Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5946

Pages:81

Published On:December 2025

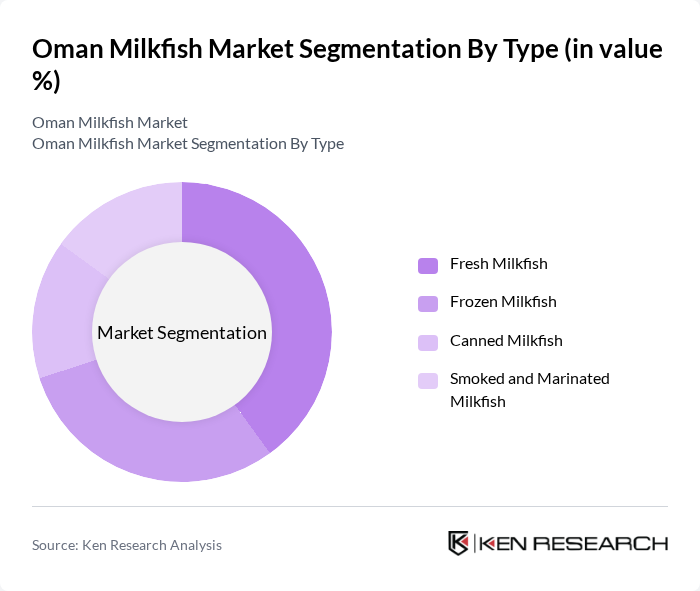

By Type:The market is segmented into various types of milkfish products, including Fresh Milkfish, Frozen Milkfish, Canned Milkfish, and Smoked and Marinated Milkfish. Each type caters to different consumer preferences and market demands, with fresh and frozen products being the most popular due to their convenience and availability.

The Fresh Milkfish segment leads the market due to its high demand among consumers who prefer fresh seafood for its taste and nutritional value. The growing trend of healthy eating and the popularity of local cuisine have further boosted the consumption of fresh milkfish. Frozen Milkfish follows closely, appealing to consumers seeking convenience and longer shelf life. Canned and smoked products cater to niche markets, often favored for their unique flavors and ease of preparation.

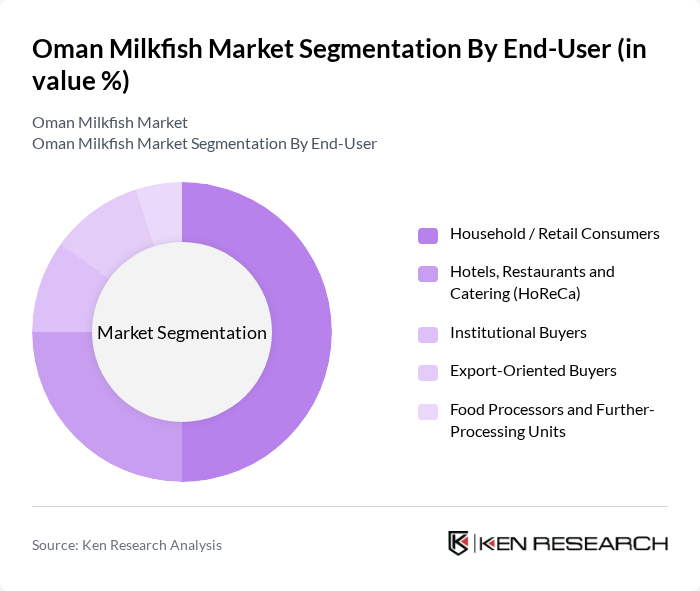

By End-User:The market is segmented by end-users, including Household/Retail Consumers, Hotels, Restaurants and Catering (HoReCa), Institutional Buyers, Export-Oriented Buyers, and Food Processors and Further-Processing Units. Each segment has distinct purchasing behaviors and requirements, influencing the overall market dynamics.

The Household/Retail Consumers segment dominates the market, driven by the increasing trend of home cooking and the preference for fresh seafood. The HoReCa segment is also significant, as restaurants and catering services seek high-quality milkfish to meet consumer demand. Institutional buyers and export-oriented buyers represent smaller but important segments, focusing on bulk purchases and international trade, respectively.

The Oman Milkfish Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Fisheries Co. SAOG, Fisheries Development Oman (FDO), Blue Waters LLC, Oceanic Shrimp Aquaculture LLC, Muscat Livestock & Fisheries Co., Al Wusta Fisheries Industries LLC, Al Bahja Group (Food & Fisheries Division), Al Namaa Poultry & Fisheries Co., Salalah Macroo Fisheries LLC, Gulf International Fisheries Co. LLC, Al Marsa Fisheries LLC, Oman Sea Food Co. LLC, Suhar Fisheries & Marine Products LLC, Duqm Fish Processing & Packaging LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman milkfish market is poised for growth, driven by increasing consumer demand and a focus on sustainable practices. As health consciousness rises, the market is likely to see a shift towards organic and traceable seafood products. Additionally, advancements in aquaculture technology will enhance production efficiency. The government’s commitment to supporting the fishing industry through regulatory reforms and investment in infrastructure will further bolster market potential, ensuring a competitive landscape for milkfish producers.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Milkfish Frozen Milkfish Canned Milkfish Smoked and Marinated Milkfish |

| By End-User | Household / Retail Consumers Hotels, Restaurants and Catering (HoReCa) Institutional Buyers (canteens, hospitals, camps) Export-Oriented Buyers Food Processors and Further-Processing Units |

| By Distribution Channel | Traditional Fish Markets Supermarkets and Hypermarkets Fish Retail Shops Online and App-Based Platforms HoReCa and Institutional Direct Sales |

| By Region | Muscat Governorate Dhofar Governorate Al Batinah North & South Al Sharqiyah North & South Other Governorates (Al Dakhiliyah, Al Dhahirah, Al Wusta, Musandam) |

| By Product Form | Whole (Gutted/Head-on) Steaks and Portions Fillets (skin-on / skinless) Value-Added Products (breaded, ready-to-cook, ready-to-eat) |

| By Packaging Type | Retail Packs (poly bags, trays) Bulk / Foodservice Packs IQF and Carton Packaging Vacuum and MAP Packaging |

| By Price Range | Premium Imported / Specialty Grade Standard Domestic Farmed Grade Economy / Mass-Market Grade Discount and Promotional Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Local Fish Farmers | 90 | Aquaculture Managers, Farm Owners |

| Seafood Distributors | 60 | Distribution Managers, Supply Chain Coordinators |

| Retail Seafood Outlets | 50 | Store Managers, Seafood Buyers |

| Government Fisheries Officials | 40 | Policy Makers, Regulatory Officers |

| Consumers of Seafood | 120 | Household Decision Makers, Health-Conscious Consumers |

The Oman Milkfish Market is valued at approximately USD 140 million, reflecting a significant growth driven by increasing consumer demand for seafood, particularly in coastal regions, and the rising popularity of milkfish for its nutritional benefits and culinary versatility.