Region:Middle East

Author(s):Dev

Product Code:KRAC8736

Pages:100

Published On:November 2025

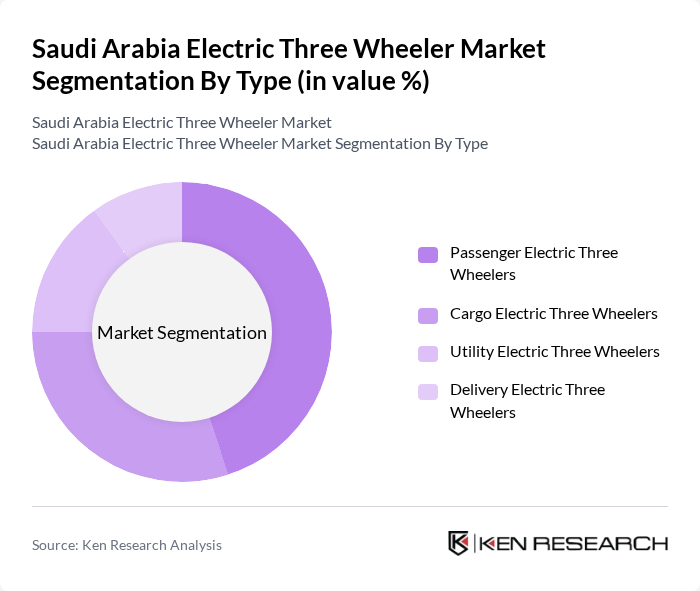

By Type:The market is segmented into four main types: Passenger Electric Three Wheelers, Cargo Electric Three Wheelers, Utility Electric Three Wheelers, and Delivery Electric Three Wheelers. Among these, Passenger Electric Three Wheelers are currently leading the market due to their increasing popularity for personal and shared transportation. The growing trend of ride-sharing and the need for eco-friendly transport solutions are driving this segment's growth. Cargo Electric Three Wheelers are also gaining traction, particularly in urban logistics, as businesses seek efficient and sustainable delivery options.

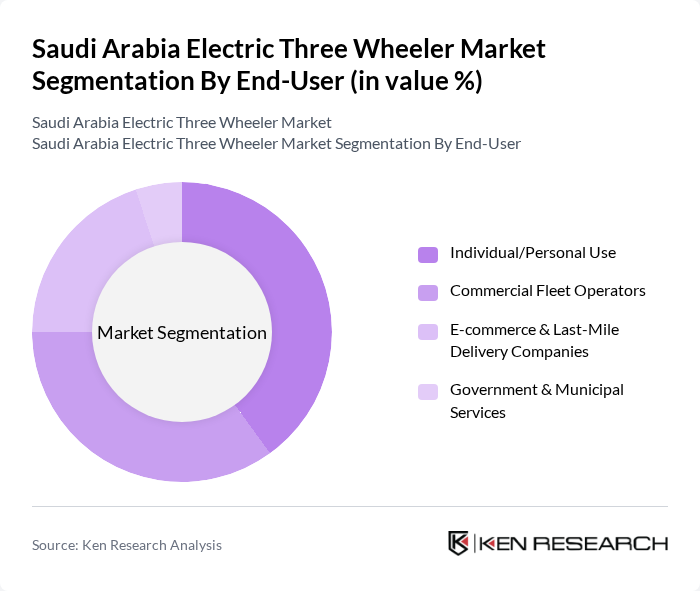

By End-User:The end-user segmentation includes Individual/Personal Use, Commercial Fleet Operators, E-commerce & Last-Mile Delivery Companies, and Government & Municipal Services. The Individual/Personal Use segment is currently the largest, driven by rising consumer interest in sustainable transportation options. Commercial Fleet Operators are also significant contributors, as businesses increasingly adopt electric three-wheelers for logistics and delivery services. E-commerce growth has further accelerated the demand for last-mile delivery solutions, making this segment increasingly relevant.

The Saudi Arabia Electric Three Wheeler Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ceer (Saudi Arabia), Lucid Motors (Saudi Arabia/USA), Abdul Latif Jameel Motors (Saudi Arabia), Al-Futtaim Electric Mobility Company (UAE/Saudi Arabia), BYD Auto (China), Mahindra Electric Mobility (India), Tata Motors (India), Piaggio Vehicles (Italy/India), Bajaj Auto (India), Terra Motors (Japan), Electra EV (India), Green Scooter (Saudi Arabia), E-Trio (India), TVS Motor Company (India), Kinetic Green Energy & Power Solutions (India) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric three-wheeler market in Saudi Arabia appears promising, driven by increasing government support and a growing consumer base seeking sustainable transportation options. As urbanization continues, the demand for efficient last-mile delivery solutions will rise, further propelling market growth. Additionally, advancements in battery technology are expected to enhance vehicle performance and reduce costs, making electric three-wheelers more appealing to consumers and businesses alike, thereby fostering a more sustainable urban mobility landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Electric Three Wheelers Cargo Electric Three Wheelers Utility Electric Three Wheelers Delivery Electric Three Wheelers |

| By End-User | Individual/Personal Use Commercial Fleet Operators E-commerce & Last-Mile Delivery Companies Government & Municipal Services |

| By Region | Riyadh (Central Region) Eastern Province (Dammam, Khobar) Western Region (Jeddah, Mecca, Medina) Southern Region (Abha, Jizan) |

| By Application | Urban Passenger Transport Rural Mobility Solutions Delivery & Logistics Industrial/Facility Use |

| By Battery Type | Lithium-ion Batteries Lead-acid Batteries Nickel-Metal Hydride Batteries |

| By Charging Type | Fast Charging Standard Charging Battery Swapping |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Local Content Requirements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuters | 80 | Daily commuters, ride-sharing users |

| Logistics Companies | 50 | Fleet Managers, Operations Directors |

| Government Officials | 40 | Policy Makers, Urban Planners |

| Environmental NGOs | 40 | Sustainability Advocates, Project Coordinators |

| Manufacturers and Distributors | 60 | Sales Managers, Product Development Heads |

The Saudi Arabia Electric Three Wheeler Market is valued at approximately USD 1.9 billion, driven by urbanization, government initiatives promoting electric vehicles, and increasing consumer awareness of environmental sustainability.