UAE FinTech Lending Platforms Market Overview

- The UAE FinTech Lending Platforms Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for alternative financing solutions, the rise of digital banking, and the growing acceptance of technology in financial services. The market has seen a surge in consumer interest as individuals and businesses seek faster, more accessible lending options.

- Key players in this market are concentrated in major cities such as Dubai and Abu Dhabi, which serve as financial hubs due to their advanced infrastructure, regulatory support, and a high concentration of tech-savvy consumers. The UAE's strategic location and its status as a business-friendly environment further enhance its dominance in the FinTech lending sector.

- In 2023, the UAE government implemented regulations to enhance the transparency and security of digital lending platforms. This includes mandatory licensing for all FinTech companies operating in the lending space, aimed at protecting consumers and ensuring compliance with financial standards, thereby fostering a more trustworthy lending environment.

UAE FinTech Lending Platforms Market Segmentation

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, auto loans, home loans, microloans, and others. Personal loans are particularly popular due to their flexibility and ease of access, catering to a wide range of consumer needs. Business loans are also significant, driven by the growing number of startups and SMEs seeking funding for expansion and operational costs.

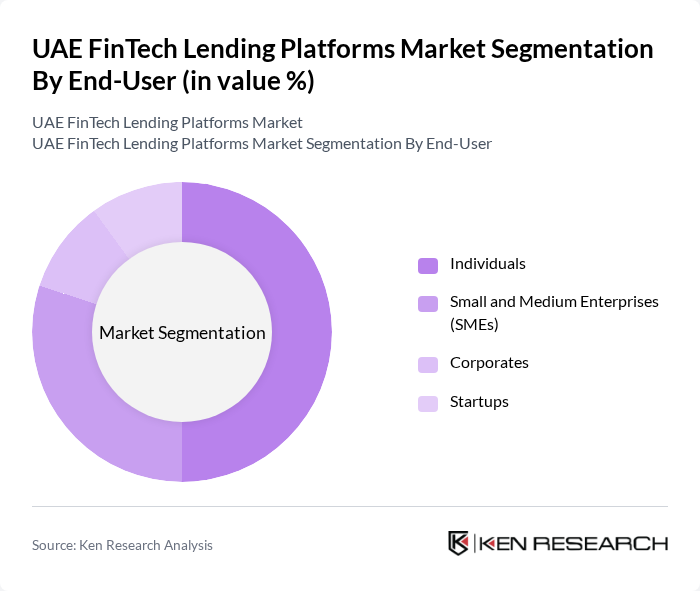

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and startups. Individuals dominate the market as they seek personal loans for various purposes, including education, home improvement, and emergencies. SMEs are also a significant segment, as they require funding for growth and operational expenses, reflecting the entrepreneurial spirit prevalent in the UAE.

UAE FinTech Lending Platforms Market Competitive Landscape

The UAE FinTech Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tabby, Rain, Beehive, Edfa3ly, Liwwa, YAPILI, Fintech Galaxy, PinPay, Zand, RAK Bank, Abu Dhabi Commercial Bank, Emirates NBD, Dubai Islamic Bank, First Abu Dhabi Bank, Sharjah Islamic Bank contribute to innovation, geographic expansion, and service delivery in this space.

UAE FinTech Lending Platforms Market Industry Analysis

Growth Drivers

- Increasing Demand for Alternative Financing:The UAE's alternative financing sector is experiencing significant growth, driven by a 15% increase in small and medium-sized enterprises (SMEs) seeking funding. In future, the total number of SMEs is projected to reach 360,000, highlighting the need for accessible financing options. This demand is further supported by a 25% rise in online lending applications, indicating a shift towards digital solutions for financing needs, as reported by the UAE Ministry of Economy.

- Technological Advancements in Financial Services:The UAE's FinTech landscape is bolstered by a 35% increase in investment in technology-driven financial solutions, amounting to approximately AED 1.8 billion in future. Innovations such as blockchain and AI are enhancing operational efficiencies and customer experiences. The adoption of these technologies is expected to streamline lending processes, reduce costs, and improve risk assessment, making financial services more accessible to a broader audience.

- Supportive Government Regulations:The UAE government has implemented favorable regulations, with over 60 new policies introduced to support FinTech growth. The Central Bank of the UAE has allocated AED 1.2 billion to promote innovation in financial services. These initiatives aim to create a conducive environment for FinTech companies, fostering competition and enhancing consumer protection, which is crucial for building trust in alternative lending platforms.

Market Challenges

- Regulatory Compliance Complexity:Navigating the regulatory landscape poses a significant challenge for FinTech lending platforms, with over 65% of companies citing compliance as a major hurdle. The introduction of stringent regulations, including anti-money laundering (AML) and consumer protection laws, requires substantial investment in compliance infrastructure. This complexity can hinder operational efficiency and increase costs, impacting the overall growth of the sector.

- Consumer Trust Issues:Despite the growth of FinTech lending, consumer trust remains a critical challenge, with 45% of potential borrowers expressing concerns over data security and privacy. A survey by the UAE Financial Services Authority indicated that 60% of consumers prefer traditional banks due to perceived reliability. Building trust through transparency and robust security measures is essential for FinTech platforms to attract and retain customers in this competitive market.

UAE FinTech Lending Platforms Market Future Outlook

The future of the UAE FinTech lending market appears promising, driven by ongoing technological advancements and increasing consumer acceptance of digital financial solutions. As the market matures, platforms are likely to enhance their offerings through innovative products tailored to diverse customer needs. Additionally, the collaboration between FinTech firms and traditional banks is expected to foster a more integrated financial ecosystem, ultimately improving access to credit for underserved populations and driving sustainable growth in the sector.

Market Opportunities

- Expansion into Underserved Segments:There is a significant opportunity for FinTech platforms to target underserved demographics, particularly expatriates and low-income individuals. With approximately 85% of the UAE's population being expatriates, tailored lending solutions can address their unique financial needs, potentially increasing market penetration and customer loyalty.

- Utilization of Big Data for Credit Scoring:Leveraging big data analytics can revolutionize credit scoring processes, allowing platforms to assess creditworthiness more accurately. By analyzing non-traditional data sources, such as social media activity and transaction history, FinTech companies can expand their customer base, reducing the risk of defaults and enhancing profitability in a competitive landscape.