Region:Middle East

Author(s):Dev

Product Code:KRAC2992

Pages:98

Published On:January 2026

By Service Type:The service type segmentation includes various offerings that cater to the diverse needs of customers. The subsegments are Hair Care (cutting, coloring, styling, treatments), Skin Care & Facial Treatments, Nail Care (manicure, pedicure, nail art), Makeup & Bridal Services, Spa & Wellness Services (massage, hammam, body treatments), and Others (lash/brow, waxing, threading, advanced aesthetic services). This structure is consistent with the way Oman beauty salon reports classify services into hair care, skin care, nail care, spa and other specialized treatments. Among these, Hair Care services dominate the market due to the high frequency of basic grooming visits, regular cutting and styling needs, and the rising trend of professional hair coloring and treatments among both women and men.

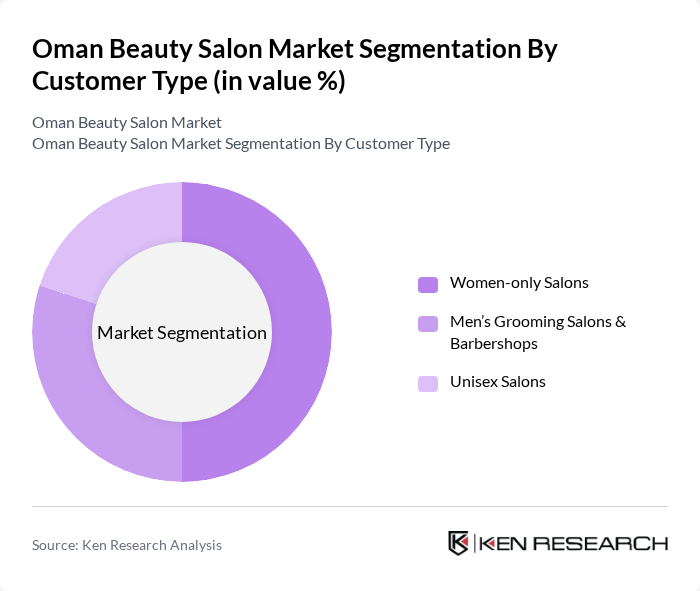

By Customer Type:The customer type segmentation includes Women-only Salons, Men’s Grooming Salons & Barbershops, and Unisex Salons. This segmentation reflects the Oman market structure, where female-focused salons and spa lounges form the core of organized demand, while male grooming outlets and barbershops are expanding as men’s grooming becomes more mainstream. Women-only salons are particularly popular due to cultural preferences, privacy requirements, and the demand for specialized services tailored to women. Men’s grooming salons are gaining traction with rising interest in beard styling, hair treatments, and skincare among male customers, while unisex salons cater to a broader audience, often positioned in malls and mixed-use developments to provide a variety of services for all genders.

The Oman Beauty Salon Market is characterized by a dynamic mix of regional and international players. Leading participants such as The White Room (Muscat), The Beauty Bar Oman, Al Shiffa Beauty Salon, Alia Beauty Lounge, Glamour Beauty Salon & Spa, Beauty Lounge Muscat, The Nail Spa Oman, Oasis Spa & Beauty Salon, Bella Mujer Ladies Salon, Lush Beauty & Spa, Dream Ladies Beauty Salon, Pure Touch Beauty Salon, Radiance Ladies Salon, Essence Spa & Beauty Lounge, Glamour House Beauty Salon contribute to innovation, geographic expansion, and service delivery in this space.

The Oman beauty salon market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As the demand for personalized and high-quality services increases, salons will need to adapt by integrating innovative solutions such as online booking and mobile services. Additionally, the focus on sustainability will likely shape service offerings, encouraging salons to adopt eco-friendly practices and products, ultimately enhancing customer loyalty and market competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Hair Care (cutting, coloring, styling, treatments) Skin Care & Facial Treatments Nail Care (manicure, pedicure, nail art) Makeup & Bridal Services Spa & Wellness Services (massage, hammam, body treatments) Others (lash/brow, waxing, threading, advanced aesthetic services) |

| By Customer Type | Women-only Salons Men’s Grooming Salons & Barbershops Unisex Salons |

| By End User Profile | Nationals (Omani) Expatriates Tourists |

| By Salon Format | Organized Chains / Franchise Salons Independent Premium Salons Independent Mass / Neighborhood Salons Home-based / Freelance & Mobile Beauty Services |

| By Price Positioning | Luxury / High-end Mid-market Value / Budget |

| By City | Muscat Salalah Sohar Other Cities & Towns |

| By Ownership | Local-owned Salons GCC / Regional Chains International Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hair Salon Services | 90 | Salon Owners, Hair Stylists |

| Nail and Spa Services | 70 | Nail Technicians, Spa Managers |

| Skincare and Aesthetic Treatments | 60 | Estheticians, Dermatologists |

| Consumer Beauty Preferences | 140 | Beauty Service Consumers, Trendsetters |

| Market Trends and Innovations | 50 | Industry Experts, Beauty Product Developers |

The Oman Beauty Salon Market is valued at approximately USD 280 million, reflecting growth driven by increasing disposable incomes, urbanization, and a rising interest in personal grooming among both locals and expatriates.