Region:Africa

Author(s):Dev

Product Code:KRAB2286

Pages:87

Published On:October 2025

By Type:The luxury fashion and lifestyle market can be segmented into various types, including Apparel, Footwear, Accessories, Jewelry, Handbags, Fragrances, and Others. Among these, Apparel is the leading sub-segment, driven by the increasing demand for designer clothing, the influence of social media, and the desire for unique, high-quality garments that reflect personal style and status. Consumers are also showing increased interest in sustainable and locally produced apparel, further fueling growth in this segment .

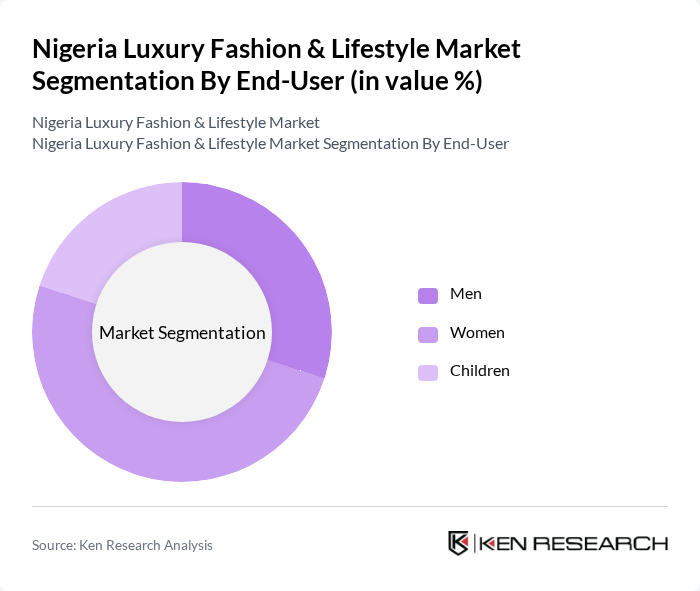

By End-User:The market can also be segmented by end-user demographics, including Men, Women, and Children. The Women segment dominates the market, driven by a growing interest in fashion and luxury products among female consumers. Women are increasingly investing in luxury apparel, accessories, and beauty products, reflecting their desire for self-expression and status through fashion. The influence of social media influencers and fashion bloggers continues to drive demand in this segment .

The Nigeria Luxury Fashion & Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deola Sagoe, Tiffany Amber, Mai Atafo, Lisa Folawiyo, Orange Culture, Maki Oh, Ziva Lagos, Ejiro Amos Tafiri, Adebayo Oke-Lawal, The Folklore, Ayo Van Elmar, Kulture Fashion, NACK (Nigerian Articulate Culture Kollection), Gert-Johan Coetzee, Polo Luxury Group contribute to innovation, geographic expansion, and service delivery in this space .

The Nigeria luxury fashion and lifestyle market is poised for dynamic growth, driven by increasing disposable incomes and urbanization trends. As consumers become more discerning, brands that prioritize sustainability and authenticity are likely to thrive. The rise of digital platforms will further enhance market accessibility, allowing luxury brands to reach a broader audience. However, addressing challenges such as economic instability and counterfeiting will be crucial for sustained growth and brand loyalty in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Jewelry Handbags Fragrances Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Boutiques |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Occasion | Casual Wear Formal Wear Special Events |

| By Material | Leather Cotton Silk |

| By Brand Origin | Local Brands International Brands Hybrid Brands |

| By Distribution Mode | Direct Sales Distributors E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 120 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessory Buyers | 90 | Luxury Brand Loyalists, Trendsetters |

| Lifestyle Product Consumers | 60 | Home Decor Aficionados, Lifestyle Influencers |

| Fashion Retailers and Boutiques | 50 | Store Managers, Brand Representatives |

| Fashion Event Attendees | 40 | Event Organizers, Fashion Show Participants |

The Nigeria Luxury Fashion & Lifestyle Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by rising disposable incomes and an increasing interest in luxury brands among consumers.