Region:Middle East

Author(s):Rebecca

Product Code:KRAB7033

Pages:85

Published On:October 2025

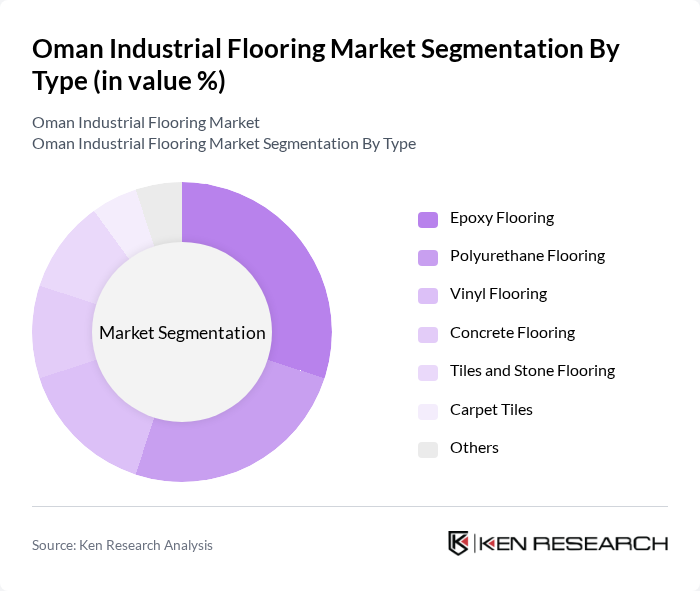

By Type:The market is segmented into various types of flooring solutions, including Epoxy Flooring, Polyurethane Flooring, Vinyl Flooring, Concrete Flooring, Tiles and Stone Flooring, Carpet Tiles, and Others. Each type serves specific applications and industries, catering to diverse consumer needs.

The Epoxy Flooring segment is currently dominating the market due to its superior durability, chemical resistance, and ease of maintenance, making it a preferred choice for industrial applications. The increasing focus on safety and hygiene in manufacturing and warehousing sectors has further propelled the demand for epoxy flooring. Additionally, the aesthetic appeal and customization options available with epoxy solutions are attracting more consumers, solidifying its position as the leading subsegment in the Oman Industrial Flooring Market.

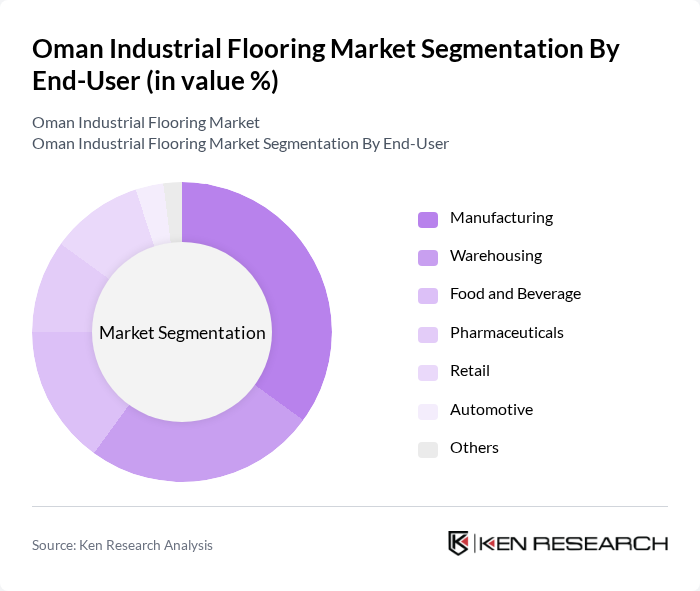

By End-User:The market is segmented based on end-users, including Manufacturing, Warehousing, Food and Beverage, Pharmaceuticals, Retail, Automotive, and Others. Each end-user category has unique flooring requirements driven by operational needs and industry standards.

The Manufacturing sector is the leading end-user in the Oman Industrial Flooring Market, accounting for a significant share. This dominance is attributed to the high demand for durable and resistant flooring solutions that can withstand heavy machinery and foot traffic. Additionally, the increasing number of manufacturing facilities in Oman, driven by government initiatives to diversify the economy, is further boosting the demand for industrial flooring solutions tailored to this sector.

The Oman Industrial Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Flooring Solutions LLC, Oman Flooring Company, Al Jazeera Paints Company, National Flooring Company, Al Huraiz Trading LLC, Al Mufeedh Group, Oman Cement Company SAOG, Al Muna Group, Al Futtaim Engineering, Al Shanfari Group, Al Mufeedh Trading LLC, Al Mufeedh Construction LLC, Al Mufeedh Industrial LLC, Al Mufeedh Flooring LLC, Al Mufeedh Group of Companies contribute to innovation, geographic expansion, and service delivery in this space.

The Oman industrial flooring market is poised for significant growth, driven by increasing investments in infrastructure and a shift towards sustainable practices. As the government continues to prioritize economic diversification, the demand for innovative flooring solutions that meet safety and environmental standards will rise. Additionally, the integration of smart technologies in flooring systems is expected to enhance functionality and efficiency, further propelling market growth. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Flooring Polyurethane Flooring Vinyl Flooring Concrete Flooring Tiles and Stone Flooring Carpet Tiles Others |

| By End-User | Manufacturing Warehousing Food and Beverage Pharmaceuticals Retail Automotive Others |

| By Application | Heavy-Duty Areas Clean Rooms Commercial Spaces Outdoor Areas Decorative Applications Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Material Type | Synthetic Materials Natural Materials Composite Materials Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Facility Flooring | 100 | Facility Managers, Operations Directors |

| Logistics and Warehousing Flooring Solutions | 80 | Warehouse Managers, Supply Chain Coordinators |

| Retail Outlet Flooring Installations | 70 | Store Managers, Retail Operations Heads |

| Architectural Design for Industrial Spaces | 60 | Architects, Interior Designers |

| Flooring Material Suppliers and Distributors | 90 | Sales Managers, Product Line Managers |

The Oman Industrial Flooring Market is valued at approximately USD 150 million, reflecting significant growth driven by the expansion of the construction and manufacturing sectors, as well as increased investments in infrastructure development.