Region:Middle East

Author(s):Rebecca

Product Code:KRAC1195

Pages:95

Published On:October 2025

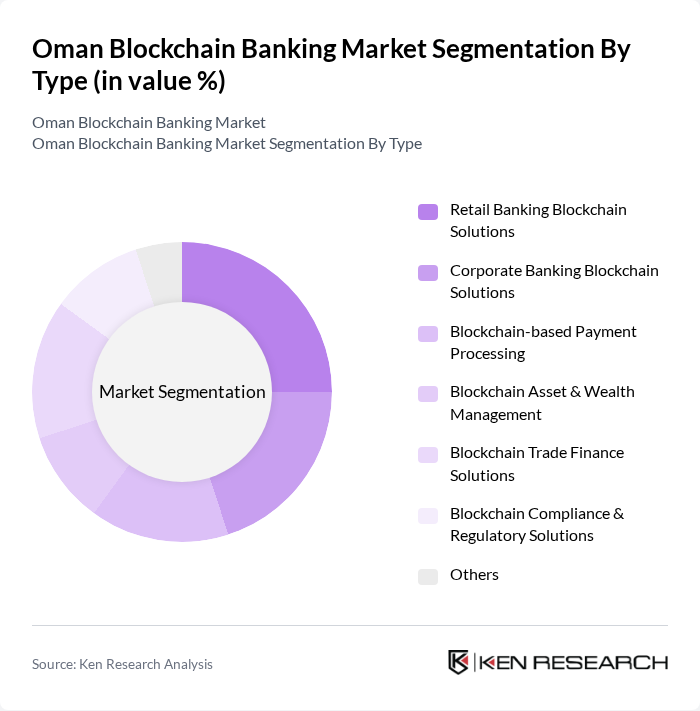

By Type:The market is segmented into Retail Banking Blockchain Solutions, Corporate Banking Blockchain Solutions, Blockchain-based Payment Processing, Blockchain Asset & Wealth Management, Blockchain Trade Finance Solutions, Blockchain Compliance & Regulatory Solutions, and Others. These segments reflect the diverse applications of blockchain in banking, including secure payments, asset tokenization, automated compliance, and enhanced trade finance transparency. Retail and corporate banking segments are increasingly leveraging distributed ledger technology (DLT), smart contracts, and tokenization to drive innovation and efficiency.

The Retail Banking Blockchain Solutions segment leads the market, driven by strong consumer demand for secure, efficient, and transparent banking services. Retail banks are adopting blockchain to deliver faster transactions, lower costs, and enhanced security. The growth of digital banking and the proliferation of fintech startups offering blockchain-enabled retail solutions are accelerating this segment’s expansion. Innovations such as smart contracts and tokenized assets are further strengthening retail banking’s market position.

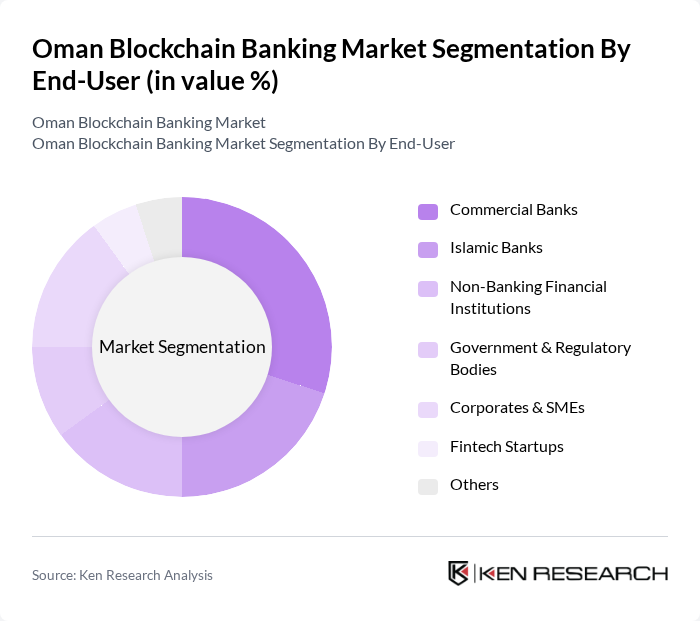

By End-User:The market is segmented by end-users, including Commercial Banks, Islamic Banks, Non-Banking Financial Institutions, Government & Regulatory Bodies, Corporates & SMEs, Fintech Startups, and Others. Each category utilizes blockchain for distinct applications: commercial banks focus on secure payments and compliance, Islamic banks leverage blockchain for Sharia-compliant finance, non-banking institutions deploy blockchain for asset management, and fintech startups drive innovation in payments and lending. Corporates and SMEs increasingly adopt blockchain for trade finance and supply chain transparency.

