Region:Middle East

Author(s):Rebecca

Product Code:KRAD4965

Pages:90

Published On:December 2025

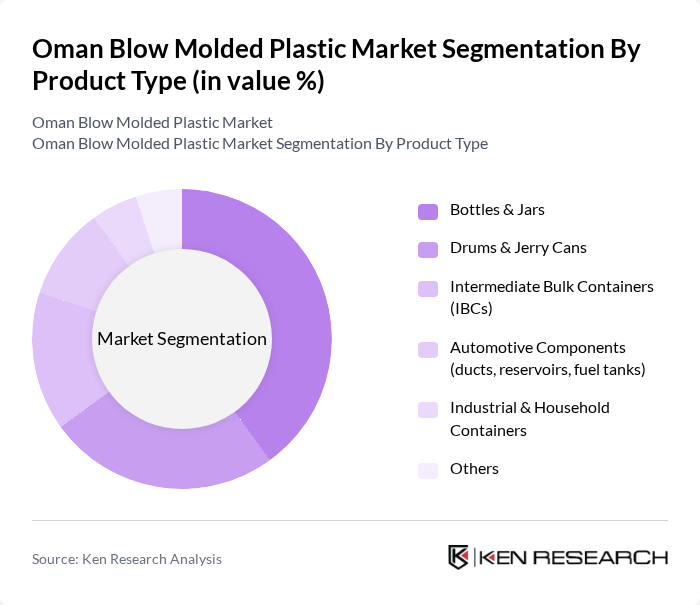

By Product Type:The product type segmentation includes various categories such as bottles & jars, drums & jerry cans, intermediate bulk containers (IBCs), automotive components, industrial & household containers, and others. This structure aligns with common product segmentation in the global and regional blow molded plastics industry, where bottles, jerry cans, drums, technical parts, and large containers represent the core demand clusters. Among these, bottles & jars are the leading sub-segment due to their extensive use in the food and beverage, home and personal care, and pharmaceutical industries, where demand for safe, lightweight, and convenient packaging is paramount, mirroring patterns observed across the Middle East and Africa. The versatility of blow molded bottles in terms of design, barrier properties, and compatibility with PET and HDPE resins further enhances their market position for beverages, edible oils, dairy, detergents, and household chemicals.

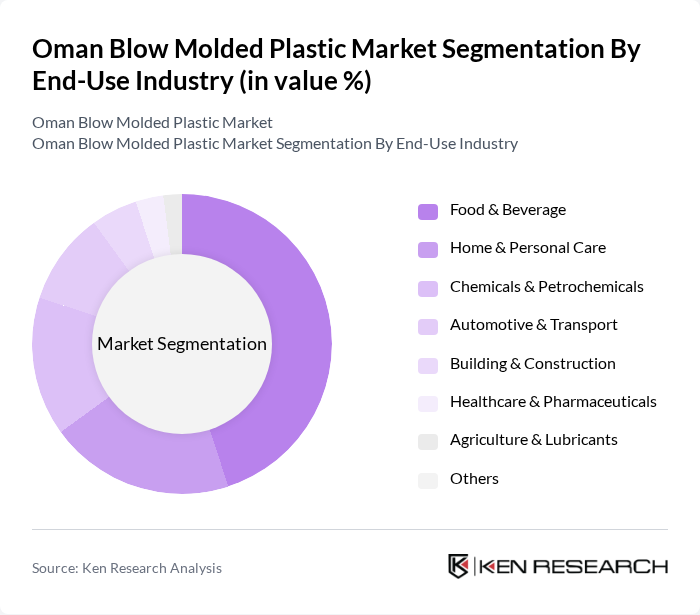

By End-Use Industry:The end-use industry segmentation encompasses food & beverage, home & personal care, chemicals & petrochemicals, automotive & transport, building & construction, healthcare & pharmaceuticals, agriculture & lubricants, and others. This segmentation is consistent with key demand sectors for blow molded plastics globally and in the Middle East and Africa, where packaging for food, beverages, household products, and chemicals accounts for the majority of consumption. The food & beverage sector is the dominant segment, driven by the increasing demand for packaged drinking water, juices, dairy, edible oils, and ready?to?consume products, alongside the expansion of modern retail and e?commerce in Oman, which require robust and lightweight PET and HDPE containers. The trend towards ready-to-eat meals and beverages, rising consumption of bottled water, and higher hygiene expectations after the pandemic period have significantly boosted the consumption of blow molded plastic bottles, jars, and multilayer containers in this industry.

The Oman Blow Molded Plastic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Plastic Industries LLC, Muscat National Plastic Industries LLC, Oman Packaging Company SAOG, Takamul Plastic Products LLC, Gulf Plastic & Converting Industries LLC, National Plastic Factory LLC (Oman), Al Rawahi Plastic Industries LLC, Al Reyami Plastic Industries LLC, Oman Polypropylene LLC, Majan Glass Company SAOG (plastic packaging and container affiliates), Taghleef Industries LLC (Oman operations), Octal Holding SAOC (rigid PET packaging), Gulf Petrochemical Services & Trading LLC (packaging & container division), Al Anwar Plastic Industries LLC, Al Sulaimi Group Holding LLC (plastics & industrial packaging businesses) contribute to innovation, geographic expansion, and service delivery in this space, in line with the broader regional trend of integrated plastics, packaging, and petrochemical-based converters in the Middle East.

The Oman blow molded plastic market is poised for significant transformation as sustainability becomes a central focus. With the government's commitment to reducing plastic waste and promoting recycling, manufacturers are likely to innovate in developing eco-friendly products. Additionally, the expansion of e-commerce is expected to drive demand for customized packaging solutions. As the construction and automotive sectors continue to grow, the integration of smart technologies in production processes will further enhance efficiency and product quality, positioning the market for robust growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Bottles & Jars Drums & Jerry Cans Intermediate Bulk Containers (IBCs) Automotive Components (ducts, reservoirs, fuel tanks) Industrial & Household Containers Others |

| By End-Use Industry | Food & Beverage Home & Personal Care Chemicals & Petrochemicals Automotive & Transport Building & Construction Healthcare & Pharmaceuticals Agriculture & Lubricants Others |

| By Region | Muscat Governorate Al Batinah (including Sohar) Dhofar (including Salalah) Al Dakhiliyah (including Nizwa) Other Governorates |

| By Application | Rigid Packaging Industrial & Chemical Containers Automotive Parts Construction & Infrastructure Products Medical & Pharma Packaging Others |

| By Material Type | High-Density Polyethylene (HDPE) Low & Linear Low-Density Polyethylene (LDPE/LLDPE) Polypropylene (PP) Polyethylene Terephthalate (PET) Polyvinyl Chloride (PVC) Others (including engineering & bio-based resins) |

| By Production Process | Extrusion Blow Molding Injection Blow Molding Injection Stretch Blow Molding Others |

| By Sales Channel | Direct Sales to Brand Owners & Industrial Customers Sales via Distributors & Traders Contract Manufacturing / Tolling Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturers of Blow Molded Plastics | 120 | Production Managers, Operations Directors |

| Distributors of Plastic Products | 90 | Sales Managers, Distribution Coordinators |

| Retailers of Consumer Goods | 80 | Category Managers, Procurement Officers |

| End-users in Automotive Sector | 70 | Product Development Engineers, Supply Chain Managers |

| Environmental Regulatory Bodies | 60 | Policy Analysts, Environmental Compliance Officers |

The Oman Blow Molded Plastic Market is valued at approximately USD 140 million, reflecting a robust demand for lightweight and durable packaging solutions across various sectors, including food and beverage, automotive, and consumer goods.