Oman Clinical Nutrition Market Overview

- The Oman Clinical Nutrition Market is valued at USD 30 million, based on a five-year historical analysis and regional market share allocation from authoritative Middle East clinical nutrition market reports. Growth is primarily driven by the increasing prevalence of chronic diseases, expanding healthcare infrastructure, rising awareness about nutritional health, and the growing geriatric population requiring specialized nutritional support. The demand for clinical nutrition products has surged as healthcare providers emphasize the importance of nutrition in patient recovery, disease management, and overall health outcomes. Additionally, innovative product launches and developments in organic and disease-specific formulas are contributing to market expansion.

- Muscat is the dominant city in the Oman Clinical Nutrition Market due to its status as the capital and largest city, housing major healthcare facilities and hospitals. The presence of a growing expatriate population and increasing healthcare investments in Muscat further accelerate market growth. Other cities such as Salalah and Sohar also play significant roles, supported by their developing healthcare infrastructure and rising health awareness among residents.

- The Omani government has implemented regulations to enhance the quality and safety of clinical nutrition products. The “Guidelines for Registration and Importation of Food for Special Medical Purposes (FSMP)” issued by the Ministry of Health, Oman (2022), require all clinical nutrition products to undergo rigorous testing, registration, and approval before market entry. These guidelines mandate compliance with safety standards, ingredient disclosures, and efficacy documentation, ensuring that patients receive safe and effective nutritional support and fostering trust in clinical nutrition solutions.

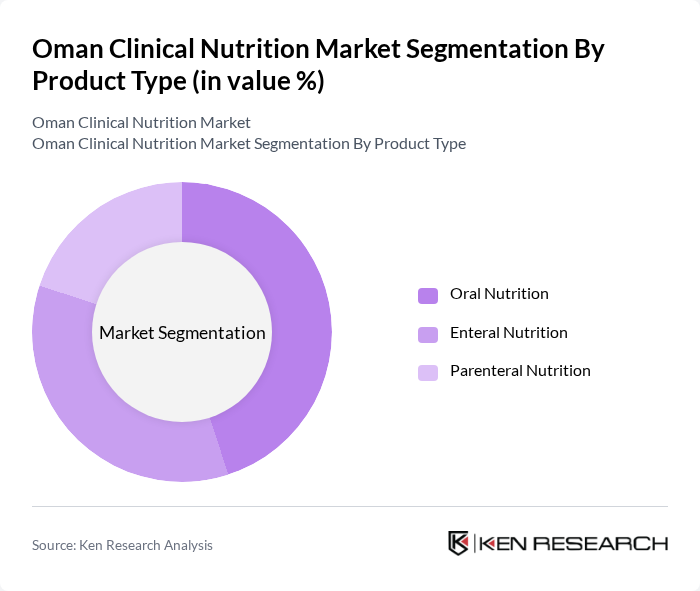

Oman Clinical Nutrition Market Segmentation

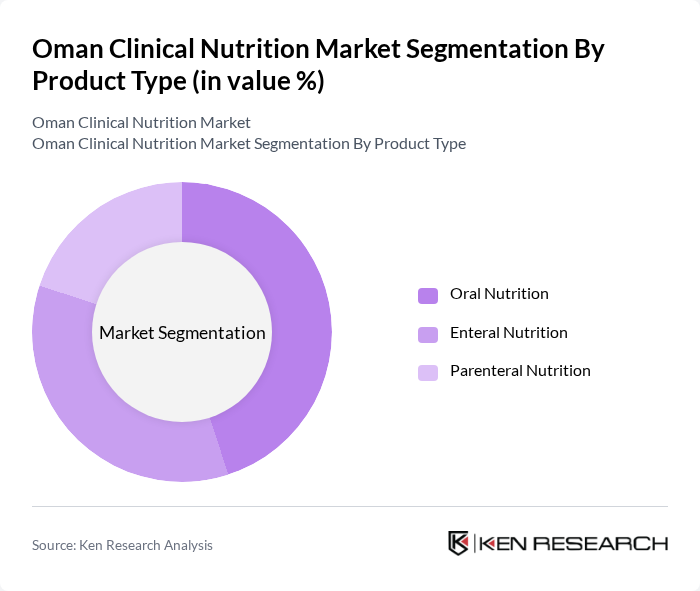

By Product Type:The market is segmented into Oral Nutrition, Enteral Nutrition, and Parenteral Nutrition. Oral Nutrition products are gaining traction due to their ease of use, palatability, and accessibility for patients, especially in outpatient and homecare settings. Enteral Nutrition is crucial for patients unable to consume food orally, such as those with swallowing disorders or severe illness. Parenteral Nutrition is essential for individuals with severe gastrointestinal issues, post-surgical recovery, or critical care needs. The demand for these products is influenced by the increasing number of patients requiring nutritional support in hospitals, long-term care, and homecare environments.

