Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA6756

Pages:94

Published On:September 2025

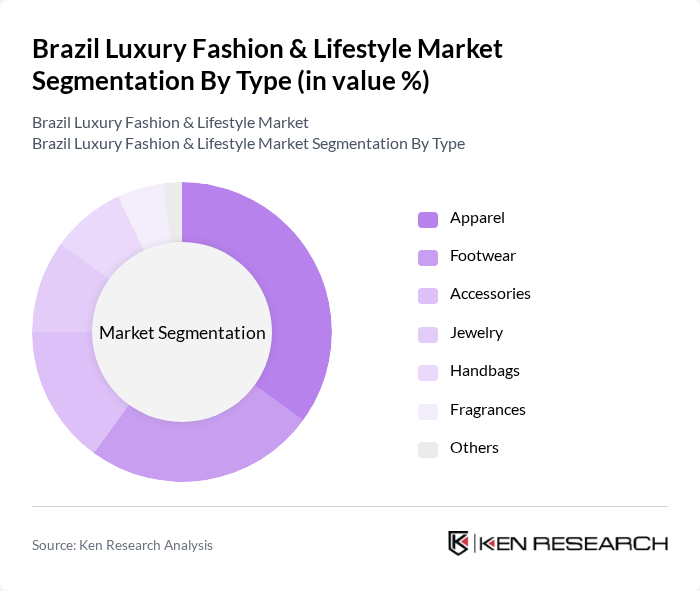

By Type:The luxury fashion and lifestyle market can be segmented into various types, including apparel, footwear, accessories, jewelry, handbags, fragrances, and others. Each of these subsegments caters to different consumer preferences and trends, with apparel and footwear being the most dominant categories due to their essential nature in luxury fashion.

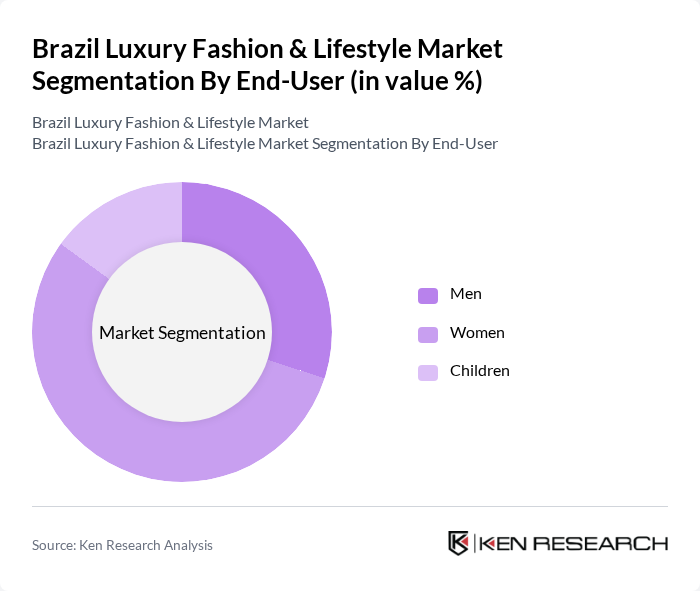

By End-User:The market can also be segmented by end-user demographics, including men, women, and children. Women represent the largest segment, driven by their higher spending on luxury fashion and lifestyle products, while men and children also contribute significantly to the market.

The Brazil Luxury Fashion & Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Soma, Arezzo&Co, Lojas Renner S.A., Osklen, Hering, Farm Rio, Colcci, Animale, Le Lis Blanc, Dudalina, TNG, C&A Modas, Riachuelo, Lojas Americanas, Zara Brasil contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian luxury fashion market is poised for transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value, brands that prioritize eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of digital technologies in retail will enhance customer experiences, fostering brand loyalty. The market is expected to adapt to these trends, with a focus on personalized shopping experiences and innovative marketing strategies that resonate with the modern consumer.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Jewelry Handbags Fragrances Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Department Stores Specialty Stores Luxury Boutiques |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Occasion | Casual Wear Formal Wear Sportswear |

| By Region | Southeast Brazil South Brazil Northeast Brazil Central-West Brazil North Brazil Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchases | 150 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessories Market | 100 | Luxury Brand Managers, Retail Buyers |

| Luxury Lifestyle Trends | 80 | Influencers, Lifestyle Bloggers |

| Consumer Preferences in Luxury Goods | 120 | Market Researchers, Trend Analysts |

| Impact of E-commerce on Luxury Sales | 90 | E-commerce Managers, Digital Marketing Specialists |

The Brazil Luxury Fashion & Lifestyle Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by increasing disposable incomes and a rising middle class eager for luxury goods.