Region:Middle East

Author(s):Rebecca

Product Code:KRAB7217

Pages:92

Published On:October 2025

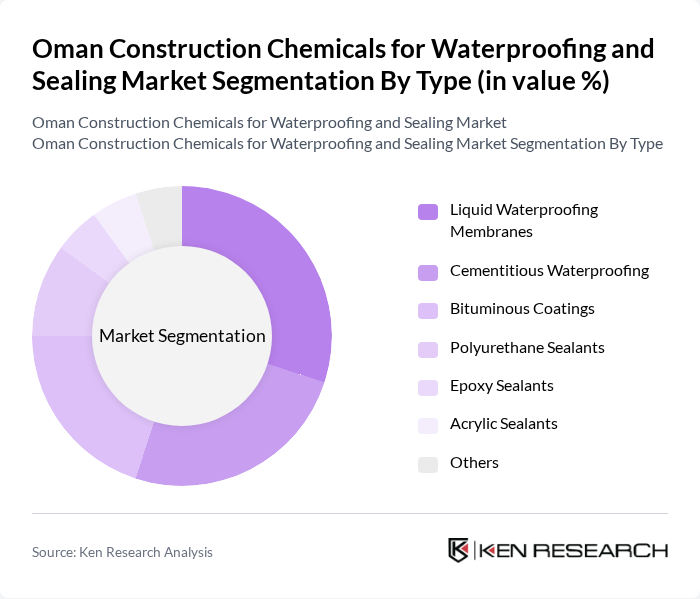

By Type:The market is segmented into various types of waterproofing and sealing solutions, including Liquid Waterproofing Membranes, Cementitious Waterproofing, Bituminous Coatings, Polyurethane Sealants, Epoxy Sealants, Acrylic Sealants, and Others. Each type serves specific applications and customer needs, contributing to the overall market dynamics.

The Liquid Waterproofing Membranes segment is currently dominating the market due to their versatility and effectiveness in various applications, including roofs and basements. These membranes are preferred for their ease of application and ability to provide a seamless barrier against water ingress. The growing trend towards sustainable construction practices has also led to increased adoption of liquid membranes, as they often contain fewer volatile organic compounds (VOCs) compared to traditional options. This shift in consumer preference is further supported by the rising awareness of environmental issues and the need for durable building materials.

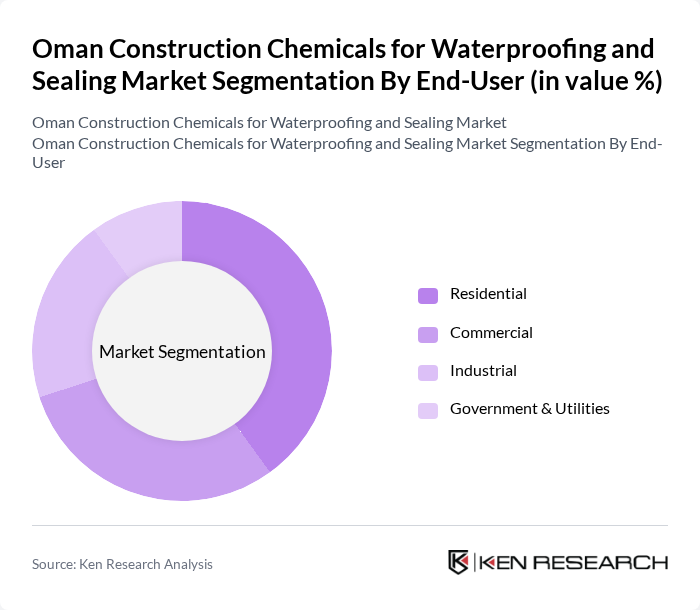

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct requirements and preferences for waterproofing and sealing solutions, influencing market trends and growth.

The Residential segment leads the market, driven by the increasing number of housing projects and the growing awareness of the importance of waterproofing in home construction. Homeowners are increasingly investing in quality waterproofing solutions to protect their properties from water damage, mold, and structural issues. This trend is further supported by government initiatives promoting sustainable housing and the use of certified materials, which enhances the demand for effective waterproofing solutions in residential buildings.

The Oman Construction Chemicals for Waterproofing and Sealing Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, Mapei S.p.A., Fosroc International Limited, Ardex Group, Bostik, Dow Chemical Company, Saint-Gobain, RPM International Inc., Pidilite Industries Limited, Henkel AG & Co. KGaA, GCP Applied Technologies Inc., Tremco Incorporated, Ceresit, Soudal N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman construction chemicals market for waterproofing and sealing appears promising, driven by ongoing infrastructure projects and a shift towards sustainable building practices. As the government continues to invest in housing and commercial developments, the demand for advanced waterproofing solutions is expected to rise. Additionally, the integration of smart technologies and eco-friendly materials will likely shape the market landscape, fostering innovation and enhancing product offerings in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Waterproofing Membranes Cementitious Waterproofing Bituminous Coatings Polyurethane Sealants Epoxy Sealants Acrylic Sealants Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Roof Waterproofing Basement Waterproofing Tunnel Waterproofing Swimming Pool Waterproofing |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low Price Mid Price High Price |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah |

| By Policy Support | Subsidies Tax Exemptions Government Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Supervisors |

| Commercial Building Developments | 80 | Architects, Construction Engineers |

| Infrastructure Projects (Bridges, Roads) | 70 | Government Officials, Civil Engineers |

| Waterproofing Product Suppliers | 60 | Sales Managers, Product Development Heads |

| Sealing Solutions in Industrial Applications | 50 | Procurement Managers, Operations Directors |

The Oman Construction Chemicals for Waterproofing and Sealing Market is valued at approximately USD 150 million, reflecting a five-year historical analysis that highlights growth driven by increased construction activities and the demand for effective waterproofing solutions.