Region:Middle East

Author(s):Rebecca

Product Code:KRAA6399

Pages:98

Published On:January 2026

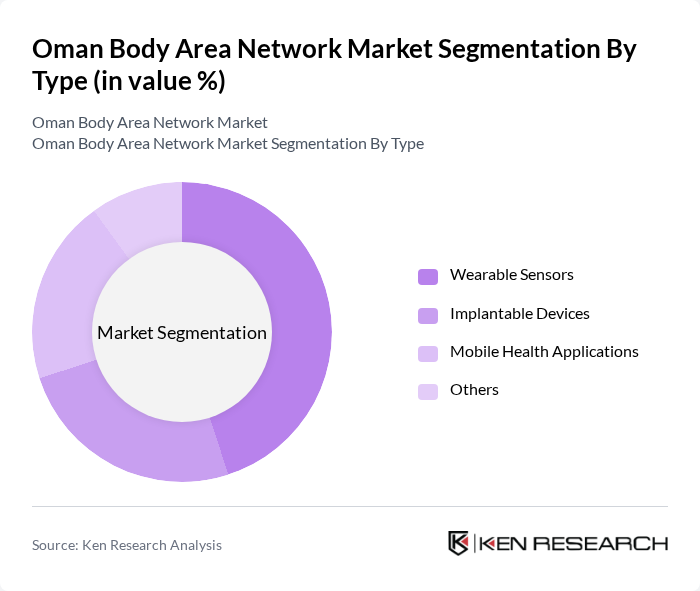

By Type:The market is segmented into various types, including wearable sensors, implantable devices, mobile health applications, and others. Among these, wearable sensors are leading the market due to their increasing adoption for fitness tracking and health monitoring. The convenience and accessibility of these devices have made them popular among consumers, driving significant growth in this segment.

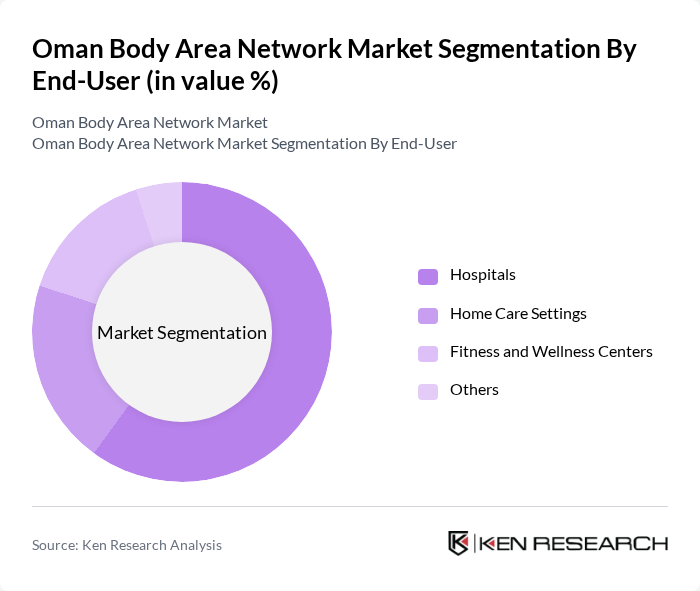

By End-User:The end-user segmentation includes hospitals, home care settings, fitness and wellness centers, and others. Hospitals are the leading end-user segment, driven by the increasing need for remote patient monitoring and chronic disease management solutions. The integration of body area networks in hospital settings enhances patient care and operational efficiency, making it a preferred choice for healthcare providers.

The Oman Body Area Network market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Medtronic, Abbott Laboratories, GE Healthcare, Siemens Healthineers, Omron Healthcare, Fitbit, Apple Inc., Samsung Electronics, Garmin Ltd., Withings, BioTelemetry, Inc., iHealth Labs, AliveCor, DarioHealth Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Body Area Network market in Oman appears promising, driven by increasing healthcare digitization and a focus on preventive care. As the government continues to invest in digital health infrastructure, the integration of artificial intelligence and machine learning into health monitoring systems is expected to enhance patient engagement and outcomes. Furthermore, the growing trend towards personalized healthcare solutions will likely create new avenues for innovation and collaboration within the healthcare ecosystem, fostering a more connected and efficient health management landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable Sensors Implantable Devices Mobile Health Applications Others |

| By End-User | Hospitals Home Care Settings Fitness and Wellness Centers Others |

| By Application | Chronic Disease Management Fitness Tracking Emergency Response Others |

| By Technology | Bluetooth Technology Wi-Fi Technology Zigbee Technology Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | Muscat Salalah Sohar Others |

| By Policy Support | Government Grants Tax Incentives Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Doctors, Nurses, Healthcare Administrators |

| Patients Using BAN Devices | 100 | Chronic Disease Patients, Fitness Enthusiasts |

| Technology Developers | 80 | Product Managers, R&D Engineers |

| Healthcare Policy Makers | 60 | Government Officials, Health Policy Analysts |

| Insurance Providers | 50 | Underwriters, Claims Adjusters |

The Oman Body Area Network market is valued at approximately USD 20 million, reflecting a significant growth driven by factors such as the increasing prevalence of chronic diseases and the rising adoption of telemedicine and wearable devices.