Region:Asia

Author(s):Dev

Product Code:KRAA7044

Pages:83

Published On:January 2026

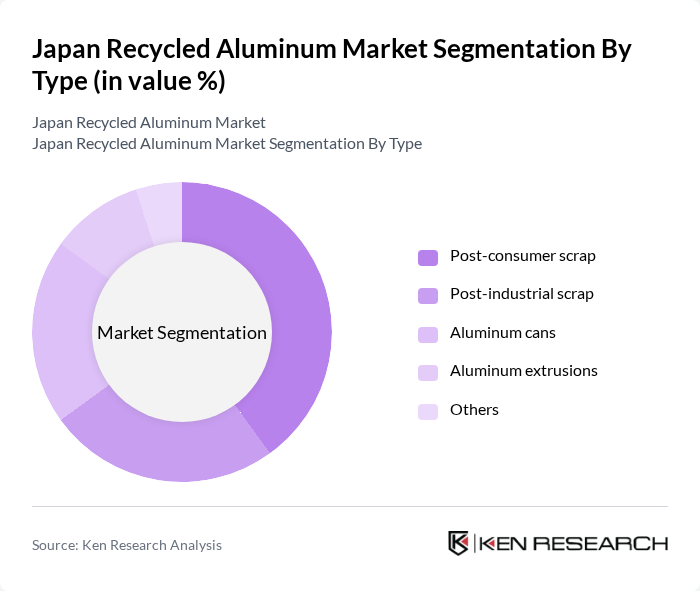

By Type:The market is segmented into various types of recycled aluminum, including post-consumer scrap, post-industrial scrap, aluminum cans, aluminum extrusions, and others. Among these, post-consumer scrap is the leading sub-segment due to the increasing consumer awareness regarding recycling and sustainability. The demand for aluminum cans is also significant, driven by the beverage industry’s shift towards sustainable packaging solutions.

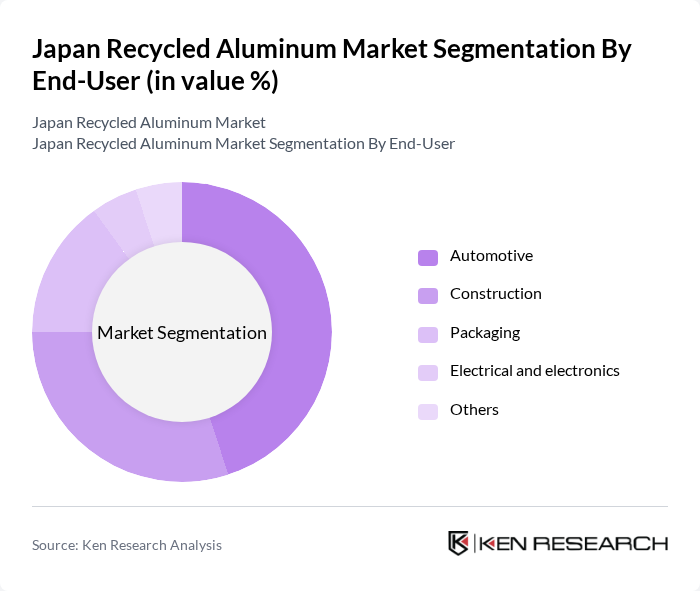

By End-User:The end-user segments include automotive, construction, packaging, electrical and electronics, and others. The automotive sector is the dominant segment, driven by the industry's focus on lightweight materials to improve fuel efficiency and reduce emissions. The construction sector also shows significant demand due to the increasing use of recycled aluminum in building materials.

The Japan Recycled Aluminum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Light Metal Holdings Company, Ltd., UACJ Corporation, Daiki Aluminum Industry Co., Ltd., Showa Aluminum Corporation, Sumitomo Light Metal Industries, Ltd., Toyo Aluminium K.K., Marubeni Corporation, Aisin Seiki Co., Ltd., Asahi Kasei Corporation, Mitsubishi Aluminum Co., Ltd., Kyoei Steel Ltd., Hokkaido Electric Power Co., Inc., JFE Holdings, Inc., Kobe Steel, Ltd., Hitachi Metals, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan recycled aluminum market appears promising, driven by increasing consumer awareness and government support for sustainable practices. As the circular economy gains traction, investments in recycling technologies are expected to rise, enhancing efficiency and recovery rates. Additionally, partnerships with key industries, such as automotive and construction, will likely foster innovation and expand the market. In future, the focus on sustainability will further solidify recycled aluminum's position as a preferred material, contributing to a greener economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Post-consumer scrap Post-industrial scrap Aluminum cans Aluminum extrusions Others |

| By End-User | Automotive Construction Packaging Electrical and electronics Others |

| By Application | Building and construction Transportation Consumer goods Industrial applications Others |

| By Source of Scrap | Municipal solid waste Industrial waste Curbside collection Others |

| By Processing Method | Mechanical recycling Pyrometallurgical recycling Hydrometallurgical recycling Others |

| By Quality of Recycled Aluminum | High purity Medium purity Low purity Others |

| By Market Channel | Direct sales Distributors Online platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aluminum Recycling Facilities | 100 | Plant Managers, Operations Directors |

| Manufacturers of Recycled Aluminum Products | 80 | Product Managers, Supply Chain Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

| End-User Industries (Automotive, Construction) | 90 | Procurement Managers, Sustainability Coordinators |

| Recycling Technology Providers | 60 | Technical Directors, R&D Managers |

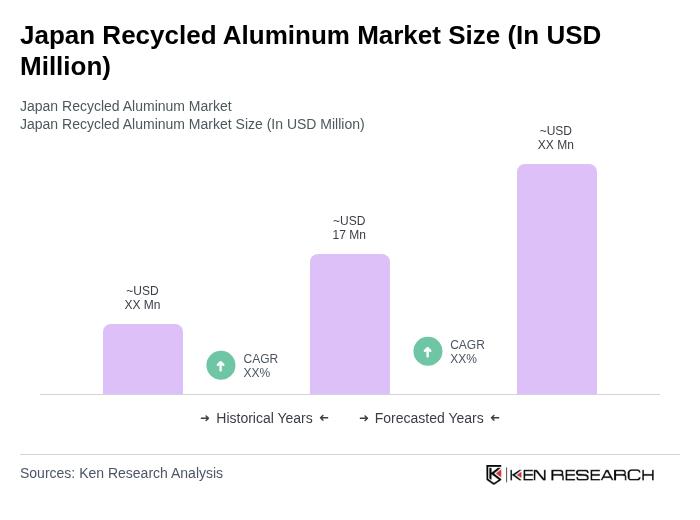

The Japan Recycled Aluminum Market is valued at approximately USD 17 million, reflecting a growing trend towards sustainability and recycling in various industries, particularly driven by environmental awareness and government regulations.