Philippines Recycled Aluminum Market Overview

- The Philippines Recycled Aluminum Market is valued at USD 550 million, based on a five-year historical analysis. This growth is primarily driven by increasing environmental awareness, government initiatives promoting recycling, rising demand for sustainable materials in construction and automotive industries, and the energy efficiency of recycling processes that require up to 95% less energy than primary production. The market has seen a significant uptick in the collection and processing of aluminum scrap, which is essential for reducing waste and conserving energy in production.

- Metro Manila, Cebu, and Davao are the dominant regions in the Philippines Recycled Aluminum Market. Metro Manila, being the capital, has a higher concentration of industries and consumers, leading to increased scrap generation. Cebu and Davao are also emerging as key players due to their growing industrial bases and initiatives to enhance recycling capabilities, making them vital contributors to the market.

- The Ecological Solid Waste Management Act of 2000 (Republic Act No. 9003), issued by the Philippine Congress, mandates source separation of waste, prohibits waste dumping, and requires local government units to establish material recovery facilities with recycling targets of at least 25% of solid waste. This regulation establishes compliance requirements for waste management hierarchies prioritizing recycling and sets standards for sanitary landfills and processing facilities, directly supporting the recycled aluminum sector through enhanced scrap collection and processing infrastructure.

Philippines Recycled Aluminum Market Segmentation

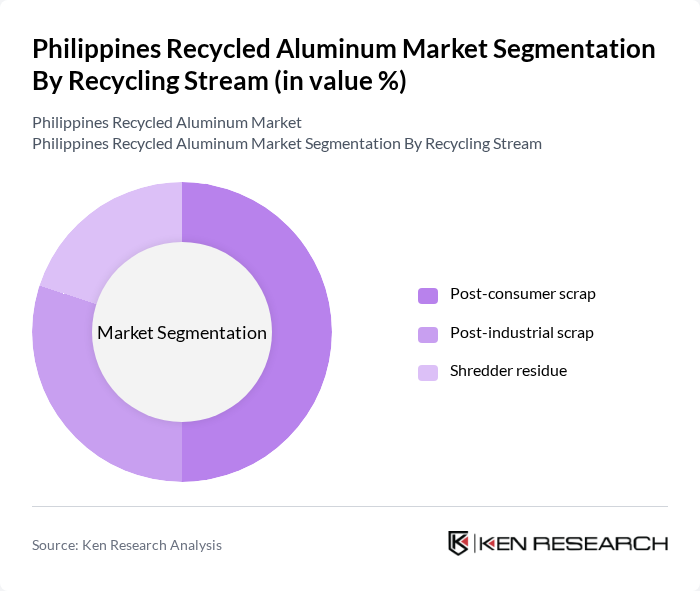

By Recycling Stream:The recycling stream segment includes various sources of aluminum scrap that are processed for reuse. The subsegments are Post-consumer scrap, Post-industrial scrap, and Shredder residue. Post-consumer scrap is derived from end-of-life products, while post-industrial scrap comes from manufacturing processes. Shredder residue consists of materials left after shredding aluminum products.

The Post-consumer scrap subsegment is currently dominating the market due to the increasing consumer awareness regarding recycling and sustainability. As more consumers opt for products made from recycled materials, the demand for post-consumer scrap has surged. This trend is further supported by government regulations encouraging recycling practices. The growth in urbanization and industrial activities has also contributed to a higher volume of post-consumer scrap being collected and processed, making it a key driver in the recycled aluminum market.

