Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7203

Pages:88

Published On:December 2025

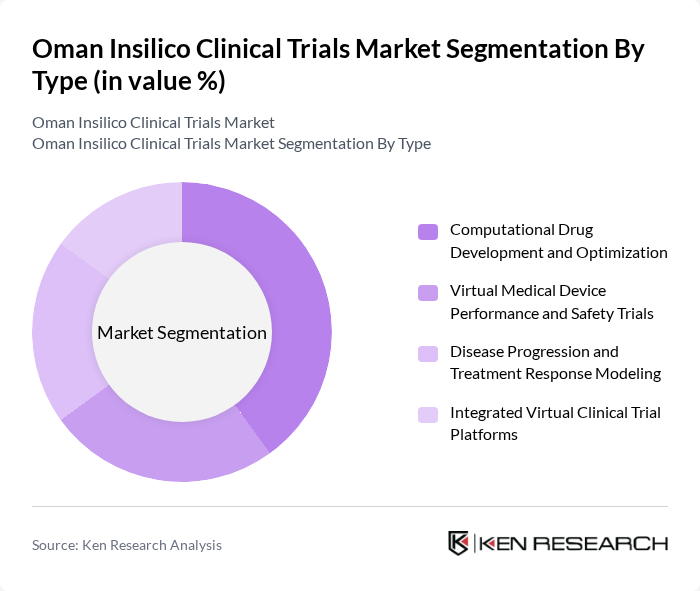

By Type:The market is segmented into various types, including Computational Drug Development and Optimization, Virtual Medical Device Performance and Safety Trials, Disease Progression and Treatment Response Modeling, and Integrated Virtual Clinical Trial Platforms. These segments are consistent with global in silico practice, where computational modeling and simulation software, PK/PD and QSP models, and AI/ML-driven analytics are widely used to support drug and device development. Each of these sub-segments plays a crucial role in enhancing the efficiency and effectiveness of clinical trials by enabling virtual cohort generation, scenario testing, and reduction of laboratory and animal experiments.

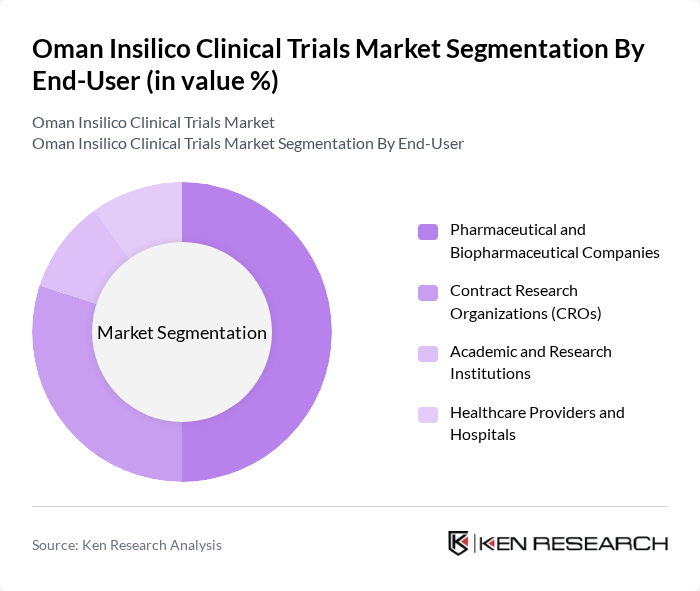

By End-User:The end-user segmentation includes Pharmaceutical and Biopharmaceutical Companies, Contract Research Organizations (CROs), Academic and Research Institutions, and Healthcare Providers and Hospitals. This structure mirrors global demand patterns, where pharmaceutical sponsors and biopharma companies are the leading users of in silico trials, followed by CROs and academic centers that provide modeling and simulation expertise and conduct investigator-initiated computational studies. Each of these segments contributes uniquely to the insilico clinical trials landscape in Oman, with hospitals and universities increasingly engaging in digital health, real-world data analytics, and simulation-supported protocol optimization.

The Oman Insilico Clinical Trials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dassault Systèmes SE (BIOVIA, SIMULIA), Certara Inc., InSilicoTrials Technologies S.p.A., Novadiscovery SAS, GNS Healthcare Inc., The AnyLogic Company, Immunetrics Inc., Insilico Medicine, Evotec SE, Exscientia plc, Oracle Health Sciences, IQVIA Inc., ICON plc, Parexel International, Oman Medical Specialty Board / Sultan Qaboos University Hospital (Key Local Research Stakeholders) contribute to innovation, geographic expansion, and service delivery in this space, in line with their recognized roles as key vendors in the global in silico clinical trials and modeling and simulation markets.

The future of the insilico clinical trials market in Oman appears promising, driven by technological advancements and a growing emphasis on personalized medicine. As the healthcare infrastructure expands, the integration of digital health technologies will likely enhance trial efficiency and patient engagement. Furthermore, increased collaboration between pharmaceutical companies and academic institutions is expected to foster innovation, leading to more robust trial designs and improved patient outcomes. This collaborative environment will be crucial for overcoming existing challenges and maximizing the potential of insilico trials.

| Segment | Sub-Segments |

|---|---|

| By Type | Computational Drug Development and Optimization Virtual Medical Device Performance and Safety Trials Disease Progression and Treatment Response Modeling Integrated Virtual Clinical Trial Platforms |

| By End-User | Pharmaceutical and Biopharmaceutical Companies Contract Research Organizations (CROs) Academic and Research Institutions Healthcare Providers and Hospitals |

| By Therapeutic Area | Oncology Cardiovascular and Metabolic Disorders Respiratory and Infectious Diseases Neurology and Rare Diseases |

| By Study Design | Model-Informed Drug Development (MIDD) Studies Dose-Response and Dose-Optimization Simulations Virtual Population and Cohort Simulation Studies Regulatory-Focused Validation Studies |

| By Data Source | Clinical Trial and Electronic Health Record (EHR) Data Real-World Evidence and Claims Data Genomic, Multi-omics and Biomarker Data Imaging, Physiological and Sensor Data |

| By Region | Muscat Salalah Sohar Other Governorates (Nizwa, Sur, Duqm, etc.) |

| By Funding Source | Government Grants and National Programs Private and Venture Capital Investments Public-Private and Academic-Industry Partnerships Internal R&D and Institutional Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Companies | 60 | Clinical Research Directors, Regulatory Affairs Managers |

| Biotechnology Firms | 50 | Product Development Managers, Data Scientists |

| Healthcare Institutions | 40 | Clinical Trial Coordinators, Medical Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Academic Research Centers | 40 | Research Scientists, Professors in Clinical Research |

The Oman Insilico Clinical Trials Market is valued at approximately USD 4 million, reflecting a five-year historical analysis and alignment with both the national and global clinical trials markets.