Thailand Luxury Fashion & Lifestyle Market Overview

- The Thailand Luxury Fashion & Lifestyle Market is valued at USD 3.2 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes among urban consumers, a burgeoning middle class, and robust demand from international tourists, particularly from China and neighboring ASEAN countries. The market has seen a significant rise in demand for high-end fashion, accessories, and lifestyle products, reflecting changing consumer preferences, the influence of global fashion trends, and the increasing adoption of international luxury brands , , .

- Bangkok stands out as the dominant city in the Thailand Luxury Fashion & Lifestyle Market due to its status as a major shopping destination, attracting both local and international tourists. Other key cities include Phuket and Chiang Mai, which also contribute to the market's growth through vibrant tourism sectors and luxury retail offerings. The combination of cultural richness, premium malls, and modern retail experiences enhances the appeal of these locations for luxury shoppers , .

- In 2023, the Thai government implemented the "Thailand Sustainable Fashion Development Guidelines, 2023" issued by the Ministry of Commerce. This regulation requires luxury brands to adopt eco-friendly materials and sustainable production methods, with operational mandates for waste reduction, carbon footprint reporting, and compliance with designated environmental standards. The initiative aims to position Thailand as a leader in sustainable luxury, aligning the sector with global trends toward environmental responsibility and ethical sourcing .

Thailand Luxury Fashion & Lifestyle Market Segmentation

By Type:The luxury fashion and lifestyle market is segmented into Apparel & Footwear, Jewelry & Watches, Cosmetics & Fragrances, Accessories, Handbags & Leather Goods, Home Décor & Furniture, and Others. Apparel & Footwear remains the largest segment, driven by demand for premium brands and contemporary designs. Jewelry & Watches are favored by both tourists and affluent locals, while Cosmetics & Fragrances see strong growth due to rising interest in personal care and wellness. Accessories, Handbags & Leather Goods, and Home Décor & Furniture cater to evolving lifestyle aspirations, with "Others" including luxury beverages, fine foods, and automobiles that appeal to high-net-worth individuals seeking exclusivity and status , .

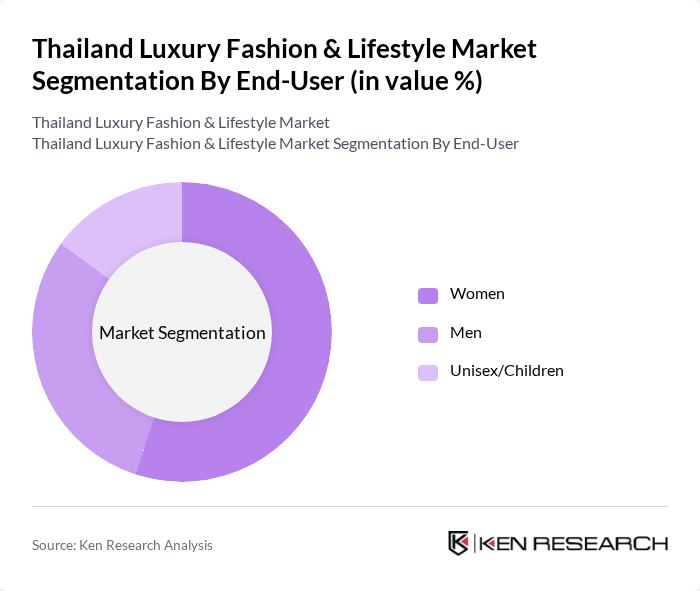

By End-User:The market is segmented by end-user demographics: Women, Men, and Unisex/Children. Women account for the majority share, driven by strong demand for luxury apparel, accessories, and beauty products. Men represent a significant segment, particularly in watches, footwear, and tailored fashion. Unisex/Children is a growing niche, reflecting changing family purchasing patterns and the emergence of luxury children's wear and gender-neutral collections , .

Thailand Luxury Fashion & Lifestyle Market Competitive Landscape

The Thailand Luxury Fashion & Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Chanel, Prada, Hermès, Burberry, Dior, Fendi, Versace, Valentino, Bvlgari, Salvatore Ferragamo, Tiffany & Co., Montblanc, Balenciaga, Pandora, Jim Thompson, Sretsis, Disaya, Kloset contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Luxury Fashion & Lifestyle Market Industry Analysis

Growth Drivers

- Rising Disposable Income:Thailand's GDP per capita is projected to reach approximately $7,800 in future, reflecting a steady increase in disposable income. This growth enables consumers to allocate more funds towards luxury fashion and lifestyle products. The affluent segment, comprising around 1.3 million households, is expected to drive demand for high-end brands, as they seek quality and exclusivity in their purchases. This trend is further supported by a growing middle class with increasing purchasing power.

- Increasing Tourism:In future, Thailand is anticipated to welcome over 42 million international tourists, significantly boosting the luxury fashion market. Tourists, particularly from China, Europe, and the U.S., contribute approximately $65 billion to the economy, with a substantial portion spent on luxury goods. This influx of visitors creates a vibrant market for high-end brands, as tourists often seek unique fashion items and luxury experiences, enhancing the overall market landscape.

- Growing Online Shopping Trends:E-commerce in Thailand is projected to reach $32 billion in future, driven by a surge in online shopping for luxury goods. With over 55% of the population engaging in online shopping, brands are increasingly investing in digital platforms to reach consumers. The convenience of online shopping, coupled with enhanced delivery services, is reshaping consumer behavior, making luxury fashion more accessible and appealing to a broader audience.

Market Challenges

- Economic Fluctuations:Thailand's economy faces potential volatility due to global economic conditions, with GDP growth projected at 3.8% in future. Such fluctuations can impact consumer spending on luxury items, as economic uncertainty often leads to cautious spending behavior. Additionally, inflation rates, expected to hover around 3.0%, may further strain disposable income, affecting the luxury market's stability and growth potential.

- Intense Competition:The luxury fashion market in Thailand is characterized by fierce competition, with over 220 international brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, making it challenging for new entrants to establish themselves. Established brands must continuously innovate and differentiate their offerings to maintain customer loyalty and market presence amidst this competitive landscape.

Thailand Luxury Fashion & Lifestyle Market Future Outlook

The Thailand luxury fashion and lifestyle market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As digital engagement increases, brands will likely enhance their online presence and invest in personalized shopping experiences. Additionally, the demand for sustainable and ethically sourced products is expected to rise, prompting brands to adapt their strategies. This shift towards sustainability and digitalization will shape the market, creating new avenues for growth and consumer engagement in the coming years.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce presents a significant opportunity for luxury brands to reach a wider audience. With online sales projected to account for 30% of total luxury sales in future, brands can leverage digital marketing strategies to enhance visibility and accessibility, catering to tech-savvy consumers seeking convenience and variety in their shopping experiences.

- Collaborations with Local Designers:Collaborating with local designers can provide luxury brands with unique offerings that resonate with Thai consumers. Such partnerships can enhance brand authenticity and appeal, tapping into the growing trend of supporting local artisans. This strategy not only fosters community engagement but also differentiates brands in a competitive market, potentially increasing customer loyalty and sales.