Region:Middle East

Author(s):Rebecca

Product Code:KRAD7352

Pages:84

Published On:December 2025

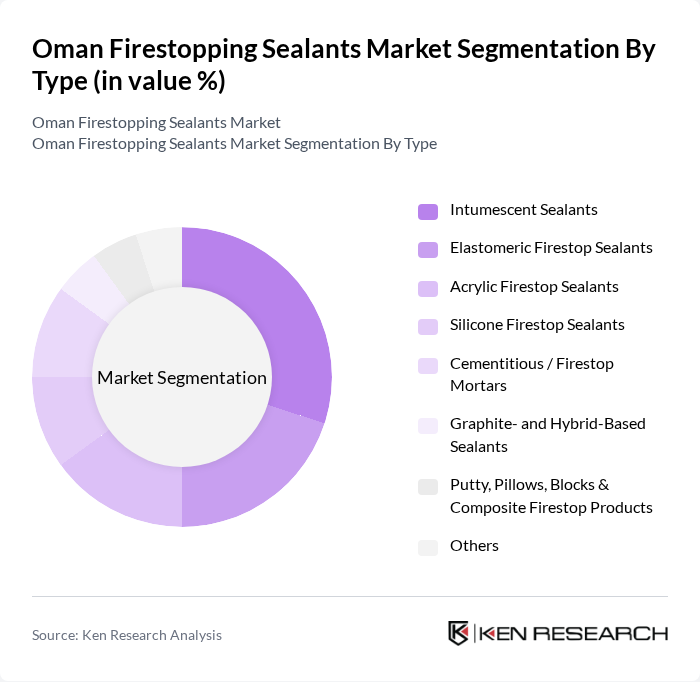

By Type:The firestopping sealants market can be segmented into various types, including Intumescent Sealants, Elastomeric Firestop Sealants, Acrylic Firestop Sealants, Silicone Firestop Sealants, Cementitious / Firestop Mortars, Graphite- and Hybrid-Based Sealants, Putty, Pillows, Blocks & Composite Firestop Products, and Others. Among these, Intumescent Sealants are leading the market due to their superior fire resistance properties, ability to expand and form an insulating char under high temperatures, and increasing adoption in high-rise buildings, commercial complexes, and critical infrastructure where compartmentation is essential. The growing focus on safety regulations, alignment with international building codes, and preference for tested and listed systems has further propelled the demand for these sealants, making them a preferred choice for contractors, consultants, and builders in Oman.

