Region:Middle East

Author(s):Rebecca

Product Code:KRAC1134

Pages:89

Published On:October 2025

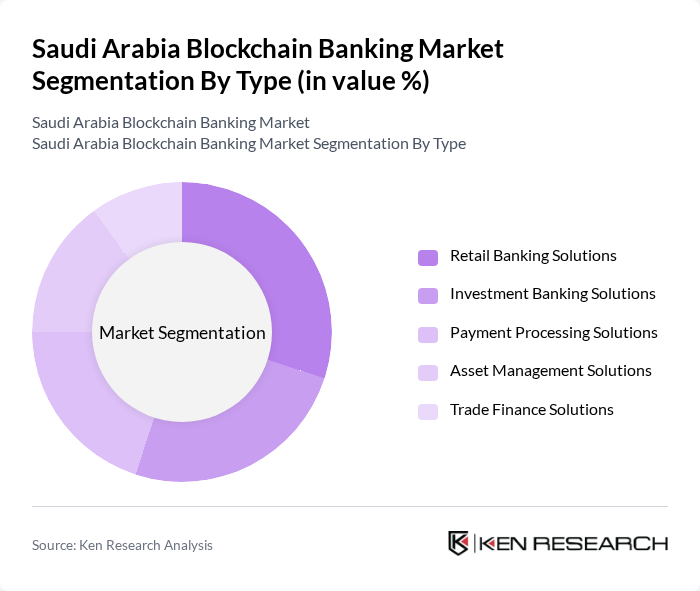

By Type:The market is segmented into various types, including Retail Banking Solutions, Investment Banking Solutions, Payment Processing Solutions, Asset Management Solutions, and Trade Finance Solutions. Each of these segments plays a crucial role in the overall market dynamics, catering to different customer needs and preferences. Retail Banking Solutions are seeing the highest adoption, driven by the demand for digital onboarding, instant payments, and enhanced customer authentication. Payment Processing Solutions are also rapidly expanding as banks and fintechs focus on real-time settlement and cross-border remittances using blockchain .

TheRetail Banking Solutionssegment is currently dominating the market due to the increasing demand for digital banking services among consumers. With the rise of mobile banking and online financial services, retail banking has seen significant growth. Consumers are increasingly seeking convenient and secure banking options, leading to a surge in the adoption of blockchain technology for transactions and account management. This trend is further supported by the growing number of fintech startups focusing on enhancing customer experiences through innovative solutions .

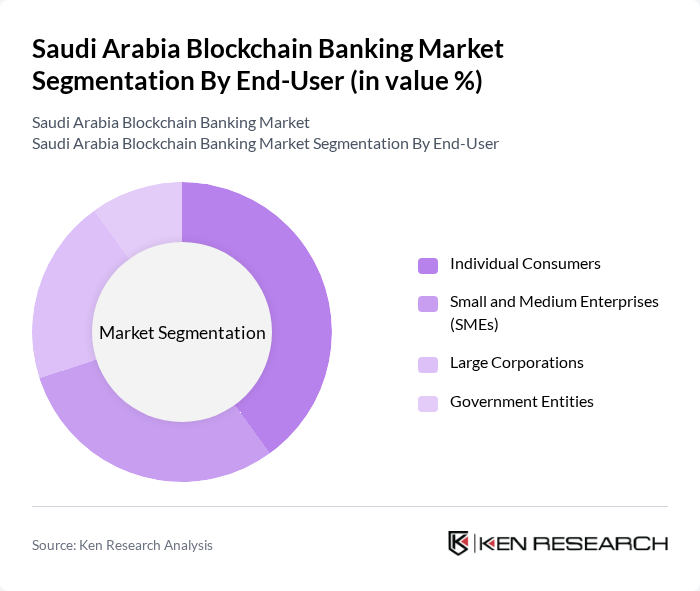

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each end-user category has distinct requirements and preferences, influencing the adoption of blockchain banking solutions. Individual Consumers are the leading end-user group, driven by the proliferation of mobile banking apps, digital wallets, and secure peer-to-peer payment platforms. SMEs are increasingly adopting blockchain for supply chain finance and invoice management, while large corporations and government entities focus on blockchain for compliance, transparency, and automation .

