Region:Middle East

Author(s):Rebecca

Product Code:KRAD5064

Pages:83

Published On:December 2025

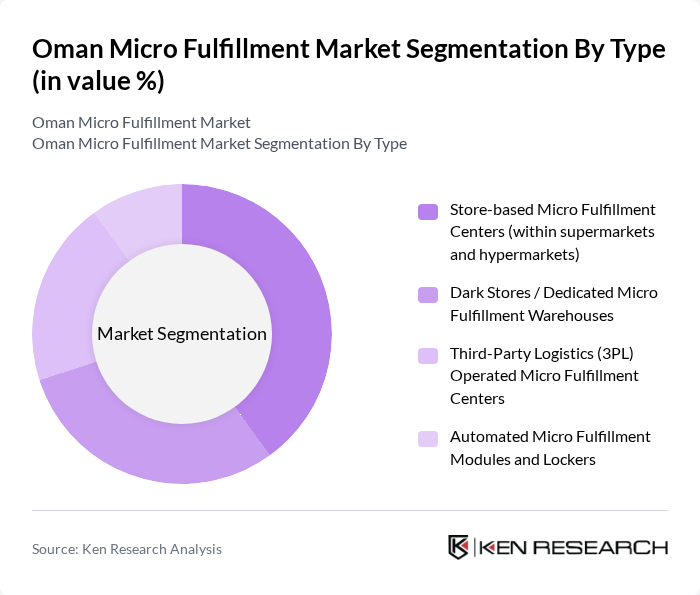

By Type:The market is segmented into various types of micro fulfillment centers, including store-based micro fulfillment centers, dark stores, third-party logistics operated centers, and automated modules. Store-based micro fulfillment centers typically operate within or adjacent to supermarkets and hypermarkets, enabling efficient in-store picking or automated picking for online grocery and click-and-collect orders. Dark stores and dedicated micro fulfillment warehouses are optimized for high?throughput online order processing without in?store shoppers, supporting both grocery and general merchandise. Third?party logistics operated centers provide shared, multi-client facilities and technology platforms that allow retailers and brands to outsource e-commerce fulfillment and last?mile preparation. Automated micro fulfillment modules and lockers, often using shuttle, cube storage, or autonomous mobile robot technologies, support rapid picking, consolidation, and contactless pickup in urban locations and transportation hubs.