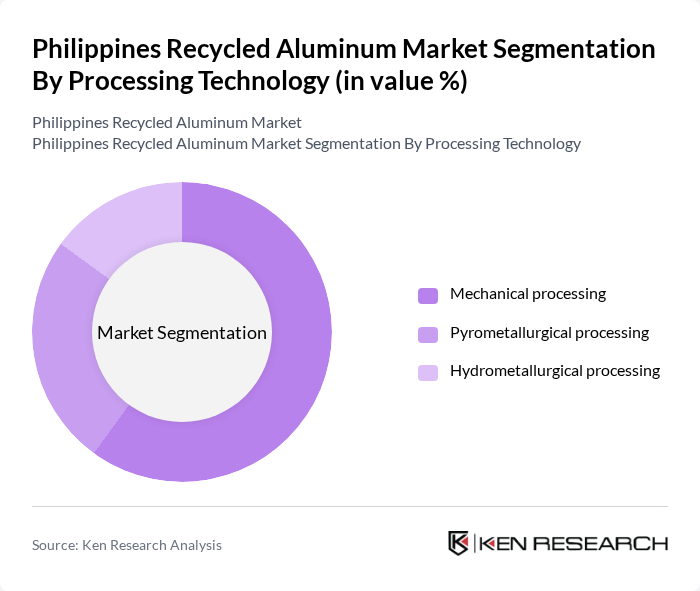

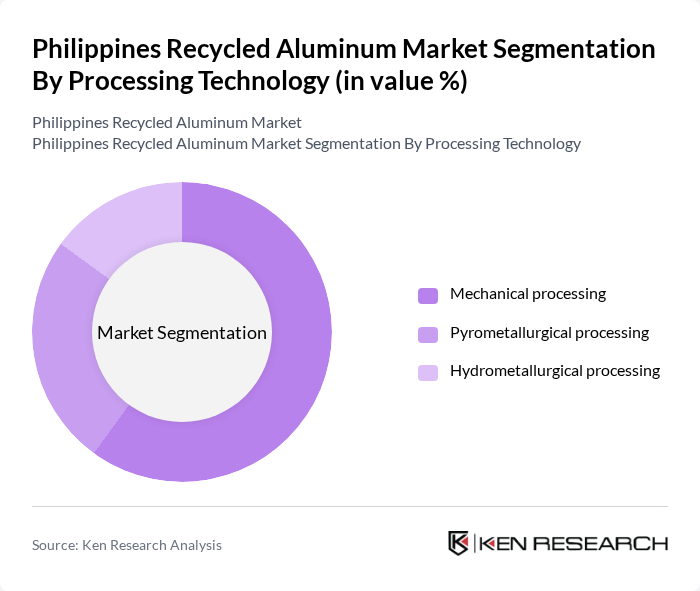

By Processing Technology:This segment focuses on the methods used to process recycled aluminum. The subsegments include Mechanical processing, Pyrometallurgical processing, and Hydrometallurgical processing. Mechanical processing involves physical methods to separate aluminum from other materials, while pyrometallurgical processing uses high temperatures to extract aluminum. Hydrometallurgical processing employs chemical methods to recover aluminum from scrap.

Mechanical processing is the leading method in the market due to its cost-effectiveness and efficiency in handling large volumes of scrap. This method allows for the quick separation of aluminum from other materials, making it a preferred choice among recyclers. The increasing focus on reducing operational costs and maximizing output has led to a rise in the adoption of mechanical processing technologies. Additionally, advancements in machinery and techniques have further enhanced the efficiency of this processing method, solidifying its position in the market.

Philippines Recycled Aluminum Market Competitive Landscape

The Philippines Recycled Aluminum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Aluminum Industry Association, Alco Industries, Metallica Resources, A. Brown Company, Philippine Recycled Metals Corporation, Aboitiz Group, San Miguel Corporation, Universal Robina Corporation, JG Summit Holdings, First Philippine Holdings, Republic Cement, DMCI Holdings, Manila Mining Corporation, Philex Mining Corporation, Nickel Asia Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Recycled Aluminum Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Materials:The Philippines is witnessing a significant shift towards sustainable materials, with the recycled aluminum sector projected to benefit immensely. In future, the demand for recycled aluminum is expected to reach approximately 220,000 metric tons, driven by industries such as automotive and construction, which are increasingly prioritizing eco-friendly materials. This trend aligns with global sustainability goals, as companies aim to reduce their carbon footprints and enhance their corporate social responsibility initiatives.

- Government Initiatives Promoting Recycling:The Philippine government has implemented various initiatives to promote recycling, including the National Solid Waste Management Act, which mandates local government units to establish recycling programs. In future, the government is expected to allocate around PHP 1.2 billion (approximately USD 21 million) to support recycling infrastructure and public awareness campaigns. These initiatives are crucial in enhancing the recycling rate, which currently stands at only 25%, thereby fostering a more sustainable aluminum market.

- Rising Costs of Primary Aluminum:The cost of primary aluminum has been on the rise, with prices reaching USD 2,800 per metric ton in early future. This increase is primarily due to supply chain disruptions and geopolitical tensions affecting global aluminum production. As a result, manufacturers in the Philippines are increasingly turning to recycled aluminum, which is more cost-effective and environmentally friendly. This shift is expected to drive the recycled aluminum market, as companies seek to mitigate rising material costs while adhering to sustainability practices.

Market Challenges

- Limited Recycling Infrastructure:The Philippines faces significant challenges due to its limited recycling infrastructure, which hampers the efficiency of aluminum recycling processes. Currently, only 35% of aluminum waste is collected for recycling, with many regions lacking adequate facilities. In future, it is estimated that the country will require an investment of approximately PHP 2.5 billion (around USD 45 million) to enhance its recycling capabilities. This lack of infrastructure poses a barrier to maximizing the potential of the recycled aluminum market.

- Fluctuating Market Prices:The recycled aluminum market in the Philippines is susceptible to price fluctuations, which can deter investment and disrupt supply chains. In future, the price of recycled aluminum is projected to vary between USD 2,000 and USD 2,500 per metric ton, influenced by global market trends and local demand. Such volatility creates uncertainty for manufacturers and recyclers, making it challenging to establish stable pricing models and long-term contracts, ultimately affecting market growth.

Philippines Recycled Aluminum Market Future Outlook

The future of the Philippines recycled aluminum market appears promising, driven by increasing consumer awareness and government support for sustainable practices. As the country moves towards a circular economy, investments in recycling technologies and infrastructure are expected to rise significantly. By future, the market could see a 60% increase in recycling rates, bolstered by public-private partnerships. Additionally, the growing demand for eco-friendly packaging solutions will further enhance the market's potential, positioning the Philippines as a key player in the Southeast Asian recycled aluminum landscape.

Market Opportunities

- Expansion of Recycling Facilities:There is a significant opportunity for expanding recycling facilities across the Philippines. With an estimated investment of PHP 1.8 billion (approximately USD 32 million) needed, new facilities can enhance collection and processing capabilities. This expansion will not only increase recycling rates but also create job opportunities, contributing to local economies and promoting sustainable practices.

- Partnerships with Local Governments:Collaborating with local governments presents a valuable opportunity for the recycled aluminum market. By forming partnerships, companies can leverage government resources and support to improve recycling initiatives. In future, local governments are expected to allocate around PHP 600 million (approximately USD 11 million) for recycling programs, which can be utilized to enhance community engagement and awareness, ultimately boosting recycling rates.