TheIndividual Consumerssegment is leading the market, driven by the increasing adoption of digital banking solutions. Consumers are becoming more tech-savvy and are seeking efficient, secure, and user-friendly banking options. The rise of mobile applications and online platforms has made it easier for individuals to access banking services, thus propelling the demand for blockchain technology in retail banking. This segment's growth is also supported by the increasing awareness of the benefits of blockchain, such as enhanced security and reduced transaction costs .

The Saudi Arabia Blockchain Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi National Bank, Al Rajhi Bank, Riyad Bank, Samba Financial Group, Arab National Bank, Banque Saudi Fransi, National Commercial Bank, Alinma Bank, Gulf International Bank, Saudi Investment Bank, Bank Aljazira, Bank of Tokyo-Mitsubishi UFJ, Emirates NBD, Qatar National Bank, Abu Dhabi Commercial Bank, IBM Saudi Arabia, SAP Saudi Arabia, Microsoft Saudi Arabia, Accenture Saudi Arabia, PwC Saudi Arabia, Deloitte Saudi Arabia, KPMG Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the blockchain banking market in Saudi Arabia appears promising, driven by increasing government support and a growing emphasis on digital transformation. As banks continue to explore innovative solutions, the integration of blockchain with artificial intelligence is expected to enhance operational efficiency. Furthermore, the rise of decentralized finance (DeFi) platforms will likely reshape traditional banking models, offering new avenues for growth and customer engagement in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Banking Solutions Investment Banking Solutions Payment Processing Solutions Asset Management Solutions Trade Finance Solutions |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Cross-Border Payments Smart Contracts Identity Verification Supply Chain Management Invoice Financing |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions |

| By Investment Source | Private Investments Venture Capital Government Grants |

| By Regulatory Compliance | Sharia-compliant Solutions International Compliance Standards Local Regulatory Frameworks |

| By Market Maturity | Emerging Market Growth Stage Established Market |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Banking Sector | 65 | Banking Executives, IT Directors, Chief Innovation Officers |

| Fintech Startups | 55 | Founders, CTOs, Product Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Investment Banks | 50 | Investment Analysts, Risk Managers |

| Consumer Banking Services | 60 | Customer Experience Managers, Digital Banking Heads |

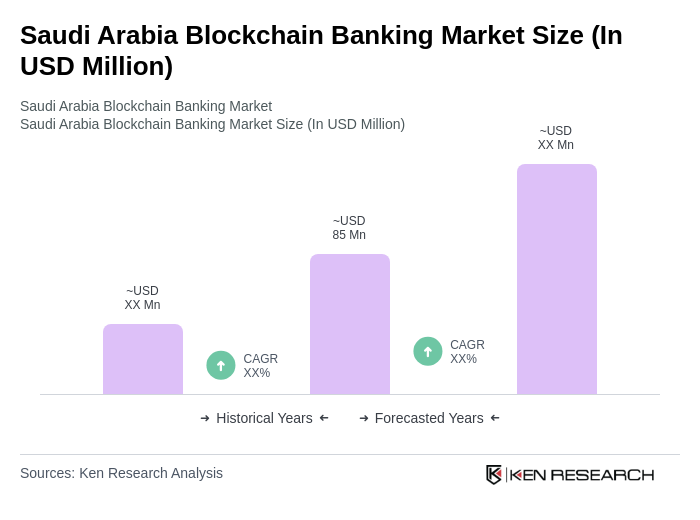

The Saudi Arabia Blockchain Banking Market is valued at approximately USD 85 million, reflecting significant growth driven by the adoption of blockchain technology in financial services, enhancing transaction security and efficiency.