Region:Middle East

Author(s):Rebecca

Product Code:KRAD4922

Pages:99

Published On:December 2025

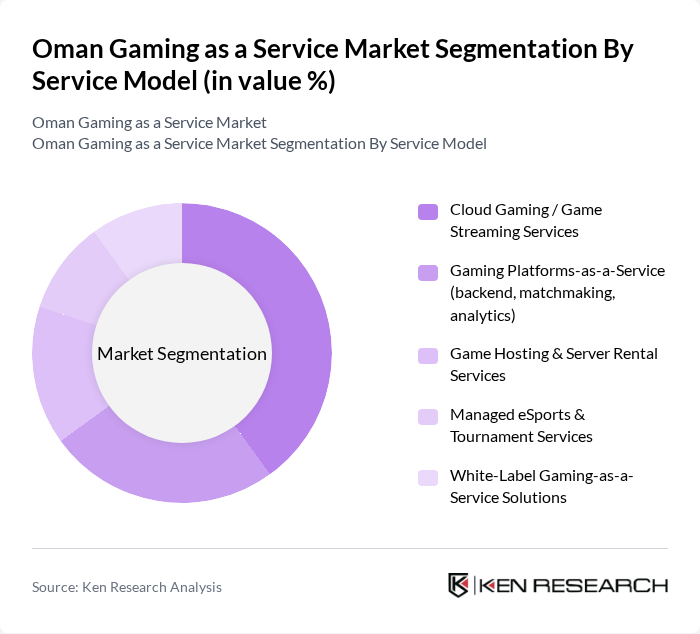

By Service Model:The service model segmentation includes various offerings that cater to different aspects of gaming services. The subsegments are Cloud Gaming / Game Streaming Services, Gaming Platforms-as-a-Service (backend, matchmaking, analytics), Game Hosting & Server Rental Services, Managed eSports & Tournament Services, and White-Label Gaming-as-a-Service Solutions. Among these, Cloud Gaming / Game Streaming Services is currently the leading subsegment, aligned with regional trends where cloud and streaming platforms are among the fastest-growing parts of the gaming value chain, supported by 5G rollouts and GPU deployments. The convenience of accessing games without the need for high-end hardware, combined with increased broadband speeds and device-agnostic access, has made this model particularly appealing to consumers and telecom operators bundling gaming with data plans.

By Platform:This segmentation focuses on the various platforms through which gaming services are delivered. The subsegments include Mobile (Android / iOS), PC & Laptop, Console, Smart TV & Set-Top Box, and Web / Browser-Based. Mobile gaming is the dominant platform, consistent with the Oman video game market where mobile gaming accounts for over half of the market share, supported by widespread smartphone penetration, affordable data, and strong 4G/5G coverage. The convenience of gaming on-the-go, availability of free-to-play and in-app purchase models, and the increasing number of mobile gamers have solidified its position as the leading platform in the market.

The Oman Gaming as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel (Oman Telecommunications Company S.A.O.G.), Ooredoo Oman (Omani Qatari Telecommunications Company), Atyaf Home Entertainment LLC, Akamai Technologies Inc., Amazon Web Services (AWS) Middle East, Microsoft Azure Middle East & Africa, NVIDIA GeForce NOW, Blacknut Cloud Gaming, Tencent Cloud International, Google Cloud (including Google Play Games services), Meta Platforms Inc. (gaming & cloud infrastructure services), Unity Technologies (cloud gaming backend & live services), Epic Games Inc. (Epic Online Services / backend platform), PlayStation Network (Sony Interactive Entertainment), Xbox Cloud Gaming (Microsoft) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman gaming market appears promising, driven by technological advancements and increasing consumer interest. As cloud gaming services gain traction, more players are expected to enter the market, enhancing competition and innovation. Additionally, the integration of augmented reality (AR) technologies is likely to create immersive gaming experiences, attracting a diverse audience. With ongoing government support and infrastructure improvements, the market is poised for significant growth, fostering a vibrant gaming ecosystem in Oman.

| Segment | Sub-Segments |

|---|---|

| By Service Model | Cloud Gaming / Game Streaming Services Gaming Platforms-as-a-Service (backend, matchmaking, analytics) Game Hosting & Server Rental Services Managed eSports & Tournament Services White-Label Gaming-as-a-Service Solutions |

| By Platform | Mobile (Android / iOS) PC & Laptop Console Smart TV & Set-Top Box Web / Browser-Based |

| By Revenue Model | Subscription (SVoD / Game Pass models) Free-to-Play with In-Game Purchases Pay-per-Use / Session-Based Access Advertising-Supported Hybrid Models |

| By End-User Segment | Individual Gamers Game Publishers & Developers Telecom Operators & ISPs Enterprises (corporate engagement & training) Educational & Training Institutions |

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud On-Premise Managed Services Edge / Local Data Center Deployment |

| By Content Type / Genre | Action & Adventure Role-Playing Games (RPG) Sports & Racing Strategy & Simulation Casual, Puzzle & Hyper-Casual |

| By Distribution & Access Channel | Telecom Bundled Offers App Stores & Digital Marketplaces Direct-to-Consumer Platforms OEM / Device Manufacturer Partnerships Third-Party Aggregators & Portals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 150 | Casual Gamers, Mobile App Developers |

| Console Gaming Enthusiasts | 100 | Console Gamers, Retail Managers |

| PC Gaming Community | 90 | PC Gamers, eSports Organizers |

| Game Development Studios | 60 | Game Designers, Product Managers |

| Online Gaming Service Providers | 70 | Service Managers, Marketing Directors |

The Oman Gaming as a Service Market is valued at approximately USD 15 million, reflecting a growing interest in digital gaming driven by high smartphone penetration, expanding 5G infrastructure, and a young, digitally engaged population.