Commercial Banks are the leading end-user segment, supported by their large customer base and ongoing investments in secure transaction processing. These institutions are integrating blockchain to streamline operations, reduce fraud, and enhance regulatory compliance. The adoption of blockchain enables commercial banks to offer innovative services such as real-time payments, automated KYC/AML, and improved customer trust, reinforcing their market leadership.

The Oman Blockchain Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Arab Bank, National Bank of Oman, BankDhofar, Oman Investment and Finance Co. SAOG, Alizz Islamic Bank, Sohar International, Muscat Finance, Oman Housing Bank, Ahli Bank Oman, HSBC Bank Oman, Bank Nizwa, Oman Data Park, Thawani Technologies, Blockchain Solutions Oman contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman blockchain banking market appears promising, driven by increasing digitalization and a growing emphasis on financial inclusion. As banks continue to invest in blockchain technology, we can expect enhanced operational efficiencies and improved customer experiences. Additionally, the collaboration between traditional banks and fintech startups is likely to foster innovation, leading to the development of new financial products and services that cater to a broader audience, ultimately transforming the banking landscape in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Banking Blockchain Solutions Corporate Banking Blockchain Solutions Blockchain-based Payment Processing Blockchain Asset & Wealth Management Blockchain Trade Finance Solutions Blockchain Compliance & Regulatory Solutions Others |

| By End-User | Commercial Banks Islamic Banks Non-Banking Financial Institutions Government & Regulatory Bodies Corporates & SMEs Fintech Startups Others |

| By Application | Cross-Border Payments & Remittances Smart Contracts & Automation Digital Identity Verification (e-KYC) Supply Chain Finance Tokenization of Assets Fraud Detection & AML Others |

| By Distribution Channel | Direct Enterprise Sales Digital/Online Platforms Partnerships with Financial Institutions System Integrators Others |

| By Regulatory Compliance | KYC/AML Compliance Solutions Data Privacy & Security Compliance Central Bank Regulatory Compliance Shariah Compliance (for Islamic Banking) Others |

| By Investment Source | Private Equity & Venture Capital Government & Regulatory Funding Corporate Investments International Development Funds Others |

| By Market Maturity | Early Adoption Growth Phase Mature Phase Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Banking Sector | 100 | Banking Executives, IT Managers |

| Fintech Startups | 60 | Founders, Product Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Investment Firms | 50 | Investment Analysts, Portfolio Managers |

| Consumer Banking Services | 80 | Customer Experience Managers, Marketing Directors |

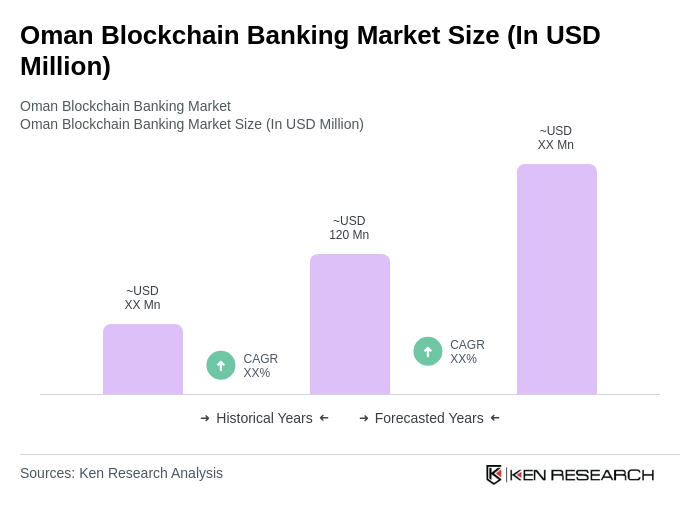

The Oman Blockchain Banking Market is valued at approximately USD 120 million, reflecting a significant growth driven by the adoption of blockchain technology in financial services, enhancing transaction security and operational efficiency.