Region:Global

Author(s):Geetanshi

Product Code:KRAE4681

Pages:86

Published On:December 2025

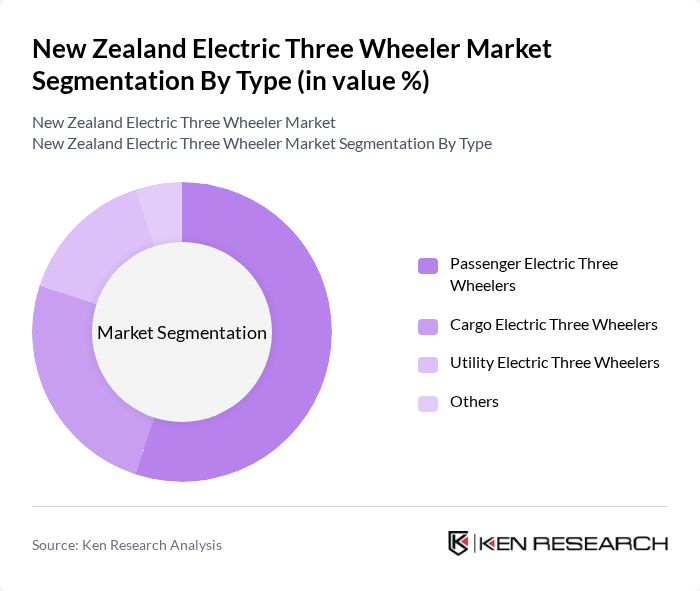

By Type:The market is segmented into various types of electric three-wheelers, including Passenger Electric Three Wheelers, Cargo Electric Three Wheelers, Utility Electric Three Wheelers, and Others. Among these, Passenger Electric Three Wheelers are currently dominating the market due to their increasing popularity for personal and shared mobility solutions. The growing trend of urban commuting and the need for eco-friendly transportation options have significantly boosted the demand for passenger models.

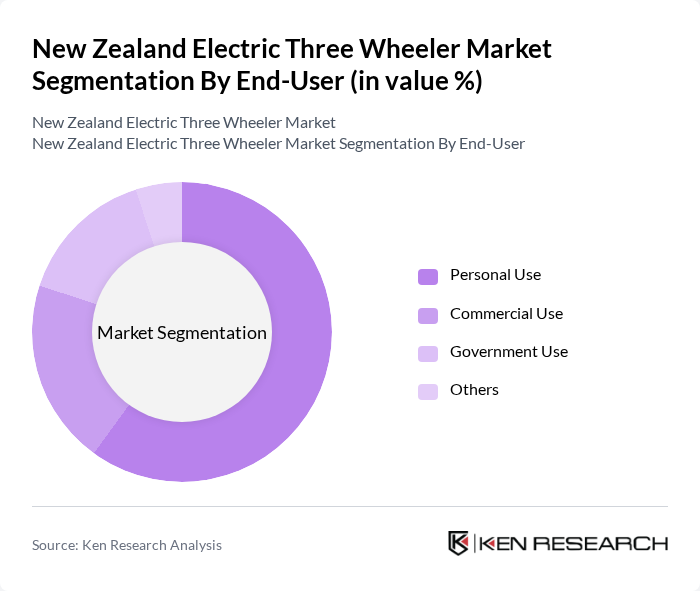

By End-User:The end-user segmentation includes Personal Use, Commercial Use, Government Use, and Others. The Personal Use segment is leading the market, driven by the increasing adoption of electric three-wheelers for daily commuting and leisure activities. Consumers are increasingly opting for electric vehicles due to their cost-effectiveness and environmental benefits, which has led to a significant rise in personal ownership.

The New Zealand Electric Three Wheeler Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kiwi EVs, Electric Three Wheelers NZ, EcoRider, Green Wheels, E-Trike Solutions, Urban Electric Vehicles, New Zealand Electric Vehicles Ltd., E-Motion Transport, Eco Transport Solutions, Future Mobility NZ, Smart Electric Mobility, Green Transport Innovations, E-Trike Innovations, Sustainable Transport Solutions, Kiwi Electric Mobility contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand electric three-wheeler market appears promising, driven by increasing consumer awareness and government support. With urbanization trends leading to higher traffic congestion, electric three-wheelers are positioned as a viable solution for last-mile delivery and personal transport. Additionally, advancements in battery technology are expected to enhance vehicle range and performance, making electric three-wheelers more appealing to consumers. As infrastructure improves, the market is likely to see accelerated growth and wider acceptance among the populace.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Electric Three Wheelers Cargo Electric Three Wheelers Utility Electric Three Wheelers Others |

| By End-User | Personal Use Commercial Use Government Use Others |

| By Battery Type | Lithium-ion Batteries Lead-acid Batteries Others |

| By Range | Short Range (up to 50 km) Medium Range (50-100 km) Long Range (over 100 km) |

| By Charging Type | Standard Charging Fast Charging Wireless Charging |

| By Market Channel | Direct Sales Online Sales Dealerships Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuters | 120 | Daily commuters, Students, Professionals |

| Delivery Service Providers | 75 | Logistics Managers, Fleet Operators |

| Government Transport Officials | 40 | Policy Makers, Urban Planners |

| Electric Vehicle Enthusiasts | 65 | Members of EV clubs, Environmental Advocates |

| Retailers of Electric Vehicles | 50 | Sales Managers, Business Owners |

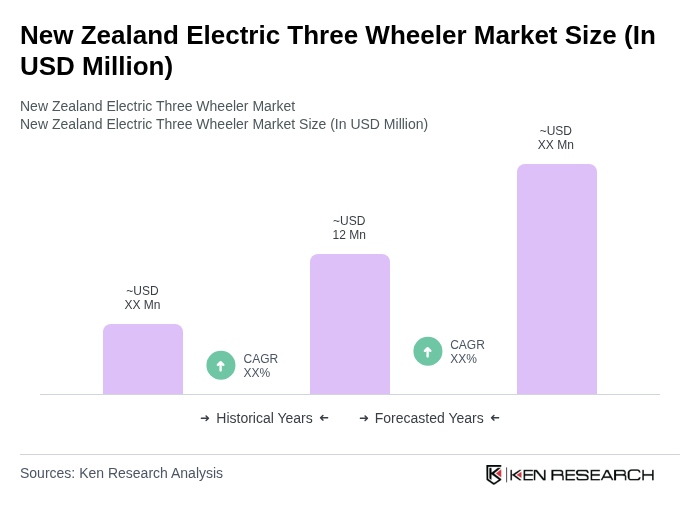

The New Zealand Electric Three Wheeler Market is valued at approximately USD 12 million, reflecting a growing demand driven by urbanization, government initiatives, and advancements in battery technology aimed at promoting sustainable transportation solutions.