Region:Asia

Author(s):Rebecca

Product Code:KRAA6368

Pages:87

Published On:January 2026

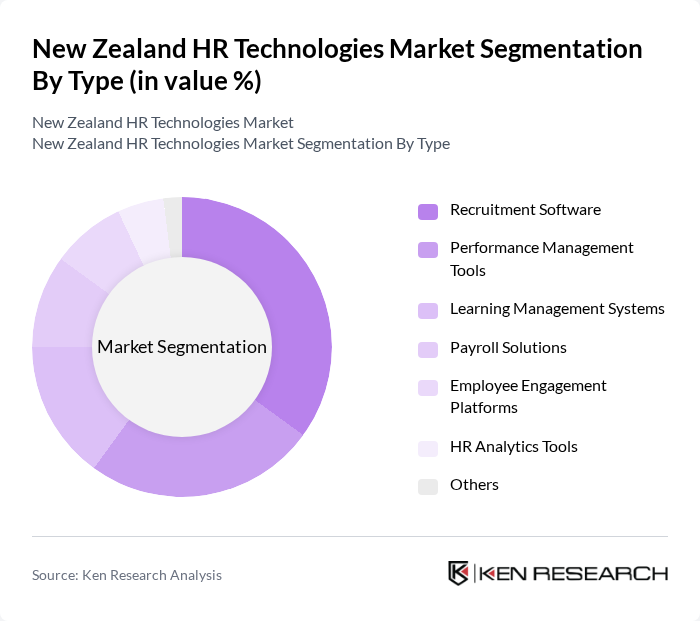

By Type:The HR technologies market is segmented into various types, including recruitment software, performance management systems, learning management systems, payroll management solutions, applicant tracking systems, employee engagement platforms, and others. Among these, recruitment software is currently the leading sub-segment, driven by the increasing need for efficient hiring processes and the integration of AI technologies to enhance candidate sourcing and selection.

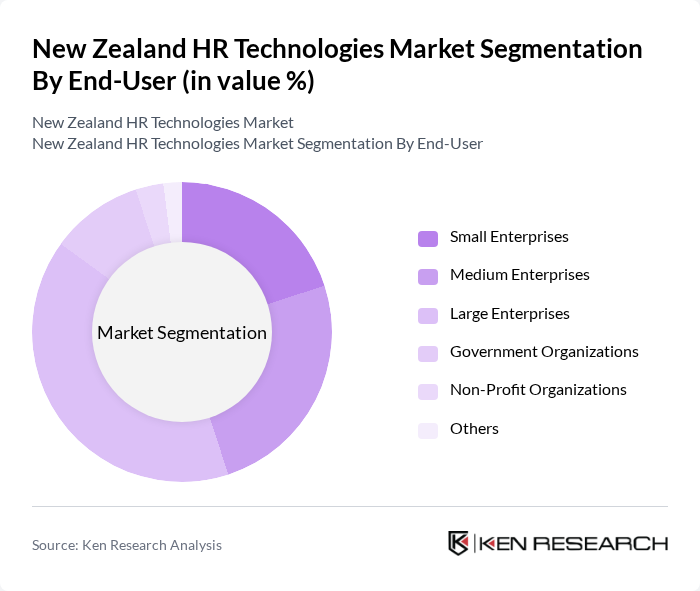

By End-User:The end-user segmentation of the HR technologies market includes small enterprises, medium enterprises, large enterprises, government organizations, non-profit organizations, and others. Large enterprises dominate this segment due to their extensive HR needs and the ability to invest in comprehensive HR technology solutions that enhance operational efficiency and employee satisfaction.

The New Zealand HR Technologies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Xero, MYOB, BambooHR, Employment Hero, Figured, PayHero, SmartRecruiters, JobAdder, PeopleSoft, SAP SuccessFactors, Workday, ADP, Oracle HCM Cloud, Cornerstone OnDemand, Talentsoft contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand HR technologies market is poised for transformative growth, driven by technological advancements and evolving workforce dynamics. As organizations increasingly prioritize employee-centric solutions, the integration of AI and machine learning will enhance decision-making processes. Furthermore, the expansion of cloud-based platforms will facilitate seamless remote work management. In future, the focus on compliance and regulatory solutions will also intensify, ensuring that HR practices align with legal standards while fostering a more inclusive workplace culture.

| Segment | Sub-Segments |

|---|---|

| By Type | Recruitment Software Performance Management Systems Learning Management Systems Payroll Management Solutions Applicant Tracking Systems Employee Engagement Platforms Others |

| By End-User | Small Enterprises Medium Enterprises Large Enterprises Government Organizations Non-Profit Organizations Others |

| By Industry | Healthcare Education Retail Manufacturing IT and Technology Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid Others |

| By Functionality | Talent Acquisition Employee Management Learning and Development Compensation and Benefits Others |

| By User Type | HR Professionals Line Managers Employees Executives Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small to Medium Enterprises (SMEs) HR Technology Adoption | 100 | HR Managers, Business Owners |

| Large Corporations' HR Technology Integration | 80 | Chief HR Officers, IT Directors |

| Startups Utilizing HR Tech Solutions | 60 | Founders, HR Specialists |

| Public Sector HR Technology Implementation | 50 | HR Directors, Policy Makers |

| HR Tech Vendors and Service Providers | 70 | Sales Executives, Product Managers |

The New Zealand HR Technologies Market is valued at approximately USD 85 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of digital solutions in human resource management, enhancing efficiency and employee engagement.