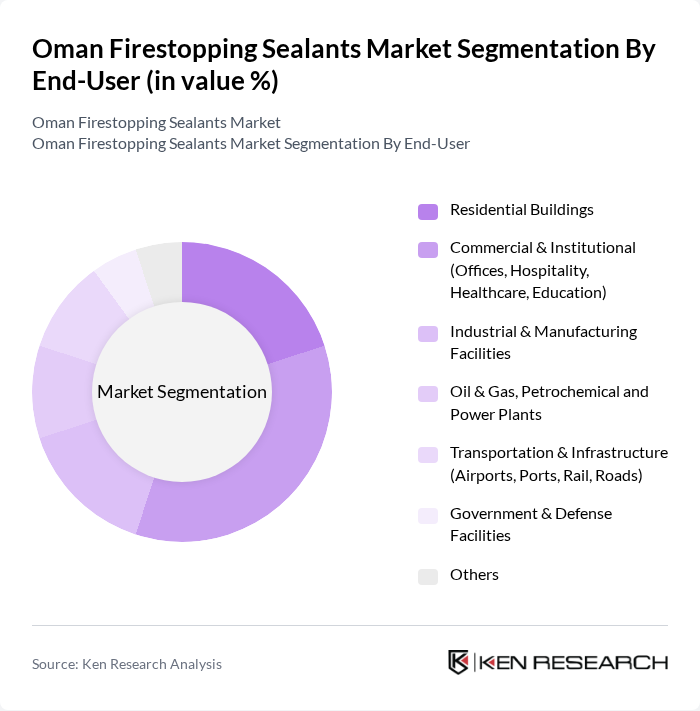

By End-User:The end-user segmentation includes Residential Buildings, Commercial & Institutional (Offices, Hospitality, Healthcare, Education), Industrial & Manufacturing Facilities, Oil & Gas, Petrochemical and Power Plants, Transportation & Infrastructure (Airports, Ports, Rail, Roads), Government & Defense Facilities, and Others. The Commercial & Institutional segment is currently the largest end-user of firestopping sealants, driven by the rapid growth of the construction sector in offices, malls, hotels, hospitals, and educational facilities and the increasing need for fire safety and life-safety compliance in public buildings and commercial spaces. This segment's growth is further supported by government requirements for fire safety systems in new constructions, greater enforcement of inspection and certification by Civil Defence, and the preference of project owners for internationally tested firestop systems to meet insurance and accreditation requirements.

The Oman Firestopping Sealants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hilti Corporation, 3M Company, Sika AG, Tremco CPG Inc., Bostik SA (an Arkema company), Fosroc International Limited, H.B. Fuller Company, Mapei S.p.A., Knauf Group (incl. Knauf Insulation), Promat International (Etex Group), Specified Technologies Inc. (STI Firestop), RectorSeal LLC, Arabian Vermiculite Industries (AVI), NAFFCO (National Fire Fighting Manufacturing FZCO), Unitech Qatar / Unitech for Building and Construction Materials contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman firestopping sealants market appears promising, driven by ongoing construction projects and a commitment to enhancing fire safety standards. As the government continues to enforce stringent regulations, the demand for compliant firestopping solutions is expected to rise. Additionally, the integration of smart building technologies and sustainable practices will likely shape the market landscape, encouraging innovation and the development of eco-friendly products that meet evolving consumer preferences and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Intumescent Sealants Elastomeric Firestop Sealants Acrylic Firestop Sealants Silicone Firestop Sealants Cementitious / Firestop Mortars Graphite- and Hybrid-Based Sealants Putty, Pillows, Blocks & Composite Firestop Products Others |

| By End-User | Residential Buildings Commercial & Institutional (Offices, Hospitality, Healthcare, Education) Industrial & Manufacturing Facilities Oil & Gas, Petrochemical and Power Plants Transportation & Infrastructure (Airports, Ports, Rail, Roads) Government & Defense Facilities Others |

| By Application | Pipe Penetrations (Metal & Plastic) Cable & Conduit Penetrations Curtain Wall & Perimeter Joints Floor & Wall Expansion Joints Electrical & Mechanical Service Openings New Construction Renovation & Retrofitting of Existing Buildings Others |

| By Material / Chemistry | Silicone-Based Sealants Acrylic / Water-Based Sealants Polyurethane & Hybrid Polymer Sealants Cementitious & Gypsum-Based Systems Intumescent-Only Formulations Low-VOC & Halogen-Free Formulations Others |

| By Distribution Channel | Direct Sales to Contractors & EPCs Local Distributors & Building Material Dealers Specialized Fire Protection Integrators Online & E-Procurement Portals Others |

| By Region | Muscat Governorate Dhofar (Salalah) Al Batinah (incl. Sohar) Ad Dakhiliyah (incl. Nizwa) Al Sharqiyah Al Dhahirah & Al Buraimi Others |

| By Policy & Compliance Driver | Alignment with Oman Civil Defence & Fire Safety Codes Green Building & Sustainability Requirements (LEED, Estidama-equivalent) Government Infrastructure Programs (Vision 2040, PPP Projects) Insurance & Risk-Management Driven Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Construction Projects | 45 | Project Managers, Safety Officers |

| Residential Building Developments | 40 | Architects, Contractors |

| Industrial Facility Upgrades | 40 | Facility Managers, Compliance Officers |

| Fire Safety Compliance Audits | 40 | Fire Safety Inspectors, Regulatory Officials |

| Training and Certification Programs | 40 | Training Coordinators, Safety Trainers |

The Oman Firestopping Sealants Market is valued at approximately USD 2 million, reflecting a historical analysis of the market's growth and its share within the broader Middle East firestop sealants market.