Oman Aluminum Foil Market Overview

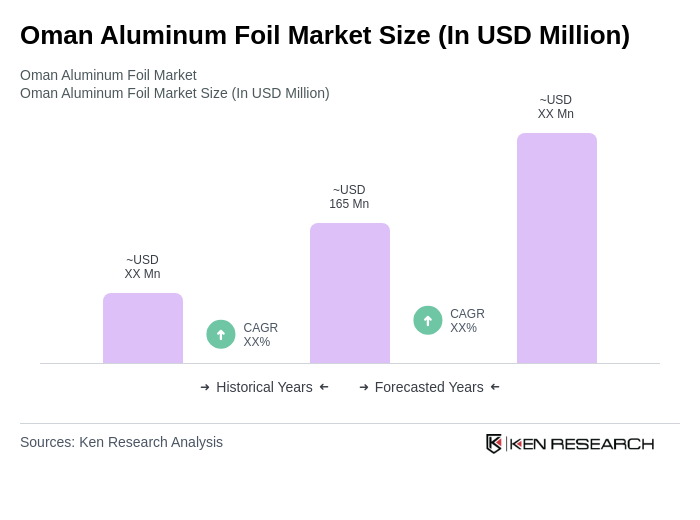

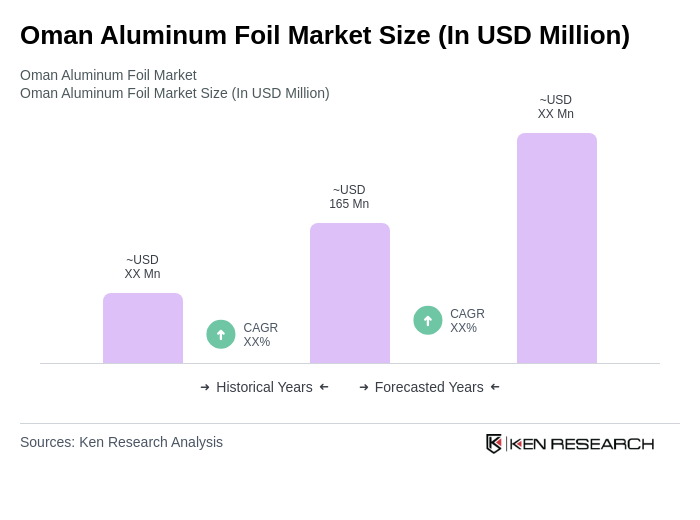

- The Oman Aluminum Foil Market is valued at USD 165 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for packaging solutions in the food and beverage sector, as well as the rising awareness of sustainable packaging options. The market is also supported by the expansion of the retail sector and the growing trend of convenience foods, which require efficient packaging materials. Additionally, population growth, the Oman Vision 2040 aimed at diversifying the economy away from oil and imports, and the hot climate increasing demand for beverages are significant factors bolstering market expansion.

- Muscat and Salalah are the dominant cities in the Oman Aluminum Foil Market due to their strategic locations and robust infrastructure. Muscat, being the capital, serves as a commercial hub with a high concentration of food processing and packaging companies. Salalah, on the other hand, benefits from its port facilities, facilitating the import and export of aluminum products, thus enhancing market accessibility.

- The Oman Ministry of Environment and Climate Affairs established the Environmental Protection Requirements for Packaging Materials framework, which mandates that all packaging materials, including aluminum foil, must meet specific environmental standards to reduce waste and promote sustainability. This regulation drives innovation in the aluminum foil sector, encouraging manufacturers to adopt eco-friendly practices and recyclable solutions.

