Japan Luxury Fashion & Lifestyle Market Overview

- The Japan Luxury Fashion & Lifestyle Market is valued at USD 6.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable income, a rising trend in luxury consumption among younger consumers, and the rapid adoption of digital retail channels. The market has seen a significant shift towards online retail, with e-commerce and social media platforms fueling expansion and enhancing accessibility for both domestic and international luxury brands .

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Luxury Fashion & Lifestyle Market. Tokyo, as a global fashion hub, attracts both local and international luxury brands, while Osaka and Yokohama serve as key retail centers due to their affluent populations and vibrant shopping districts. The concentration of high-end boutiques and flagship stores in these cities enhances their market dominance .

- In 2023, the Japanese government implemented the Act on Promotion of Resource Circulation for Plastics (Ministry of the Environment, 2022), which requires fashion and lifestyle brands to adopt sustainable practices, including the use of eco-friendly materials and improved production methods. This regulation is part of a broader national strategy to reduce environmental impact and promote sustainability across the fashion sector, mandating compliance with resource circulation standards and encouraging transparency in supply chains .

Japan Luxury Fashion & Lifestyle Market Segmentation

By Type:The market is segmented into various types, including Apparel, Footwear, Accessories, Handbags, Jewelry, Watches, and Others. Among these, Apparel is the leading sub-segment, driven by the increasing demand for high-quality clothing, the influence of global fashion trends, and the rise of digital-first luxury shopping experiences. Consumers are increasingly seeking unique and stylish apparel, which has led to a surge in luxury clothing brands. Footwear and Accessories also hold significant market shares, as they complement the overall fashion statement of consumers .

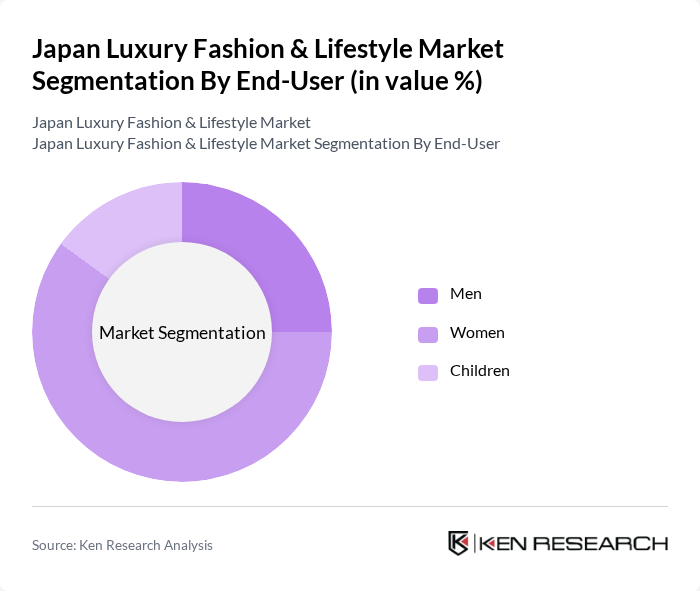

By End-User:The market is segmented by end-user into Men, Women, and Children. Women represent the largest segment, driven by higher spending power, a greater inclination towards luxury fashion, and the influence of social media and e-commerce platforms. The increasing number of women entering the workforce and their growing interest in fashion trends contribute to this dominance. The Men’s segment is also significant, as more men are investing in luxury apparel and accessories, reflecting evolving societal norms and a broader acceptance of male fashion consumption .

Japan Luxury Fashion & Lifestyle Market Competitive Landscape

The Japan Luxury Fashion & Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Chanel, Prada, Hermès, Dior, Burberry, Fendi, Valentino, Bottega Veneta, Salvatore Ferragamo, Versace, Balenciaga, Givenchy, Montblanc, Tiffany & Co., Celine, Miu Miu, Mikimoto, Issey Miyake contribute to innovation, geographic expansion, and service delivery in this space.

Japan Luxury Fashion & Lifestyle Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:Japan's disposable income per capita is projected to reach ¥3.5 million (approximately $32,000) in future, reflecting a steady increase from ¥3.3 million in future. This rise in disposable income enables consumers to allocate more funds towards luxury fashion and lifestyle products. As a result, the luxury market is expected to benefit from a growing consumer base willing to invest in high-quality, premium goods, enhancing overall market growth.

- Rising Demand for Sustainable Fashion:The sustainable fashion segment in Japan is anticipated to grow significantly, with the market size expected to reach ¥1 trillion (around $9 billion) by future. This growth is driven by increasing consumer awareness regarding environmental issues and a preference for eco-friendly products. Brands that adopt sustainable practices are likely to attract a more conscientious consumer base, thereby enhancing their market position and contributing to overall industry growth.

- Growth of E-commerce Platforms:E-commerce sales in Japan's luxury fashion sector are projected to exceed ¥1.5 trillion (approximately $13.5 billion) in future, up from ¥1.2 trillion in future. The convenience of online shopping, coupled with the rise of mobile commerce, is reshaping consumer purchasing behaviors. This shift towards digital platforms allows luxury brands to reach a broader audience, particularly younger consumers who prefer online shopping experiences, thus driving market expansion.

Market Challenges

- Intense Competition from Global Brands:The Japanese luxury fashion market is characterized by fierce competition, with over 50 international brands vying for market share. This saturation makes it challenging for local brands to establish a foothold. In future, the market is expected to see a 10% increase in marketing expenditures by global brands, intensifying the competition and making it difficult for smaller players to compete effectively.

- Counterfeit Products Undermining Brand Integrity:The counterfeit luxury goods market in Japan is estimated to be worth ¥600 billion (approximately $5.4 billion) in future. This prevalence of counterfeit products poses a significant threat to brand integrity and consumer trust. Luxury brands must invest heavily in anti-counterfeiting measures and consumer education to protect their reputations and maintain market share in an increasingly challenging environment.

Japan Luxury Fashion & Lifestyle Market Future Outlook

The Japan luxury fashion and lifestyle market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize eco-friendly practices will likely gain a competitive edge. Additionally, the integration of augmented reality and virtual shopping experiences is expected to enhance customer engagement. These trends indicate a shift towards a more personalized and immersive shopping experience, positioning the market for continued expansion in the coming years.

Market Opportunities

- Expansion into Rural Markets:With approximately 30% of Japan's population residing in rural areas, luxury brands have a significant opportunity to tap into this underserved market. By establishing localized retail experiences and leveraging e-commerce, brands can cater to the unique preferences of rural consumers, potentially increasing their market share and driving sales growth.

- Growth in Online Luxury Resale Market:The online luxury resale market in Japan is projected to reach ¥300 billion (around $2.7 billion) in future. This growth is fueled by increasing consumer interest in sustainable consumption and the desire for affordable luxury. Brands that embrace this trend can enhance their brand loyalty and attract a new demographic of eco-conscious consumers, thereby expanding their market presence.