Region:Asia

Author(s):Rebecca

Product Code:KRAB1738

Pages:88

Published On:October 2025

By Type:The market is segmented into various types, including Apparel, Footwear, Accessories, Jewelry, Handbags, Fragrances, and Others. Among these, Apparel and Footwear are the leading segments, driven by changing fashion trends and increasing consumer spending on clothing and shoes. The demand for Accessories and Handbags is also growing, as consumers seek to complement their outfits with stylish additions. Jewelry and Fragrances are gaining traction, particularly among affluent consumers who prioritize luxury and exclusivity. The market is also witnessing the rise of non-traditional luxury formats, such as limited-edition collaborations and custom-made collections, catering to the preferences of younger, experience-driven shoppers.

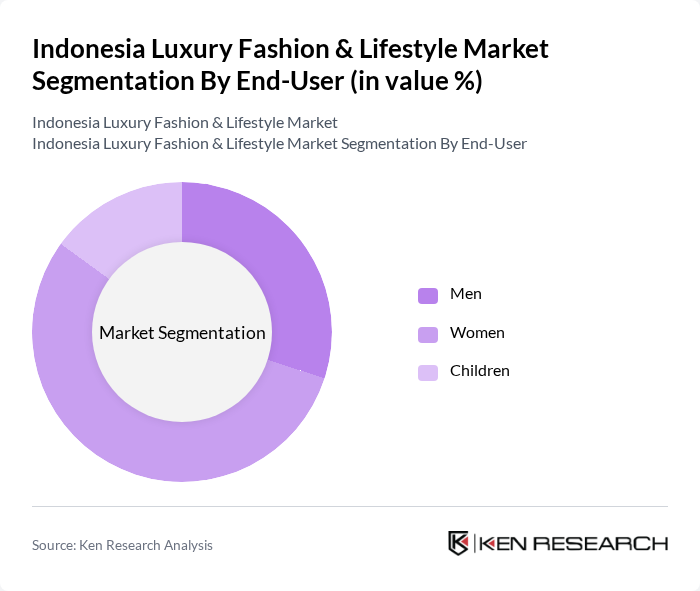

By End-User:The market is segmented by end-user into Men, Women, and Children. Women represent the largest segment, driven by their increasing participation in the workforce and growing interest in fashion. Men’s fashion is also on the rise, with more men investing in luxury clothing and accessories. The Children’s segment is smaller but is gaining traction as parents increasingly seek high-quality and stylish options for their children. The growing influence of affluent millennials and Gen Z, who prioritize experiences and brand authenticity, is reshaping demand across all segments.

The Indonesia Luxury Fashion & Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton Indonesia, Gucci Indonesia, Prada Indonesia, Chanel Indonesia, Hermès Indonesia, Burberry Indonesia, Fendi Indonesia, Versace Indonesia, Salvatore Ferragamo Indonesia, Bvlgari Indonesia, Michael Kors Indonesia, Coach Indonesia, Balenciaga Indonesia, Valentino Indonesia, Dolce & Gabbana Indonesia, Sejauh Mata Memandang, Toton, Danjyo Hiyoji, Biyan, Ivan Gunawan contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia luxury fashion and lifestyle market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to resonate with consumers. Additionally, the integration of augmented reality in retail experiences is expected to enhance customer engagement. The focus on personalization and unique shopping experiences will further shape the market, creating opportunities for brands to innovate and connect with their audience effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Jewelry Handbags Fragrances Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail (e.g., Tokopedia, Shopee, Zalora, Brand Official Websites) Offline Retail (e.g., Plaza Indonesia, Pacific Place, Senayan City, Grand Indonesia) Luxury Department Stores (e.g., Sogo, Seibu, Metro Department Store) |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Brand Origin | Domestic Brands (e.g., Sejauh Mata Memandang, Toton, Danjyo Hiyoji, Biyan, Ivan Gunawan) International Brands (e.g., Louis Vuitton, Gucci, Chanel, Hermès, Prada, Burberry, Fendi, Versace, Salvatore Ferragamo, Bvlgari, Michael Kors, Coach, Balenciaga, Valentino, Dolce & Gabbana) |

| By Consumer Demographics | Age Group (e.g., Gen Z, Millennials, Gen X, Baby Boomers) Income Level (e.g., Upper Middle Class, High Net Worth Individuals, Ultra High Net Worth Individuals) Lifestyle Preferences (e.g., Urban Professionals, Socialites, Fashion Enthusiasts, Sustainability Advocates) |

| By Occasion | Casual Wear Formal Wear Special Events (e.g., Weddings, Galas, Red Carpet) Everyday Wear |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchases | 120 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessories Market | 90 | Luxury Brand Managers, Retail Buyers |

| Lifestyle Goods Consumption | 60 | Interior Designers, Lifestyle Influencers |

| Online Luxury Shopping Trends | 100 | E-commerce Managers, Digital Marketing Experts |

| Consumer Attitudes Towards Sustainability | 70 | Sustainability Advocates, Eco-conscious Shoppers |

The Indonesia Luxury Fashion & Lifestyle Market is valued at approximately USD 3.0 billion, driven by rising disposable incomes, a growing middle class, and increased consumer interest in luxury goods, particularly among millennials and Gen Z.