Oman Aluminum Foil Market Segmentation

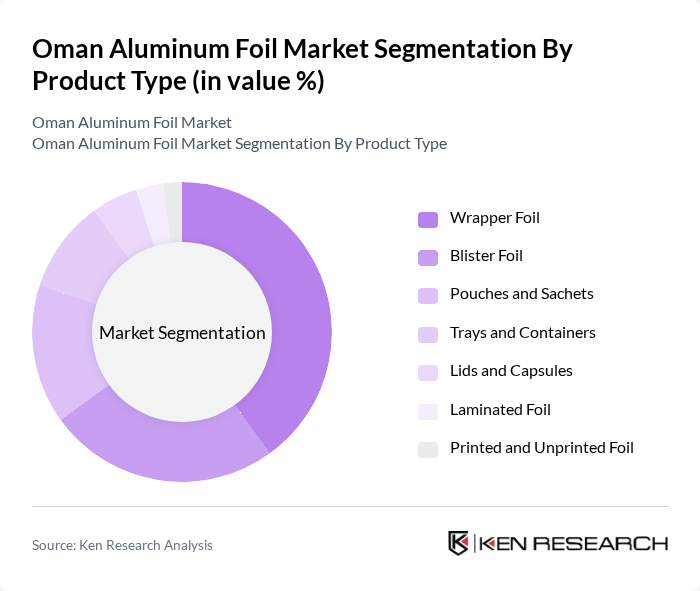

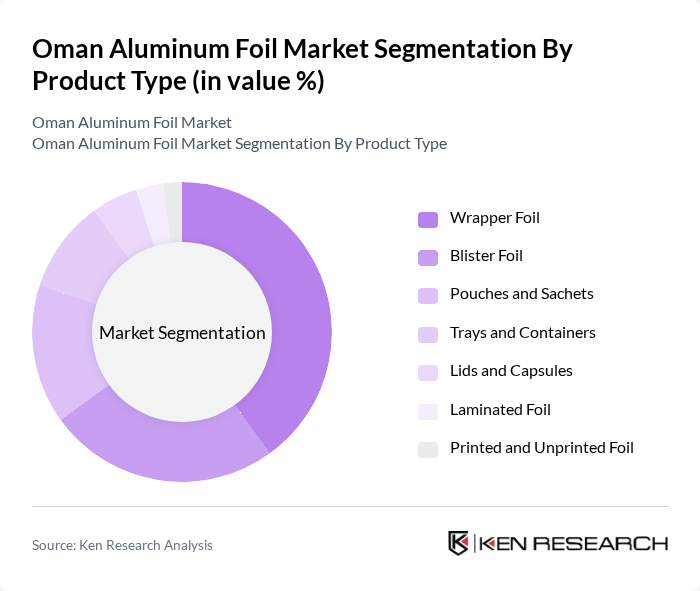

By Product Type:The product type segmentation includes various forms of aluminum foil used across different applications. The subsegments are Wrapper Foil, Blister Foil, Pouches and Sachets, Trays and Containers, Lids and Capsules, Laminated Foil, and Printed and Unprinted Foil. Among these, Wrapper Foil is the most dominant due to its extensive use in food packaging, driven by consumer preferences for convenience and freshness. The demand for Blister Foil is also significant, particularly in the pharmaceutical sector, where it is used for packaging tablets and capsules.

By Thickness:The thickness segmentation categorizes aluminum foil based on its gauge, which affects its application and performance. The subsegments include Up to 0.09 mm, 0.09 mm to 0.2 mm, and 0.2 mm to 0.4 mm. The thickness range of 0.09 mm to 0.2 mm is the most widely used, particularly in food packaging, as it provides a balance between flexibility and strength. Thicker foils are preferred in industrial applications, while thinner options are favored for consumer goods.

Oman Aluminum Foil Market Competitive Landscape

The Oman Aluminum Foil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Aluminium Rolling Company (OARC), Gulf Aluminium Rolling Mill Company (GARMCO), Al Anwar Industrial Investments (Oman), Alufoil Products Pvt. Ltd., Novelis Inc., Hindalco Industries Limited, UACJ Corporation, RUSAL, Constellium SE, Amcor plc, Reynolds Consumer Products, Ball Corporation, Crown Holdings, Inc., Alcoa Corporation, Norsk Hydro ASA contribute to innovation, geographic expansion, and service delivery in this space.

Oman Aluminum Foil Market Industry Analysis

Growth Drivers

- Increasing Demand from Food Packaging:The food packaging sector in Oman is projected to reach a value of OMR 1.2 billion in future, driven by the rising consumption of packaged foods. This growth is attributed to changing consumer lifestyles and preferences for convenience. The aluminum foil segment is particularly favored for its barrier properties, which preserve food quality and extend shelf life. As a result, manufacturers are increasingly adopting aluminum foil for various food products, enhancing market demand significantly.

- Rising Consumer Awareness of Sustainable Packaging:In Oman, approximately 60% of consumers are now prioritizing sustainable packaging options, reflecting a global trend towards eco-friendly materials. This shift is supported by the government's initiatives to promote recycling and reduce plastic waste. As aluminum foil is 100% recyclable, its adoption in packaging is expected to rise, with a projected increase in demand by 15% annually in future. This trend aligns with the growing emphasis on environmental responsibility among consumers and businesses alike.

- Expansion of the Food and Beverage Industry:The food and beverage industry in Oman is anticipated to grow at a rate of 8% annually, reaching OMR 3 billion in future. This expansion is driven by increased tourism and a growing population, leading to higher demand for packaged food products. Consequently, the aluminum foil market is set to benefit from this growth, as manufacturers seek efficient packaging solutions that meet the rising demand for convenience and quality in food products.

Market Challenges

- Fluctuating Raw Material Prices:The aluminum market is subject to significant price volatility, with raw material costs fluctuating between OMR 1,200 and OMR 1,500 per ton in recent years. This instability poses a challenge for manufacturers in Oman, as it affects production costs and profit margins. Companies must navigate these fluctuations carefully to maintain competitive pricing while ensuring product quality, which can hinder market growth and profitability.

- Competition from Alternative Packaging Materials:The aluminum foil market faces stiff competition from alternative materials such as biodegradable plastics and paper-based packaging. The market share of these alternatives increased by 10%, driven by consumer preferences for sustainable options. This trend poses a challenge for aluminum foil manufacturers in Oman, as they must innovate and differentiate their products to retain market share amidst growing competition from these eco-friendly alternatives.

Oman Aluminum Foil Market Future Outlook

The Oman aluminum foil market is poised for significant growth, driven by increasing demand from the food packaging sector and rising consumer awareness of sustainability. Innovations in eco-friendly aluminum foil and the expansion of e-commerce are expected to create new opportunities for manufacturers. Additionally, collaborations with food manufacturers will enhance product offerings, catering to evolving consumer preferences. As the market adapts to these trends, it is likely to witness a robust transformation, positioning itself favorably in the regional packaging landscape.

Market Opportunities

- Growth in E-commerce and Online Food Delivery:The e-commerce sector in Oman is projected to reach OMR 500 million in future, significantly boosting demand for aluminum foil packaging. As online food delivery services expand, the need for efficient, protective packaging solutions will increase, presenting a lucrative opportunity for aluminum foil manufacturers to cater to this growing market segment.

- Innovations in Eco-friendly Aluminum Foil:The development of biodegradable aluminum foil products is gaining traction, with investments in research and development expected to exceed OMR 2 million in future. This innovation aligns with consumer preferences for sustainable packaging, providing manufacturers with an opportunity to differentiate their offerings and capture a larger market share in the environmentally conscious segment.