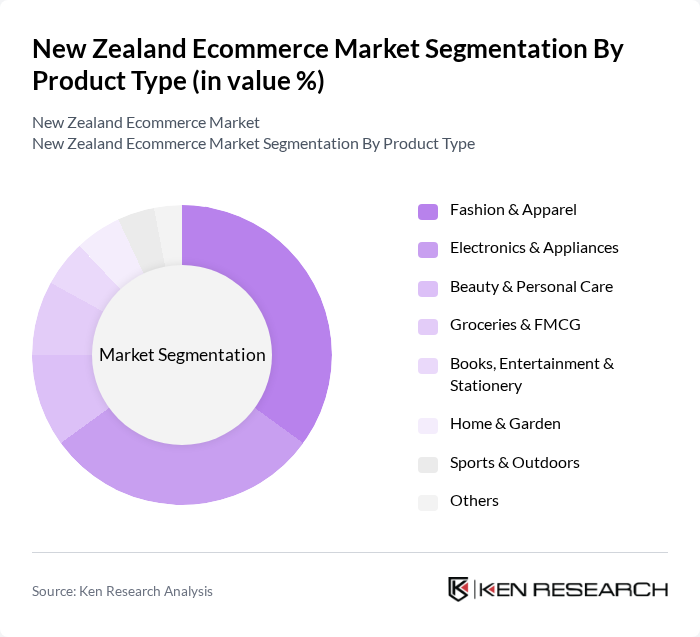

New Zealand Ecommerce Market Segmentation

By Product Type:The ecommerce market in New Zealand is segmented into various product types, including Fashion & Apparel, Electronics & Appliances, Beauty & Personal Care, Groceries & FMCG, Books, Entertainment & Stationery, Home & Garden, Sports & Outdoors, and Others. Among these, Fashion & Apparel and Electronics & Appliances are the leading segments, driven by consumer trends favoring online shopping for clothing and tech products. The convenience of online shopping, the prevalence of mobile-first purchasing, and the availability of a wide range of products have made these categories particularly popular.

By End-User:The ecommerce market is also segmented by end-user categories, which include Individual Consumers, SMEs, and Large Enterprises. Individual Consumers dominate the market, driven by the increasing adoption of online shopping among the general population. The convenience of purchasing products from home, the rise of mobile commerce, and the variety of options available online have made ecommerce a preferred choice for personal shopping.

New Zealand Ecommerce Market Competitive Landscape

The New Zealand Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trade Me, Mighty Ape, The Warehouse Group, Farmers, Countdown, Bunnings Warehouse, Noel Leeming, Harvey Norman, Fishpond, PB Tech, Whitcoulls, TheMarket, Z Energy, ASB Bank, ANZ Bank, Westpac, Kiwibank, Air New Zealand, NZ Post contribute to innovation, geographic expansion, and service delivery in this space.

New Zealand Ecommerce Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, New Zealand boasts an internet penetration rate of approximately94%, with around4.7 millionactive internet users. This high connectivity facilitates online shopping, enabling consumers to access a wide range of products and services. The growth in internet users is projected to add around200,000new users annually, further driving ecommerce engagement. Enhanced broadband infrastructure and affordable data plans contribute significantly to this trend, making online shopping more accessible to a broader audience.

- Rise of Mobile Commerce:Mobile commerce in New Zealand is experiencing rapid growth, with mobile transactions expected to reachover NZD 3 billionin future. Approximately60%of online shoppers utilize mobile devices for purchases, reflecting a shift towards mobile-friendly platforms. The increasing availability of mobile payment solutions, such as Apple Pay and Google Pay, is enhancing consumer convenience. Additionally, the proliferation of smartphones, withover 90%of the population owning one, supports this trend, making mobile commerce a critical driver of the ecommerce market.

- Shift in Consumer Behavior Towards Online Shopping:The COVID-19 pandemic has accelerated the shift towards online shopping, witharound 70%of New Zealand consumers now preferring to shop online for convenience. In future, online retail sales are projected to account forapproximately 13%of total retail sales, up from10%in previous years. This behavioral change is driven by factors such as time savings, product variety, and the ability to compare prices easily. As consumers become more accustomed to online shopping, this trend is expected to solidify, further boosting ecommerce growth.

Market Challenges

- High Competition Among Retailers:The New Zealand ecommerce market is characterized by intense competition, with over20,000online retailers vying for consumer attention. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Established players like Trade Me and The Warehouse dominate the market, capturing significant market share. As a result, smaller retailers must invest heavily in marketing and customer service to differentiate themselves, which can strain resources and limit growth potential.

- Logistics and Delivery Issues:Efficient logistics and delivery remain significant challenges for New Zealand's ecommerce sector. With a population spread across urban and rural areas, delivery times can vary widely, impacting customer satisfaction. In future, approximately15%of online orders face delays due to logistical constraints. Additionally, the cost of last-mile delivery is rising, with average delivery costs estimated atNZD 9per package. These challenges necessitate innovative solutions to enhance delivery efficiency and maintain competitive advantage in the market.

New Zealand Ecommerce Market Future Outlook

The New Zealand ecommerce market is poised for continued growth, driven by technological advancements and evolving consumer preferences. As more businesses adopt omnichannel strategies, integrating online and offline experiences, customer engagement is expected to improve. Additionally, the rise of social commerce and personalized shopping experiences will further enhance market dynamics. Companies that leverage data analytics and artificial intelligence to understand consumer behavior will likely gain a competitive edge, positioning themselves favorably in this rapidly evolving landscape.

Market Opportunities

- Growth of Niche Markets:There is a significant opportunity for ecommerce businesses to tap into niche markets, such as organic products and local artisan goods. In future, niche market sales are projected to grow byNZD 500 million, driven by increasing consumer interest in unique and sustainable products. This trend allows retailers to cater to specific consumer preferences, enhancing brand loyalty and customer retention.

- Integration of AI and Personalization:The integration of artificial intelligence in ecommerce platforms presents a substantial opportunity for enhancing customer experiences. By future, AI-driven personalization is expected to increase conversion rates by20%. Retailers can utilize AI to analyze consumer data, offering tailored recommendations and improving customer engagement. This technological advancement not only boosts sales but also fosters long-term customer relationships, making it a vital area for investment.