Region:Middle East

Author(s):Dev

Product Code:KRAA7035

Pages:92

Published On:January 2026

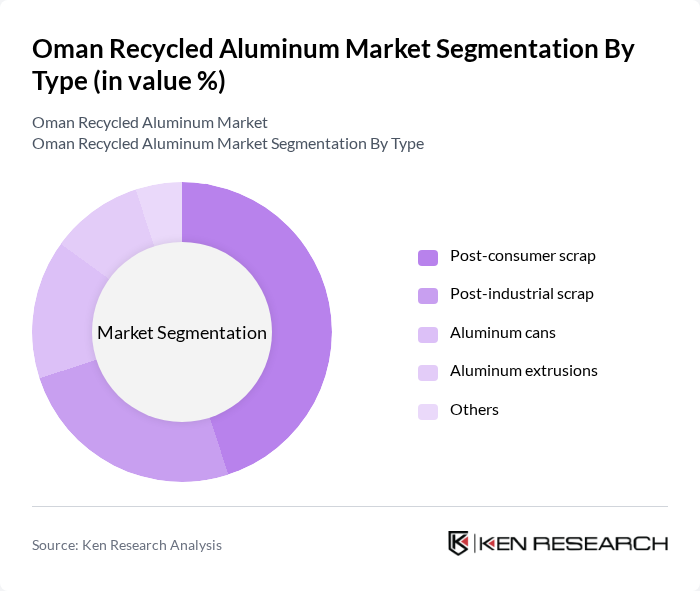

By Type:The market is segmented into various types of recycled aluminum, including post-consumer scrap, post-industrial scrap, aluminum cans, aluminum extrusions, and others. Among these, post-consumer scrap is the leading sub-segment, driven by increasing consumer awareness regarding recycling and sustainability. The demand for aluminum cans has also surged due to the growing beverage industry, which emphasizes the use of recycled materials to reduce environmental impact.

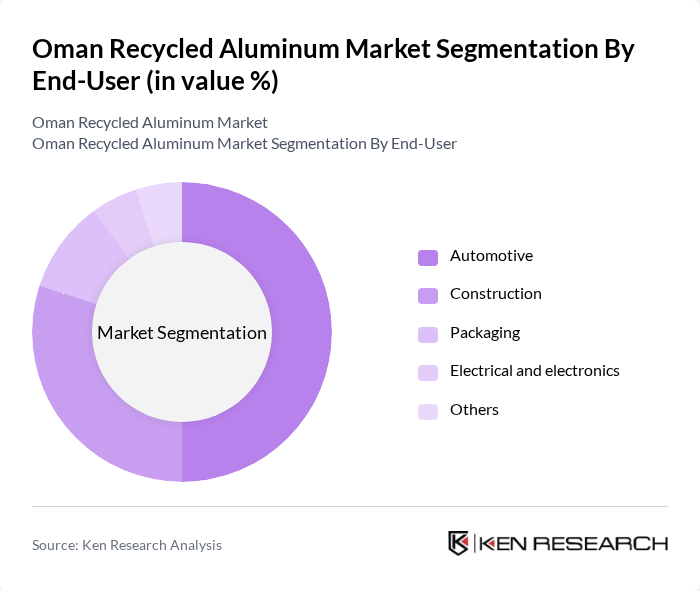

By End-User:The end-user segmentation includes automotive, construction, packaging, electrical and electronics, and others. The automotive sector is the dominant end-user, as manufacturers increasingly utilize recycled aluminum to enhance vehicle efficiency and reduce weight. The construction industry also shows significant demand due to the material's durability and lightweight properties, making it ideal for various applications.

The Oman Recycled Aluminum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Aluminum Rolling Company, Gulf Aluminum Rolling Mill Company, Alcoa Corporation, Emirates Global Aluminium, Oman Recycled Aluminum Company, Al-Bahar Aluminum, National Aluminum Products Company, Sohar Aluminium, Gulf Extrusions, Al-Futtaim Engineering, Al-Muheet Group, Al-Hosn Investment, Oman Cables Industry, Oman National Engineering and Investment Company, Muscat Aluminum contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman recycled aluminum market appears promising, driven by increasing government support and rising consumer demand for sustainable products. As the country enhances its recycling infrastructure and promotes eco-friendly practices, the market is expected to witness significant growth. Technological advancements in recycling processes will further improve efficiency and reduce costs, making recycled aluminum more competitive against virgin materials. Overall, the market is poised for expansion, aligning with global sustainability trends and local economic goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Post-consumer scrap Post-industrial scrap Aluminum cans Aluminum extrusions Others |

| By End-User | Automotive Construction Packaging Electrical and electronics Others |

| By Application | Building materials Transportation Consumer goods Industrial products Others |

| By Source of Scrap | Municipal waste Industrial waste Curbside collection Drop-off centers Others |

| By Processing Method | Mechanical recycling Pyrometallurgical recycling Hydrometallurgical recycling Others |

| By Quality of Recycled Aluminum | High-quality recycled aluminum Low-quality recycled aluminum Others |

| By Market Channel | Direct sales Distributors Online platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aluminum Recycling Facilities | 45 | Facility Managers, Operations Directors |

| Manufacturers Using Recycled Aluminum | 40 | Procurement Managers, Production Supervisors |

| Government Regulatory Bodies | 25 | Policy Makers, Environmental Officers |

| Industry Associations and NGOs | 20 | Research Analysts, Sustainability Coordinators |

| Consumers of Recycled Products | 30 | End-users, Retail Buyers |

The Oman Recycled Aluminum Market is valued at approximately USD 1.15 billion, reflecting a significant growth trend driven by increasing environmental awareness and government initiatives promoting recycling practices.