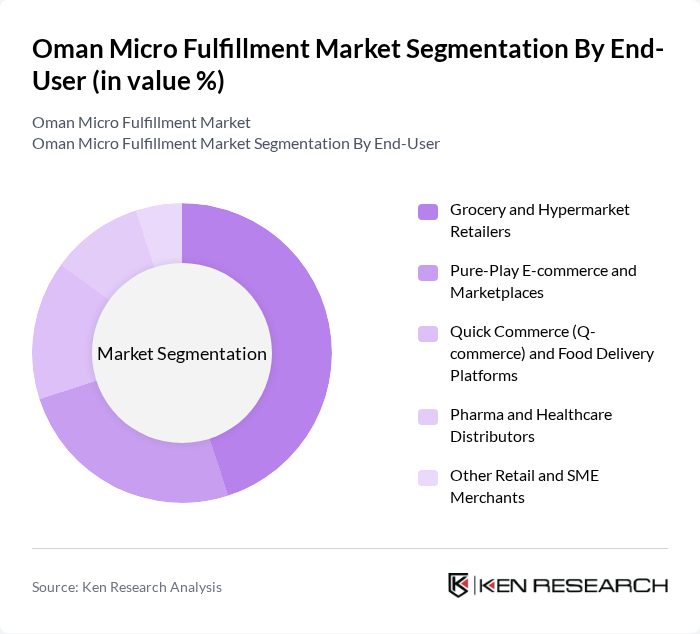

By End-User:The end-user segmentation includes grocery and hypermarket retailers, pure-play e-commerce platforms, quick commerce services, pharma distributors, and other retail merchants. Grocery and hypermarket retailers are leading the segment due to the strong shift of consumers toward online grocery and omni-channel shopping, with micro fulfillment used to support click-and-collect, curbside pickup, and home delivery of fresh produce and daily essentials. Pure-play e-commerce and marketplaces rely on micro fulfillment centers and localized warehouses to shorten delivery lead times and improve last?mile efficiency, while quick commerce and food delivery platforms leverage dark stores and small warehouses to enable sub?hour deliveries in dense urban catchments. Pharma and healthcare distributors increasingly explore temperature?controlled micro fulfillment and proximity stocking for prescription medicines and over-the-counter products, and other retail and SME merchants benefit from shared or 3PL-operated micro fulfillment capacity that reduces their capital expenditure and speeds up digital channel enablement.

The Oman Micro Fulfillment Market is characterized by a dynamic mix of regional and international players. Leading participants such as LuLu Hypermarket Oman, Carrefour Oman (Majid Al Futtaim Retail), Talabat Oman, Asyad Group (Integrated Logistics and Warehousing), Oman Post & Logistics Services, Khimji Ramdas Logistics, Fetchr Oman, Al Nowras Logistics, Oman Air Cargo, Al Madina Logistics Services Company, Aramex Oman, DHL Express Oman, FedEx Express Oman, J&T Express Oman, Akeed (Local Food and Grocery Delivery Platform) contribute to innovation, geographic expansion, and service delivery in this space, leveraging Oman’s growing logistics and warehousing base and the expansion of e-commerce fulfillment across the Middle East.

The future of the Oman micro fulfillment market appears promising, driven by ongoing technological advancements and a shift in consumer preferences towards faster delivery options. As e-commerce continues to expand, businesses are likely to invest in innovative logistics solutions to enhance efficiency. Furthermore, the government's focus on improving infrastructure and regulatory frameworks will support the growth of micro fulfillment centers, enabling companies to meet the rising demand for quick and reliable delivery services across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Store-based Micro Fulfillment Centers (within supermarkets and hypermarkets) Dark Stores / Dedicated Micro Fulfillment Warehouses Third-Party Logistics (3PL) Operated Micro Fulfillment Centers Automated Micro Fulfillment Modules and Lockers |

| By End-User | Grocery and Hypermarket Retailers Pure-Play E-commerce and Marketplaces Quick Commerce (Q-commerce) and Food Delivery Platforms Pharma and Healthcare Distributors Other Retail and SME Merchants |

| By Delivery Method | Same-day and Instant Delivery (within 2–4 hours) Next-day Delivery Click & Collect / Curbside Pickup Scheduled Time-slot Delivery |

| By Technology Used | Automated Storage and Retrieval Systems (AS/RS) and Shuttle Systems Robotics, Goods-to-Person and Conveyor Systems Warehouse Management Systems (WMS) and Order Management Systems (OMS) IoT, RFID and Real-time Tracking Solutions |

| By Geographic Coverage | Muscat Governorate Al Batinah (North and South) Dhofar (Salalah and surrounding areas) Interior and Other Governorates |

| By Service Type | First-party (Retailer-owned) Fulfillment Third-party Logistics (3PL) and Fulfillment-as-a-Service Last-mile Delivery and Pick-up Point Services Value-added Services (kitting, returns handling, cold-chain, etc.) |

| By Payment Method | Card and Online Payments Cash on Delivery Mobile Wallets and Fintech Apps Corporate and B2B Billing Arrangements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Micro Fulfillment Strategies | 120 | Logistics Managers, Retail Operations Directors |

| E-commerce Fulfillment Optimization | 90 | eCommerce Managers, Supply Chain Analysts |

| Technology Adoption in Fulfillment | 80 | IT Managers, Technology Solution Providers |

| Consumer Behavior in Online Shopping | 100 | Market Researchers, Consumer Insights Analysts |

| Logistics Cost Management | 70 | Financial Analysts, Procurement Managers |

The Oman Micro Fulfillment Market is valued at approximately USD 140 million, reflecting a significant growth trajectory aligned with the broader logistics and warehousing market in Oman, which is around USD 1.0 billion.