Region:Africa

Author(s):Dev

Product Code:KRAA3563

Pages:95

Published On:September 2025

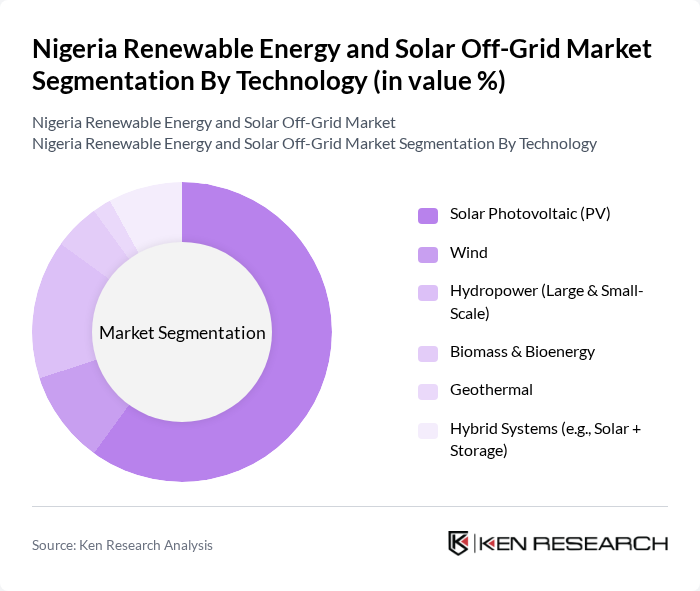

By Technology:The technology segmentation includes various renewable energy sources that contribute to the market. The subsegments are Solar Photovoltaic (PV), Wind, Hydropower (Large & Small-Scale), Biomass & Bioenergy, Geothermal, and Hybrid Systems (e.g., Solar + Storage). Solar PV is the most prominent technology due to its affordability, rapid deployment, and suitability for decentralized and off-grid applications, making it the preferred choice for both residential and commercial users. Hybrid systems, particularly solar plus storage, are gaining traction for enhancing reliability in areas with unstable grid supply .

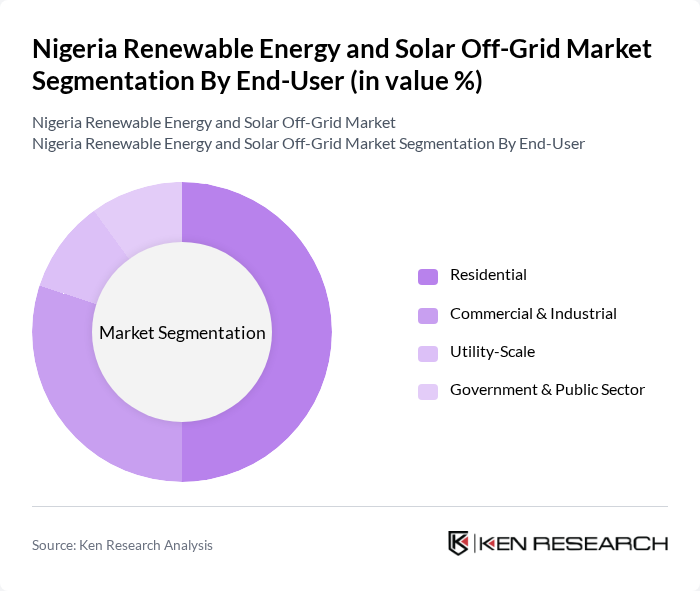

By End-User:The end-user segmentation encompasses various consumer categories, including Residential, Commercial & Industrial, Utility-Scale, and Government & Public Sector. The residential segment is the largest, driven by the urgent need for reliable electricity in off-grid and underserved areas and the rapid adoption of solar home systems and mini-grids. Commercial and industrial users are increasingly investing in renewable energy to reduce operational costs, improve energy security, and meet sustainability targets. Utility-scale and public sector projects are also expanding, particularly in partnership with development agencies and private investors .

The Nigeria Renewable Energy and Solar Off-Grid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Engie Energy Access Nigeria, Lumos Nigeria, Daystar Power, Greenlight Planet (Sun King), GVE Projects Ltd, Arnergy Solar Limited, Starsight Energy, PowerGen Renewable Energy, North South Power Company Limited, TotalEnergies Nigeria, Schneider Electric Nigeria, Rubitec Solar, Havenhill Synergy Limited, Eauxwell Nigeria Limited, Nigerian Renewable Energy Association contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's renewable energy and solar off-grid market appears promising, driven by increasing energy demand and supportive government policies. As technological advancements continue to lower costs and improve efficiency, more households and businesses are likely to adopt solar solutions. Additionally, the rise of innovative financing models will facilitate access to renewable energy, particularly in underserved regions. In the future, the market is expected to witness significant growth, contributing to national energy goals and enhancing energy security.

| Segment | Sub-Segments |

|---|---|

| By Technology | Solar Photovoltaic (PV) Wind Hydropower (Large & Small-Scale) Biomass & Bioenergy Geothermal Hybrid Systems (e.g., Solar + Storage) |

| By End-User | Residential Commercial & Industrial Utility-Scale Government & Public Sector |

| By Application | Off-Grid (Mini-Grids, Solar Home Systems) Grid-Connected Rural Electrification Rooftop Installations |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes & Grants |

| By Policy Support | Subsidies Tax Exemptions & Incentives Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Retail & Distribution Partnerships |

| By Region | North South East West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Off-Grid Users | 120 | Homeowners, Tenants |

| Small Business Solar Solutions | 90 | Business Owners, Facility Managers |

| Community Solar Projects | 60 | Community Leaders, Project Coordinators |

| Government and NGO Stakeholders | 50 | Policy Makers, Program Managers |

| Solar Technology Providers | 40 | Product Managers, Sales Directors |

The Nigeria Renewable Energy and Solar Off-Grid Market is valued at approximately USD 2.5 billion, driven by increasing electricity demand, government initiatives, and declining costs of solar technologies. This market is expected to grow significantly in the coming years.