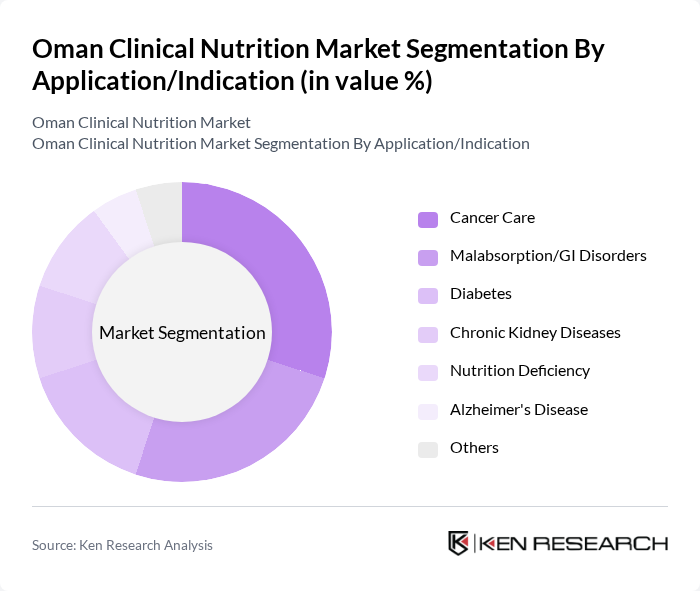

By Application/Indication:The market is categorized into Cancer Care, Malabsorption/GI Disorders, Diabetes, Chronic Kidney Diseases, Nutrition Deficiency, Alzheimer's Disease, and Others. Cancer Care is a significant segment due to the rising incidence of cancer and the need for specialized nutritional support during treatment. Malabsorption and GI disorders drive demand as patients require tailored nutrition to manage their conditions effectively. Diabetes and chronic kidney diseases are also major contributors, reflecting the increasing burden of metabolic and renal disorders in Oman. Nutrition deficiency and Alzheimer’s Disease segments highlight the importance of clinical nutrition in both acute and chronic care settings.

Oman Clinical Nutrition Market Competitive Landscape

The Oman Clinical Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Nestlé Health Science, Danone Nutricia, Fresenius Kabi, Baxter International, B. Braun Melsungen AG, Mead Johnson Nutrition, Reckitt Benckiser Group plc, Pfizer Nutrition, Ajinomoto Co., Inc., Meiji Holdings Co., Ltd., Victus, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Oman Clinical Nutrition Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and cardiovascular conditions in Oman is a significant growth driver for the clinical nutrition market. According to the World Health Organization, approximately 25% of Omani adults are affected by diabetes, leading to a heightened demand for specialized nutritional products. This trend is further supported by the Ministry of Health's initiatives to address these health issues through improved dietary practices and clinical nutrition interventions.

- Rising Awareness of Nutritional Health:There is a growing awareness among the Omani population regarding the importance of nutrition in maintaining health. Reports indicate that 60% of Omanis are actively seeking information on healthy eating habits. This shift is driven by educational campaigns from health authorities and increased access to information via digital platforms, which collectively promote the adoption of clinical nutrition solutions tailored to individual health needs.

- Growth in Healthcare Infrastructure:Oman has been investing significantly in healthcare infrastructure, with a reported increase of 10% in healthcare spending. This investment includes the establishment of specialized clinics and hospitals that focus on nutrition-related health services. Enhanced healthcare facilities are crucial for delivering clinical nutrition services, thereby expanding market access and improving patient outcomes through better nutritional management.

Market Challenges

- Limited Access to Specialized Nutrition Products:Despite the growing demand, access to specialized clinical nutrition products remains a challenge in Oman. A survey conducted by the Ministry of Health revealed that 35% of healthcare providers report difficulties in sourcing high-quality nutrition products. This limitation is exacerbated by distribution challenges and a lack of local manufacturing capabilities, hindering the availability of essential nutrition solutions.

- High Cost of Clinical Nutrition Solutions:The cost of clinical nutrition products can be prohibitive for many consumers in Oman. Data from the Oman National Center for Statistics and Information indicates that healthcare expenditures have risen by 7% annually, with clinical nutrition solutions often being priced out of reach for lower-income families. This financial barrier limits the market's growth potential and restricts access to necessary nutritional interventions.

Oman Clinical Nutrition Market Future Outlook

The future of the Oman clinical nutrition market appears promising, driven by increasing health consciousness and government support for nutritional initiatives. As the population becomes more aware of the benefits of clinical nutrition, demand for tailored solutions is expected to rise. Additionally, advancements in technology, such as telehealth services, will facilitate better access to nutrition counseling and products, enhancing patient engagement and adherence to dietary recommendations. This evolving landscape presents significant opportunities for growth and innovation in the sector.

Market Opportunities

- Expansion of Telehealth Services:The integration of telehealth services in Oman presents a unique opportunity for the clinical nutrition market. With a reported 20% increase in telehealth consultations, healthcare providers can offer personalized nutrition advice remotely, improving access for patients in rural areas and enhancing overall health outcomes.

- Increasing Demand for Personalized Nutrition:There is a growing trend towards personalized nutrition solutions in Oman, driven by consumer preferences for tailored dietary plans. Market research indicates that 75% of consumers are interested in customized nutrition products, creating opportunities for companies to develop innovative offerings that cater to individual health needs and preferences.